StableHodl has rapidly become a standout in the decentralized finance (DeFi) world. It is a multichain staking and yield-generation platform that consistently delivers impressive annual percentage yields (APYs). As other platforms struggle with market fluctuations and lower yields, StableHodl shines with its innovative strategies and robust backing, positioning itself as a leader in the DeFi space.

Strong Backing: Alpha Node Capital’s $2 Million Investment

StableHodl’s reputation and growth trajectory received a substantial boost with a $2 million investment from Web3 VC powerhouse, Alpha Node Capital. This isn’t just a financial endorsement; it’s a resounding vote of confidence from one of the most discerning investors in the blockchain space. Alpha Node Capital, renowned for identifying and nurturing high-potential blockchain projects, brings more than just capital to the table. Their involvement opens doors to an extensive network of industry veterans, strategic advisors, and potential collaborations, positioning StableHodl for groundbreaking innovation and accelerated growth.

With Alpha Node Capital’s backing, StableHodl is poised to leverage these connections to refine its platform, expand its user base, and explore new frontiers in decentralized finance. This partnership represents more than just financial support; it’s a catalyst for StableHodl’s evolution into a leading force in the DeFi ecosystem, where cutting-edge technology meets strategic insight to create unparalleled opportunities for growth and success.

StableHodl’s APY Performance: Leading the DeFi Space

StableHodl has emerged as a frontrunner in the DeFi landscape by consistently offering higher annual percentage yields (APYs) than many of its competitors. This exceptional performance makes it an attractive choice for users seeking both stability and profitability in an often unpredictable market.

During a recent testing phase, StableHodl reported outstanding APY results:

- February: 26% APY

- March: 49% APY

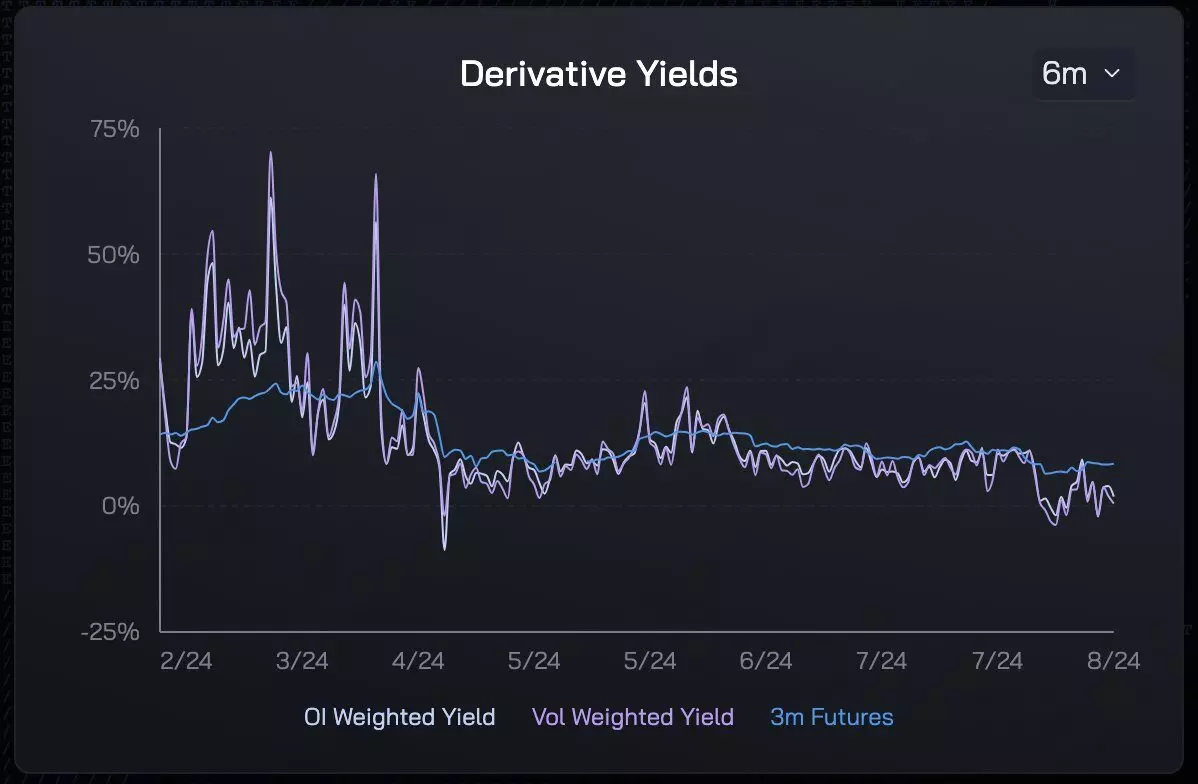

This performance outshines other platforms like Ethena, Ether.fi, and sDAI, which are often limited by market volatility or conservative strategies. StableHodl achieves these impressive returns through the implementation of delta-neutral strategies and funding arbitrage.

