Coinspeaker

Terraform Labs Trial Wraps with Jury Verdict, Faces Severe SEC Penalties and Sanctions

The climactic finale awaits in the civil fraud courtroom drama involving Terraform Labs and its visionary, Do Kwon. Following extensive witness testimonies and legal discourse, the opposing parties prepare to deliver their concluding statements today, April 5, 2024, in this captivating fraud trial.

The United States Securities and Exchange Commission (SEC) has filed allegations against Terraform Labs, a Singaporean firm, and its founder, Do Kwon. The commission asserts that they misled investors regarding the stability of their algorithmic stablecoin, TerraUSD (UST), during the year 2021.

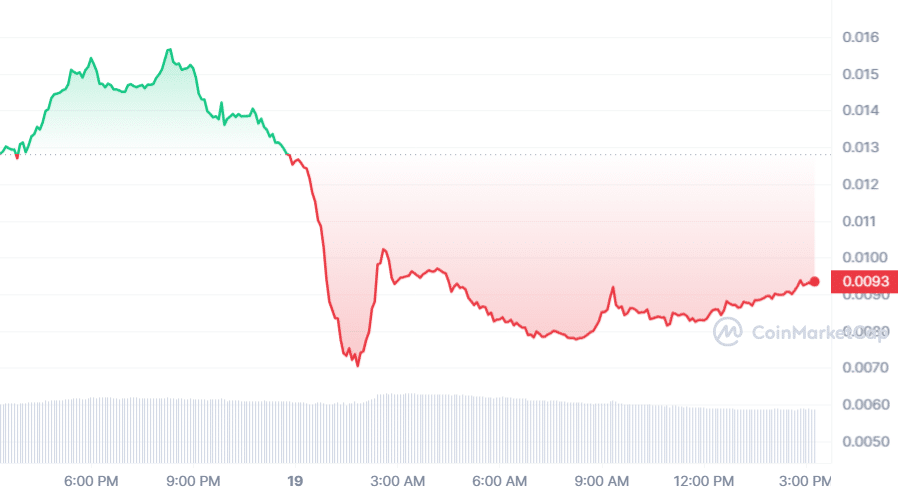

TerraUSD (UST), an algorithmic stablecoin, employed a sophisticated mechanism alongside its sister token, Luna, to maintain a $1 peg. Investors were attracted by the promise of a stable asset coupled with high returns – a combination that ultimately led to fatal outcomes.

The regulation commission asserts Terraform Labs and Do Kwon falsely depicted UST as a stablecoin, deceiving investors about integrations with widely-used Korean mobile payment platforms like Chai. According to officials, these false statements drew investors into a risky project by Teraform Labs.

Terraform Labs and Do Kwon Counter SEC’s Allegations

Terraform Labs and Do Kwon’s defence team has responded to the SEC’s allegations, contending that the regulatory agency misinterpreted statements and relied on biased witnesses potentially motivated by whistleblower rewards. They assert that the UST’s collapse was an unfortunate market occurrence, not the result of fraudulent actions.

The detaching of UST from its peg affected more than just investors, losing an estimated $40 billion, according to SEC allegations. The crash triggered a domino effect throughout crypto markets, plummeting major token values like Bitcoin. Several crypto firms filed for bankruptcy in 2022 due to the Terra collapse.

The SEC pursues monetary fines and industry restrictions for Kwon and Terraform Labs. However, the outcome of this legal action could impact future regulations within the rapidly evolving yet unstable cryptocurrency realm. An unfavorable ruling would establish a benchmark for subsequent oversight in this innovative financial space.

The Kwon Conundrum

Do Kwon, currently confronting extradition requisitions from both the United States and South Korea on criminal allegations, did not attend the judicial proceedings initiated on March 25, 2024. Kwon’s conspicuous absence adds another layer of mystery to this high-profile case.

The jury’s verdict, expected in the coming days, will be closely watched by the cryptocurrency industry and investors alike. The outcome will not only determine the fate of Terraform Labs and Do Kwon but also potentially influence the future trajectory of cryptocurrency regulations.

Terraform Labs Trial Wraps with Jury Verdict, Faces Severe SEC Penalties and Sanctions