The Ripple Swell Conference 2023 has barely started and the first major news has already been released. The fintech company has announced the rebrand of its flagship product RippleNet and the expansion of its partnership with leading payments fintech Onafriq, previously MFS Africa.

RippleNet Becomes Ripple Payments

On the first day of the Swell conference, the company announced the transformation of its flagship product, RippleNet, now rebranded as Ripple Payments. This marks a significant shift in the fintech’s strategy to enhance blockchain-enabled cross-border payments and foster enterprise crypto adoption.

In an official press release, the company highlighted key updates to its rebranded product. The expansion of Ripple’s global network now encompasses more than 70 crypto and traditional payout markets, signifying a broadened scope for enterprise-grade cross-border payment solutions. Furthermore, Ripple has fortified its regulatory compliance with over 30 licenses, including a MAS Major Payments Institution license and Money Transmitter Licenses across the US.

Monica Long, President at Ripple, emphasized the importance of blockchain and digital currency applications in overcoming the financial industry’s challenges with antiquated technologies. Prior to her speech at the Swell conference, she said, “Crypto utility starts with payments, and for the last decade, Ripple’s focused on key components of infrastructure (liquidity, off ramps, tokenization, custody, & compliance) required for enterprise-grade payments. Today, we’re unveiling an end-to-end solution for just that.”

Long further elaborated on the evolution of the company’s product offerings, explaining the accessibility and efficiency of their solutions. “This is an evolution of our product, where our customers can tap into crypto utility without having to be an expert in using this technology. A single onboarding experience, with Ripple managing the end-to-end flow to move value at any time, as fast and low-cost as possible.”

An integral part of the rebranding is the integration with the XRP Ledger’s native decentralized exchange (XRPL DEX), aiming to enhance product performance. This integration is expected to lower the barriers to entering new markets by tapping into global liquidity options, the press release states.

“Ripple has led the way in addressing key components of crypto financial infrastructure, including liquidity, off ramps, tokenization, custody, and compliance. Bringing these elements together within Ripple Payments for an intuitive end-to-end enterprise experience is the natural next step to make crypto’s benefits accessible for any business,” Long remarked.

RocketFuel, an early adopter of the new product, lauded the rebranding for its effectiveness in global service delivery. CEO Peter Jensen stated, “Ripple Payments supports our products, allowing us to serve our customers globally in a dramatically more effective way than the legacy financial system.”

Onafriq Opens Up New Payment Corridors

Ripple’s partnership with Onafriq, initially announced in November 2022 as an alliance with MFS Africa, has now taken a significant leap forward. This progression is marked by the establishment of three new payment corridors, facilitating streamlined and cost-effective remittance and business payments between Africa and several international markets.

The updated partnership enables customers of PayAngel in the UK, Pyypl in the GCC, and Zazi Transfer in Australia to make transactions with recipients in 27 countries across Onafriq’s expansive pan-African network.

Aaron Sears, SVP of Global Customer Success, emphasized the impact of this expansion:

Connecting our partners PayAngel, Pyppl and Zazi Transfer with Onafriq over Ripple Payments will bring the benefits of faster and more cost-effective cross-border payments to individuals seeking to send money into Africa from around the globe.

Onafriq aims to tackle the longstanding challenges of cross-border payments, such as extended transfer times and high costs. By addressing these issues, the partnership between both companies aspires to accelerate financial inclusion across Africa, a continent that has seen a rapid rise in mobile money adoption and digital financial services.

Dare Okoudjou, Founder & CEO of Onafriq, reinforced the strategic importance of this collaboration in advancing their mission. Okoudjou stated, “Our mission is to make borders matter less when it comes to payment within, to, and from Africa. We are advancing this mission through our partnership with Ripple, which is already enabling new types of connections with fintechs such as PayAngel, Pyppl and Zazi Transfer.”

Remarkably, the significance of this partnership extends beyond the immediate benefits of enhanced payment systems. Onafriq, boasting the largest mobile money footprint across Africa, connects over 500 million mobile wallets in 40 countries and operates across more than 1300 payment corridors on the continent. This comprehensive network makes Onafriq an important player in the field of regional interoperability and cross-border payments.

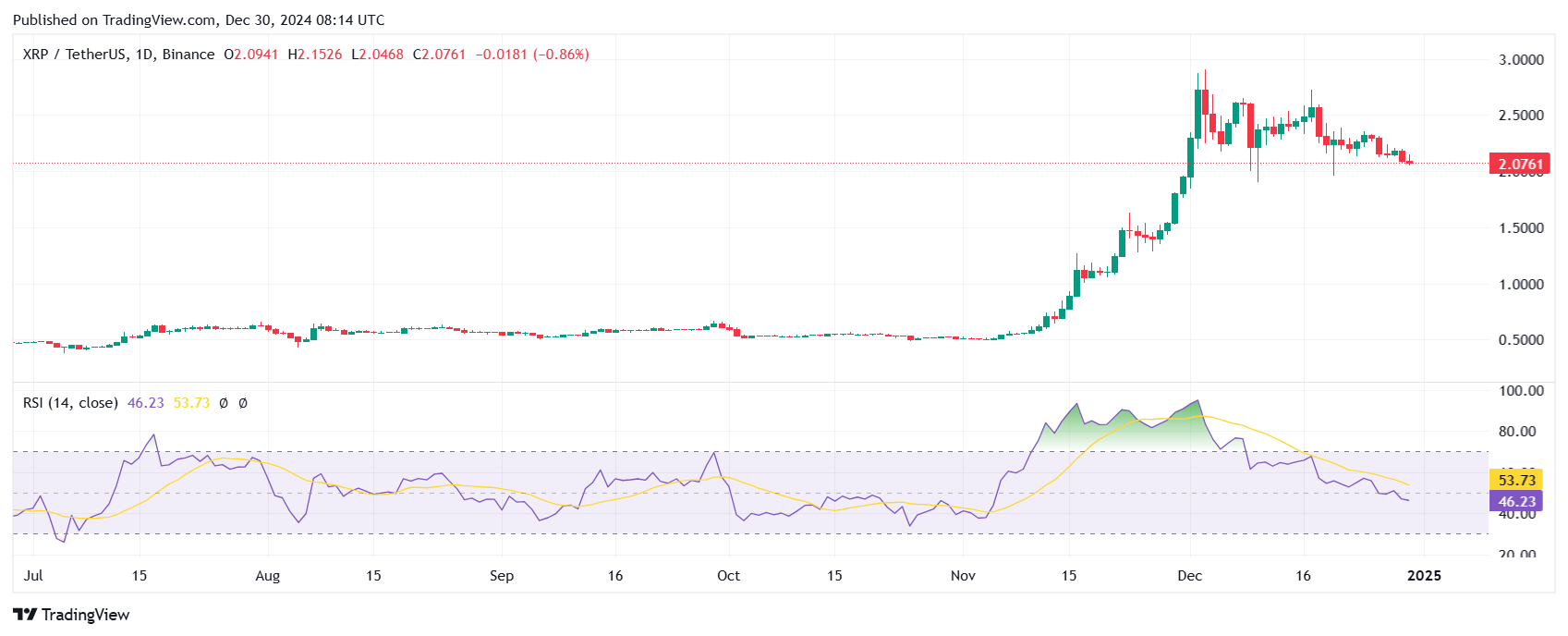

At press time, XRP traded at $0.6804.