Coinspeaker

Swiss Bank PostFinance Embraces Solana and XRP with New Trading Options

PostFinance, a Swiss bank fully owned by the government, is expanding its cryptocurrency offerings by adding Solana (SOL) and Ripple’s XRP to its trading platform. This move comes nearly a year after the bank first ventured into the crypto market.

The government-owned company joined the digital asset trading sector in August 2023 through a strategic partnership with Sygnum Bank, another Swiss financial institution with Hong Kong heritage.

PostFinance Adds Support for More Cryptocurrencies

The collaboration allowed the company to leverage Sygnum’s business-to-business (B2B) banking platform, which offers merchants opportunities to provide digital asset trading services to customers at a very low cost.

Through the partnership, PostFinance started offering its customers the ability to buy and sell digital assets. Initially, the bank’s crypto offerings were limited to major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH).

However, in February this year, the bank announced that it has added additional 11 different cryptocurrencies to its portfolio, allowing users to purchase their preferred digital asset outside Bitcoin and Ethereum.

In a recent announcement, PostFinance said it is broadening its crypto offerings with the addition of five new digital assets.

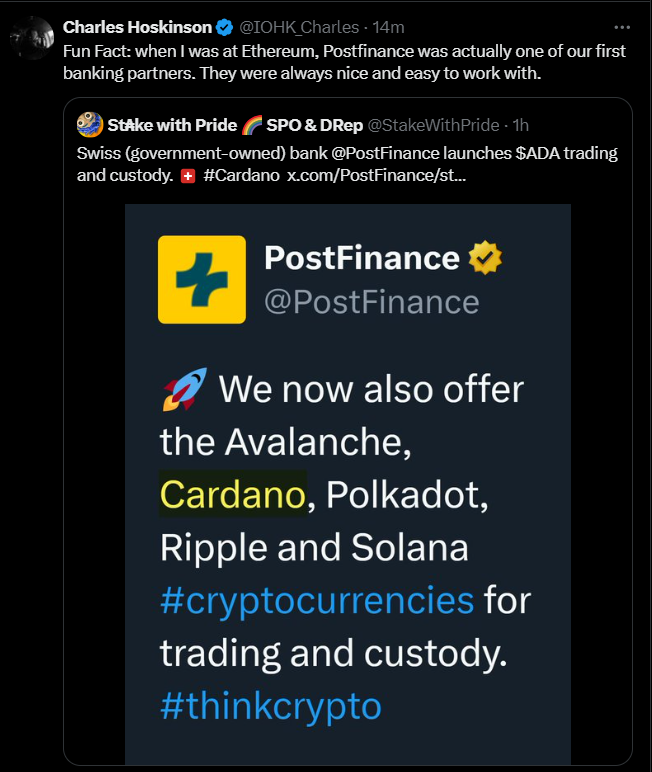

These newly added altcoins include Cardano (ADA), Polkadot (DOT), Avalanche (AVAX), Solana (SOL) and XRP.

🚀 We now also offer the Avalanche, Cardano, Polkadot, Ripple and Solana #cryptocurrencies for trading and custody. #thinkcrypto

— PostFinance (@PostFinance) July 1, 2024

The move is part of the bank’s efforts to enhance its presence in the emerging economy. Solana, known for its high-performance blockchain supporting the building of decentralized applications and crypto projects, and XRP, widely used for its real-time gross settlement system, bring significant value and diversity to the bank’s crypto portfolio.

Challenges in the Swiss Banking Landscape

Despite PostFinance’s recent addition of new cryptocurrencies to its trading platform, the crypto landscape for banks in Switzerland has not been without challenges.

Recently, the country’s financial regulator, the Swiss Financial Market Supervisory Authority (FINMA), forced FlowBank to shut down operations. The regulator cited serious violations of banking standards as the reason for the closure.

In a statement on June 13, FINMA disclosed that FlowBank could no longer meet its obligations to customers and therefore should exit the market.

“This measure became necessary as the bank no longer has the minimum capital required for its business operations. There’s no prospect of a restructuring, and there are fears that the bank is over-indebted,” FINMA stated.

Despite these challenges, according to a new study conducted by Lucerne University of Applied Sciences and Arts (HSLU), more banks in Switzerland are still planning to enter the crypto market.

Currently, 28% of Swiss banks have already started providing customers with crypto investment options through third-party platforms. The study found that the majority of the companies are state-backed financial institutions.

Swiss Bank PostFinance Embraces Solana and XRP with New Trading Options