Paolo Ardoino, CEO of Tether, underscores the significance of healthy competition among stablecoin providers, asserting that a diverse ecosystem fosters legitimacy in the eyes of regulators. Ardoino’s insights come amid Ripple’s plans to launch its own stablecoin, a move he believes could further validate and expand the utility of fiat-backed tokens. This article delves into Ardoino’s perspective on the impact of competition and the evolving role of stablecoins within the broader cryptocurrency market.

Competition Drives Legitimacy

The Tether CEO Paolo Ardoino emphasizes that the stablecoin sector thrives on competition, stressing that Tether cannot exist in isolation. He contends that the presence of multiple reputable players offering stablecoins is instrumental in demonstrating the sector’s viability to regulators. Ardoino believes that collective industry engagement presents a stronger case for regulatory acceptance, stating, “Being multiplayer helps in discussions with the regulators. If you are all alone and you have one single product, regulators will never take you seriously.”

Read more: Tether Records Remarkable $2.85 Billion Profit in Q4 Fueled by Treasury Securities

Expanding Role of Stablecoins

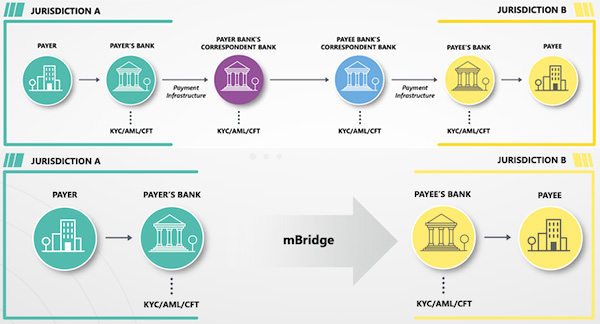

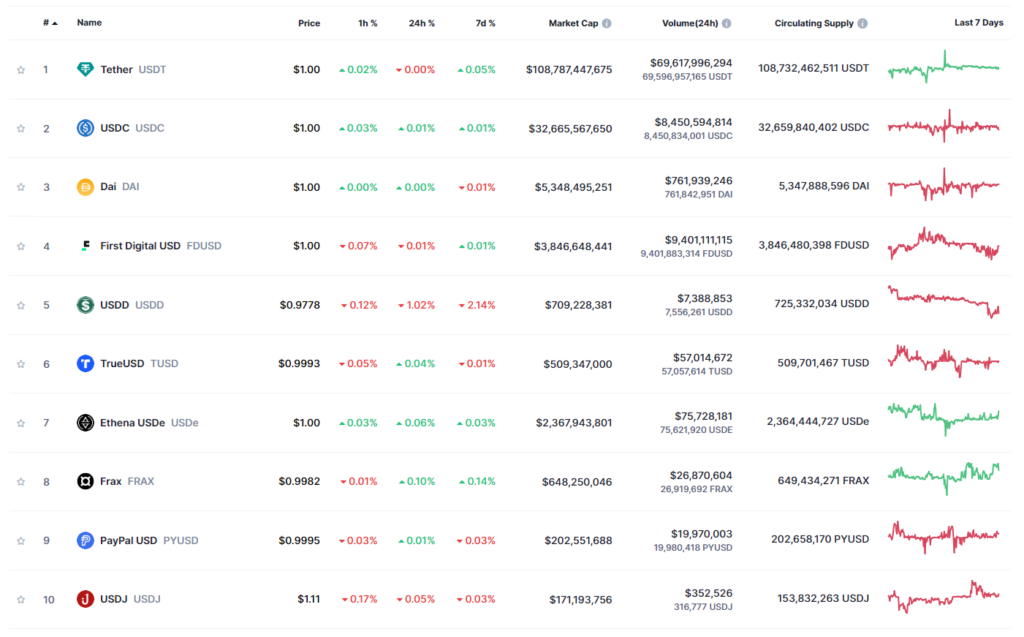

Stablecoins, with a combined market capitalization exceeding $130 billion as of April 2024, have evolved into essential tools across various cryptocurrency use cases, from facilitating centralized exchanges to powering decentralized finance (DeFi) platforms. Ardoino underscores the global demand for stable alternatives amidst rising inflation and currency devaluation in countries like Argentina, Turkey, and Venezuela. The accessibility of stablecoins offers financial inclusion to over 2 billion unbanked individuals worldwide, allowing them to transact securely without traditional banking infrastructure.

Read more: Ripple Enters the Stablecoin Market: A New Challenger Emerges

Conclusion

Paolo Ardoino’s perspectives shed light on the pivotal role of stablecoin competition in bolstering regulatory engagement and industry legitimacy. As the stablecoin landscape expands, with Tether leading the market, Ardoino advocates for a collaborative approach among industry players to navigate regulatory scrutiny effectively. The launch of Ripple’s stablecoin, anticipated later in 2024, underscores the growing demand for fiat-backed digital assets. As stablecoins continue to innovate and address global economic challenges, their role in reshaping financial inclusion and stability remains profound.