Coinspeaker

Tether Holds Back Blockchain Plans, Citing Market Saturation

Tether, the world’s largest stablecoin issuer and owner of USDT, has decided against launching its own native blockchain due to concerns over a crowded market.

In an interview with Bloomberg, the company’s CEO, Paolo Ardoino, explained that while the firm is fully capable of developing its own public ledger, it has chosen not to do so, given the current oversaturation of the market. He stated that pursuing such a venture would not be a smart business decision at this time.

“We are very good at technology, but I believe blockchains will soon become a commodity. Launching a blockchain ourselves might not be the right move,” Ardoino told Bloomberg. He added that “there are already very good blockchains out there.”

A Saturated Market

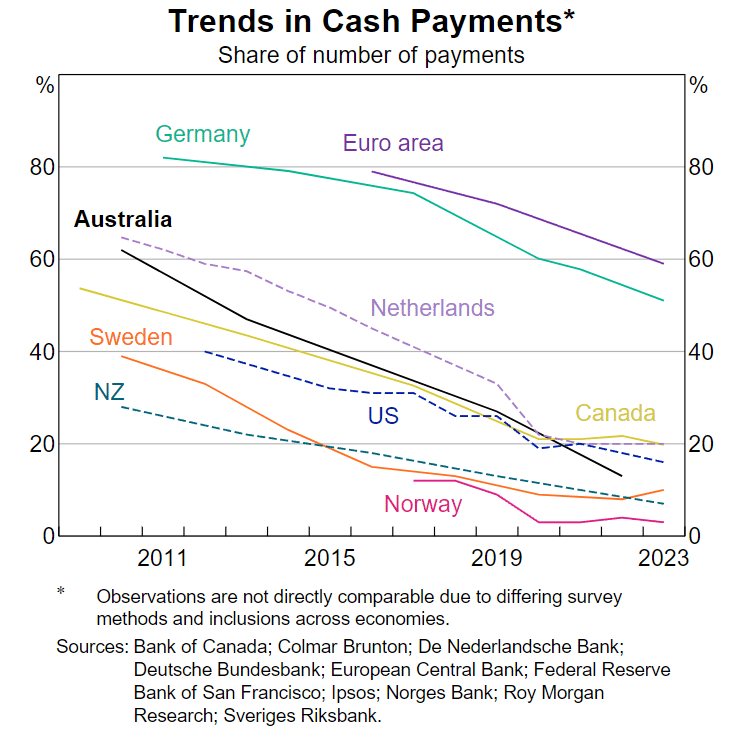

Since Bitcoin’s launch in 2009, the crypto industry has seen an explosion of blockchain projects amounting to around 306 networks in total, with each aiming to offer unique solutions and services.

However, this surge in innovation has led to market saturation, with many blockchains struggling to differentiate themselves in an increasingly competitive landscape.

Tether’s decision to forgo its own blockchain is a strategic choice aimed at avoiding further market overcrowding, despite having the financial capacity and technological expertise.

Ardoino emphasized that blockchains are becoming commoditized, and Tether’s focus remains on maintaining its leadership in the stablecoin sector rather than entering an already packed space with limited potential for growth.

For Tether, blockchains serve merely as a medium to transfer its stablecoins securely and sustainably without third-party interference.

The company said it is happy to stay “blockchain agnostic,” meaning it does not tie itself to any one specific blockchain. Instead, the company is open to integrating USDT on any platform that offers the highest levels of security and sustainability.

Recent Expansions

To date, Tether has added support for USDT, the largest stablecoin with a market capitalization of over $117 billion, to numerous blockchain protocols, including Ethereum’s ERC-20, Binance Smart Chain (BSC), and Tron (TRC-20), among others.

On these platforms, users can trade USDT for other cryptocurrencies with minimal transaction fees, without leaving the blockchain ecosystem.

Recently, the stablecoin issuer expanded its reach by bringing USDT to Aptos, a newly launched protocol known for its ability to process transactions at high speed. Ardoino praised Aptos for its scalability, citing its innovative technology as a strong foundation for enabling faster and more cost-efficient USDT transactions.

In addition to USDT, Tether offers several other stablecoins pegged 1:1 to various fiat currencies, including the Chinese yuan, European euro, and Mexican peso. Earlier this week, the company announced plans to launch a new stablecoin tied to the United Arab Emirates Dirham (AED).

Tether Holds Back Blockchain Plans, Citing Market Saturation