Coinspeaker

Staked ETH at All-Time High Levels Just before Ethereum ETF Approval

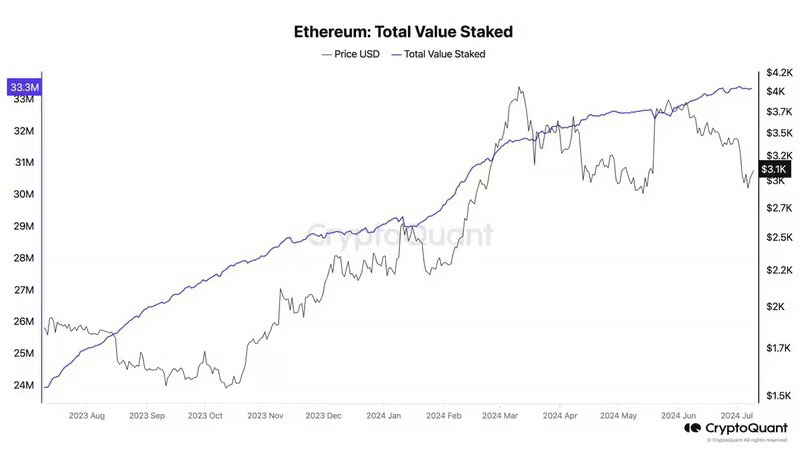

The approval of the spot Ethereum ETF in the United States shall happen within the next two weeks as per analysts’ expectations. As a result, ETH investors have already started accumulating in heavy numbers to make the most of the price rally after the actual approval. As per on-chain data, the total amount of staked ETH in the market is currently at an all-time high, while keeping the circulating volume in check.

Julio Moreno, CryptoQuant’s head of research, wrote:

“The total number of staked ETH has continued to increase and sits near its all-time high as it stands at 33.3 million ETH or 27.7% of the total supply.”

The increasing supply of Ethereum once again suggests that it has returned to becoming an inflationary asset once again. This undermines ETH’s ability to act as a store of value. Staking of Ethereum is one way to counter this while locking the ETH for a fixed period of time and burning the supply or permanently removing it from circulation.

“ETH supply is growing again, although slowly. But the narrative of ultra-sound money has ended. The total supply is at its highest level since December 11, 2023,” Moreno wrote.

Photo: CryptoQuant

A Look into Ethereum Liquidity

Moreno also noted that recent spot trading volume data indicates that Ether (ETH) could be nearly as liquid as Bitcoin (BTC), with ETH spot trading volume ranging between 80% and 90% of Bitcoin’s volume in recent weeks.

Additionally, according to CoinMetrics, approximately 12% of Ether’s total supply is currently utilized in smart contracts or bridges connecting different blockchains. When including tokens that are staked, around 40% of Ether’s cryptocurrency supply is considered “locked” and not actively traded.

40% of Ethereum supply is locked

~28% staked

~12% smart contracts and bridgesETH ETF flows are going to rapidly move this market pic.twitter.com/VkzXlBcH9W

— Tom Dunleavy (@dunleavy89) July 9, 2024

All the focus currently is on the approval of the spot Ethereum ETF. Similar to Bitcoin, the approval of the spot ETF for Ethereum can see an influx of fresh capital, thereby taking Ethereum to new all-time highs of $5,000 and beyond. Analysts are already predicting billion-dollar inflows into Ethereum ETFs within a few months of the approval.

12 hours ago, Justin Sun (@justinsuntron) allegedly spent 5M $USDT to buy 1,614 $ETH at ~$3,097.

Since Feb 8, Justin Sun might have bought 362,751 $ETH (est. cost: $1.11B) at ~$3,047 via 3 wallets (more details in previous posts 👇).

Note that he also deposited 45M $USDT to… https://t.co/xeW1usR3MJ pic.twitter.com/aJ4zhXFas2

— Spot On Chain (@spotonchain) July 11, 2024

Tron founder Justin Sun has also made strong accumulation for Ethereum grabbing more than $1.1 billion worth of ETH over the past few months.

Staked ETH at All-Time High Levels Just before Ethereum ETF Approval