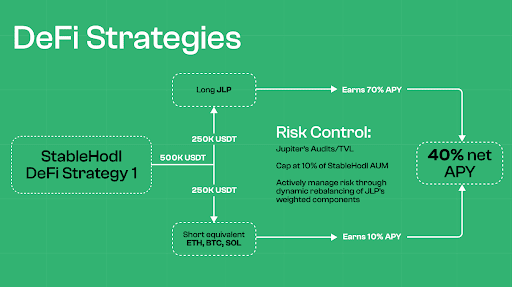

- Delta-neutral strategies involve balancing long and short positions to minimize exposure to market fluctuations. This approach allows StableHodl to generate consistent returns without the risk typically associated with other DeFi platforms. By not being reliant on the market’s direction, StableHodl can maintain its profitability even when other platforms experience downturns.

- Funding arbitrage further enhances returns by capitalizing on differences in funding rates across various exchanges. This method allows StableHodl to exploit market inefficiencies, providing users with additional profit streams. These strategies, combined with StableHodl’s innovative approach, make it a leader in the DeFi space, offering a reliable and lucrative option for yield generation.

The combination of these techniques ensures that StableHodl not only delivers high APYs but does so in a way that is sustainable and less susceptible to the risks inherent in the volatile crypto markets. This positions StableHodl as a robust and secure choice for both new and seasoned DeFi investors.

