Having shown the application of its connector in complex use cases, SWIFT will continue to increase the connector’s functions.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) messaging network has released the results of the second phase of sandbox testing for its central bank digital currency (CBDC) interlinking solution, which it calls a connector.

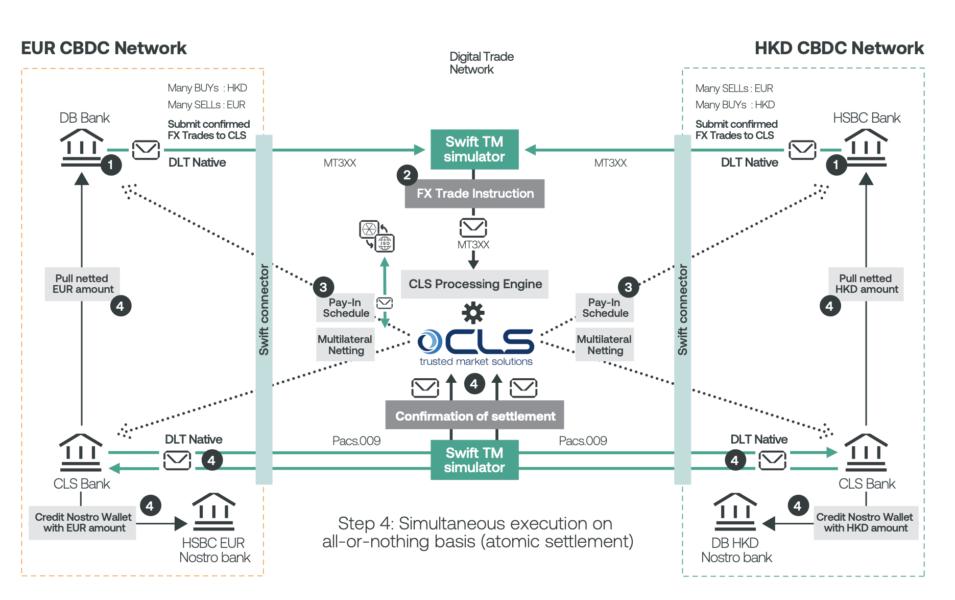

The project looked at four use cases, not all of which involved CBDC, according to the report it released on the test results. It experimented with digital trading with atomic (instantaneous) settlement using smart contracts. It connected tokenization platforms to facilitate atomic delivery versus payment and worked with financial infrastructure firm CLS Group to show the connector’s capability of connecting existing foreign exchange infrastructures using CBDC.

The fourth use case, involving using its Liquidity Saving Mechanism algorithms to reduce fragmentation of liquidity across platforms, was described as a “paper exercise, accompanied by bilateral discussions.”