Data shows the cost of mining Bitcoin has now surged up to $19.3k, something that could spell doom for the miners.

Bitcoin Difficulty Regression Model Shows Cost Of Production Now $19.3k

As per the latest weekly report from Glassnode, the cost of BTC production has gone up recently due to the hashrate and difficulty setting new all-time highs.

The “difficulty regression model” is an estimated average cost of production for Bitcoin that bases its value on the mining difficulty.

This difficulty is a feature of the BTC blockchain that controls how much hashes miners will need to make in order to mine a block on the network.

Whenever the hashrate (the total computing power connected to the chain) goes up, so does the difficulty since the network wants to keep the block production rate constant.

The difficulty regression model doesn’t make use of any elaborate data on mining equipment, power, and other costs that miners face, but it simply calculates an average cost with the assumption that the mining difficulty already accounts for all these variables in one number.

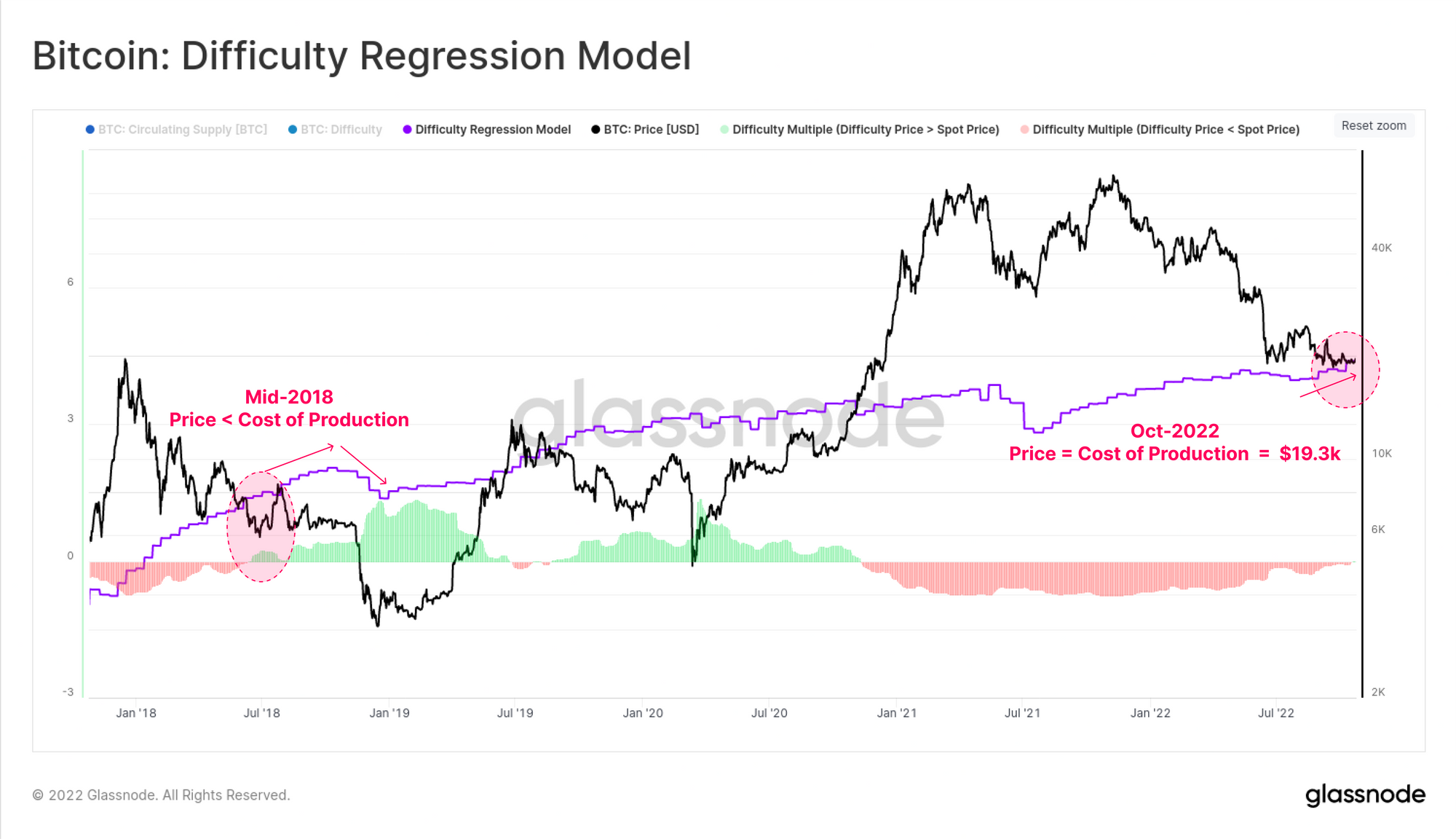

Now, here is a chart that shows the trend in this Bitcoin cost of production model over the last few years:

As you can see in the above graph, the Bitcoin difficulty regression model has increased in value during the last few weeks.

The reason behind this growth lies in the aggressive rise in the hashrate recently, which has lead to a difficulty explosion in the crypto.

After this increase in the cost of production, miners have to incur an average expense of around $19.3k if they want to mine 1 BTC.

This value happens to be about what the actual price of Bitcoin has been moving sideways around recently. This means that at present, the average miner would be making little to no profit, if not taking an outright loss.

The report notes that the last time the cost of production exceeded the price itself was back in the middle of 2018, which triggered a miner capitulation that persisted for many months after.

So, if the difficulty regression model keeps rising from here on, and the BTC price doesn’t notice any improvements, then a similar capitulation event could take place again.

BTC Price

At the time of writing, Bitcoin’s price floats around $19.5k, down 1% in the last week.