Alpha Node Capital Collaboration: Fueling Innovation and Expansion

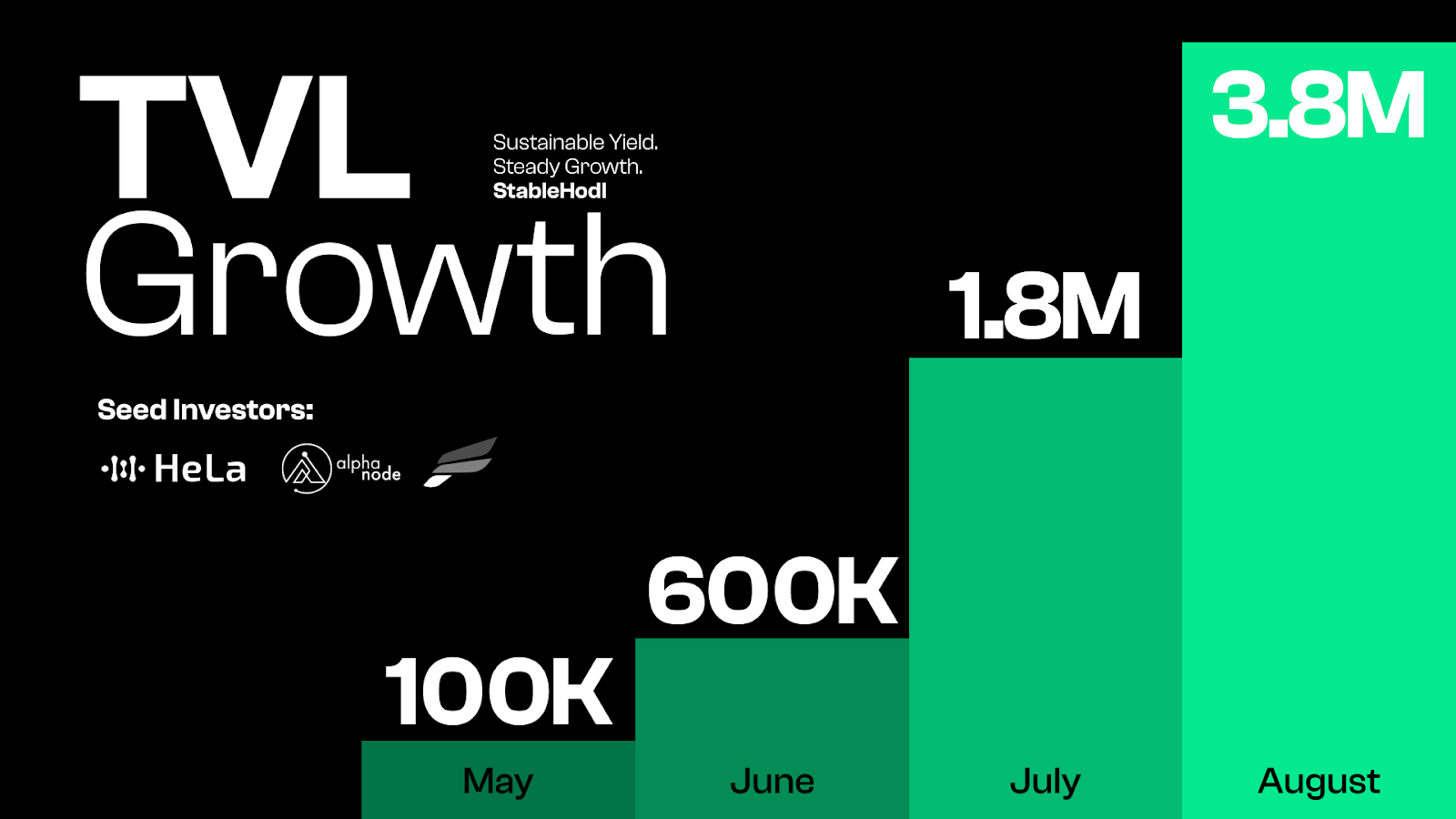

The partnership between StableHodl and Alpha Node Capital goes beyond mere financial investment. It is a strategic collaboration aimed at scaling the platform and introducing new features. With Alpha Node Capital’s support, StableHodl is poised to expand its ecosystem, integrating with additional blockchains and DeFi protocols. This expansion will enhance the platform’s reach and utility, attracting more users and increasing the total value locked (TVL).

Moreover, this partnership will likely accelerate the development of new staking pools, advanced yield-generation strategies, and enhanced security measures. Alpha Node Capital’s involvement is expected to provide StableHodl with the necessary resources to remain at the forefront of the DeFi space, continually offering innovative and secure yield-generation solutions.

Project Roadmap: A Glimpse into the Future

As StableHodl continues to build momentum, it has outlined an ambitious roadmap aimed at cementing its role as a leading DeFi solution. The forthcoming milestones highlight the platform’s commitment to growth and innovation, making it a project to watch closely.

- HeLa Mainnet Launch: Set for Q2 2024, StableHodl will play a key role as a flagship product.

- Expansion Plans:

– Focus on growing the user base and significantly increasing Total Value Locked (TVL).

– Introducing new staking pools and creating incentive programs to attract more participants.

- Native Token Launch: While details remain under wraps, users currently earning Points could see these convert into valuable rewards upon token launch.

- Strategic Partnerships: StableHodl is actively exploring collaborations with other DeFi projects and blockchain networks to enhance its platform’s capabilities and extend its reach.

These developments reflect StableHodl’s vision to not only provide superior yield generation but also to continuously innovate and expand, ensuring long-term growth and stability within the DeFi ecosystem.

Commitment to Security and Transparency

In the world of decentralized finance, where security concerns are ever-present, StableHodl stands out by committing to some of the most rigorous safety protocols in the industry. Recognizing that the trust of its users hinges on the safety of their assets, StableHodl has implemented a comprehensive suite of risk management strategies designed to safeguard funds while maximizing returns.

At the core of these measures are Multi-Party Computation (MPC) wallets, which require multiple parties to authorize transactions, thereby significantly reducing the risk of unauthorized access. These MPC wallets operate alongside off-exchange settlement services, which provide an additional layer of protection by minimizing exposure to exchange-related vulnerabilities.

This two-pronged approach ensures that users’ assets are not only secure from external threats but are also managed in a way that mitigates potential internal risks. By combining these advanced security measures with a robust yield-generation strategy, StableHodl offers its users not just attractive financial returns but also the peace of mind that their investments are well-protected in an increasingly complex and volatile market.

Conclusion

StableHodl distinguishes itself from other DeFi platforms by offering a holistic approach that seamlessly integrates high yields, robust security, and an intuitive user experience. This isn’t just another platform; it’s a comprehensive solution tailored to meet the diverse needs of modern investors. With the strategic backing of Alpha Node Capital and its innovative, forward-thinking strategies, StableHodl is poised to become a dominant force in the DeFi landscape.

As the platform continues to expand and refine its offerings, it provides users with a unique opportunity to achieve significant financial returns within a highly secure environment. StableHodl isn’t just about profitability—it’s about creating a reliable and accessible avenue for users to maximize their investments in the evolving DeFi market. For those looking to engage in DeFi with confidence, StableHodl offers a compelling, innovative, and secure choice that stands out in a crowded field.

Official Links

- Website: https://stablehodl.com/

- X: https://x.com/StableHodl

- Discord: https://discord.com/invite/stablehodl

- Telegram: https://t.me/stablehodl

- Medium: https://medium.com/stablehodl

Disclaimer

Opinions stated on CoinWire.com do not constitute investment advice. Before making any high-risk investments in cryptocurrency, or digital assets, investors should conduct extensive research. Please be aware that any transfers and transactions are entirely at your own risk, and any losses you may experience are entirely your own. CoinWire.com does not encourage the purchase or sale of any cryptocurrencies or digital assets, and it is not an investment advisor. Please be aware that CoinWire.com engages in affiliate marketing.