Tezos price analysis shows that the market sentiment is bearish, and the price may continue to fall. The strongest resistance for XTZ/USD is present at $1.45 and while the support is at $1.41. Tezos price has seen a slight rebound in recent days, however, the bull run seems to have fizzled out as the prices have once again fallen below the $2.00 mark.

The overall market sentiment for Tezos is bearish as the investors remain cautious about the current market conditions. The trading volume for XTZ/USD price is declining, which is now at $20,736,225 as the digital asset consolidates near $1.43 levels. The total market capitalization for Filecoin is now at $1,299,561,647 as the cryptocurrency remains at 41 positions on CoinMarketCap’s list.

Tezos price analysis 1-day price analysis: Market moves downward

Tezos price analysis on a 24-hour timeframe reveals that the market volatility is following a decreasing direction. This means that XTZ/USD prices subject to fluctuations will fluctuate in the same direction as volatility; less volatility means less probability of the price shifting to either extreme. The upper limit of Bollinger’s band exists at $ 1.46 while the lower limit is at $1.41. The price currently trades near the middle of Bollinger’s band, indicating decreasing market volatility.

The moving average convergence/divergence histogram supports a bearish crossover as the MACD line (blue) crosses below the signal line (red). This suggests that the downward momentum is likely to continue in the near term. The relative strength index is currently at 45.78 and it does not show any extremities, which suggests that there are no oversold or overbought conditions in the market.

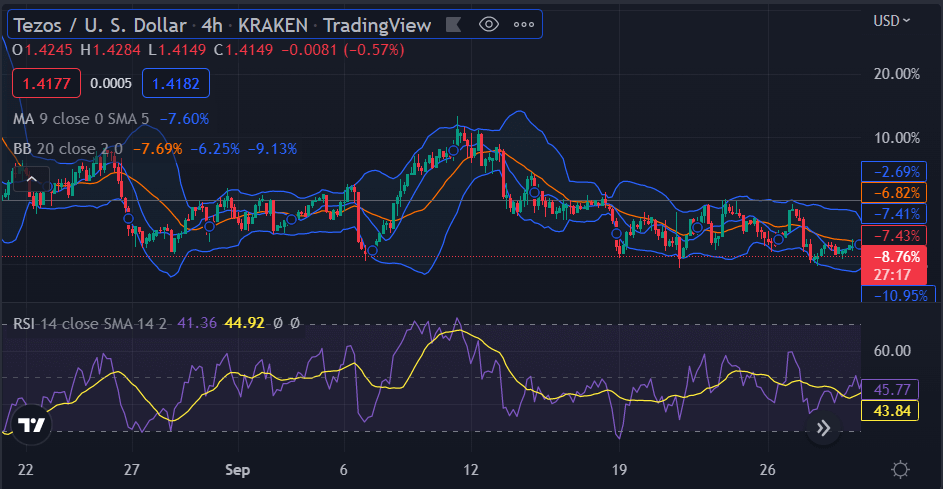

XTZ/USD 4-hour price analysis: Bearish momentum pulls price back to $1.43

The 4-hour timeframe for Tezos price analysis shows a bearish trend as the price has undergone a decline again despite the upwards price function during the starting hours of today’s session. The next few hours will be crucial for the market as the next few candlesticks will provide more insight into the market’s short-term trend.

The volatility is mild for the XTZ/USD pair on the 4-hour chart as the upper Bollinger band trades at $1.46 which acts as the immediate resistance for the prices, while the lower Bollinger band is at $1.41, which might provide support in case of a bearish breakout. The RSI has entered the lower half of the neutral zone and is present at index 43; the downslope of the RSI indicates increasing selling activity. The MACD line is over the signal line which suggests a bullish market trend in the near term.

Tezos price analysis conclusion

In conclusion, the overall Tezos price analysis is bearish as the digital asset consolidates near $1.43 levels. The market indicators are pointing to further downside momentum in the near term as the bearish winds continue to blow. Investors remain cautious about the current economic conditions. Prices will continue falling if the selling pressure persists.