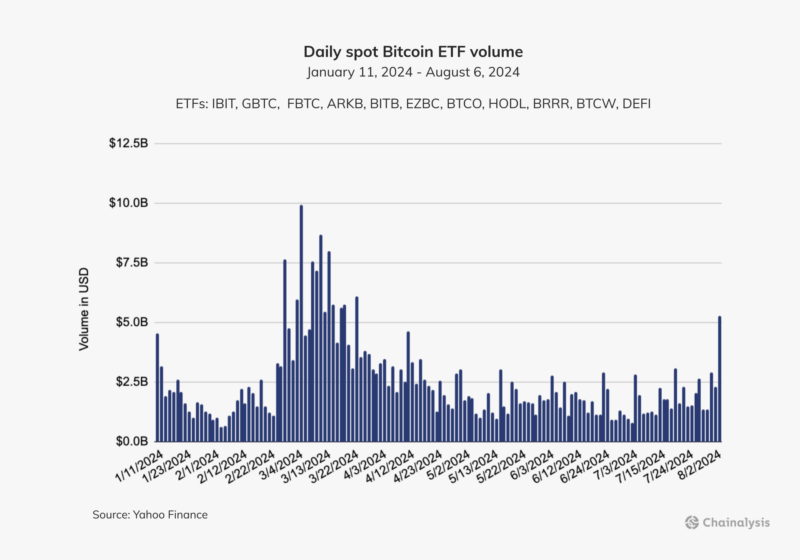

A recent Bloomberg report revealed that the U.S. Bitcoin ETFs have recorded about $10 billion in inflows since the November 5 elections and President-elect Trump’s win. The report highlighted that Trump’s pro-crypto stance and his promises to the crypto community encouraged more investments into the ETFs. The report added that investors also expected a crypto boom under Trump’s regulations.

The report mentioned that several funds, including BlackRock and Fidelity, made net investments into Bitcoin spot ETFs, reaching $9.9 billion. The ETFs are worth $113 billion, with IBIT, GBTC, and FBTC having the highest market caps of $55.87 billion, $49.80 billion, and $19.75 billion, respectively.

More reports, including a recent OKG Research report, have highlighted a growing institutional investor interest in crypto and ETFs after Trump’s win. OKG Research recently noted that ETFs also hold about 55% of the current BTC in circulation since their introduction in January, which institutional investors are directing funds into.

Last week, Trump picked a known supporter of digital assets to head the U.S. Securities and Exchange Commission (SEC). He also hired the first White House official czar who dealt exclusively with artificial intelligence and cryptocurrency.

Trump has also pledged to replace the current administration’s reluctant perception of digital assets with more liberal regulations. He even suggested there should be a national Bitcoin reserve. Once a sceptic of crypto, Trump came around when the industry-funded the efforts to support its agenda during the election campaign.

Brad Garlinghouse says Bitcoin ETFs are the ‘most successful’

Boomer candy…

“The most successful ETF ever in the US was the bitcoin ETF.” pic.twitter.com/QQrk7pjEJQ

— Nate Geraci (@NateGeraci) December 9, 2024

Key figures in the industry, including Ripple CEO Brad Garlinghouse, have noted the recent gains in the U.S. Bitcoin spot ETFs. In a recent interview on CBS’s 60 Minutes, Garlinghouse mentioned that U.S. Bitcoin ETFs were the most successful in the country’s history. The Ripple CEO explained that the BTC ETFs attracted more assets in a shorter period than any other ETFs before.

Garlinghouse’s comment came after discussing some Wall Street figures, including Jamie Dimon, being sceptical about crypto. John Reed Stark from John Reed Stark Consulting LLC also highlighted that the sceptics were cashing in on the massive fees expected from crypto ETF transactions. According to Stark, multiple Wall Street companies and banks, including JPMorgan, where Dimon is based, offer crypto ETF investments for their clientele.

When asked about Trump’s previous scepticism about crypto investment, Garlinghouse said, ‘ Trump embraced crypto, and crypto embraced Trump.’ The Ripple CEO has expressed optimism about Trump’s leadership, his non-pro-crypto stance, and how the crypto community could benefit.

Bitcoin reaches six figures before correcting

for the first time in history Bitcoin just passed $100,000📍 pic.twitter.com/R2SUmiiSPF

— SOUND | Victor Baez (@itsavibe) December 5, 2024

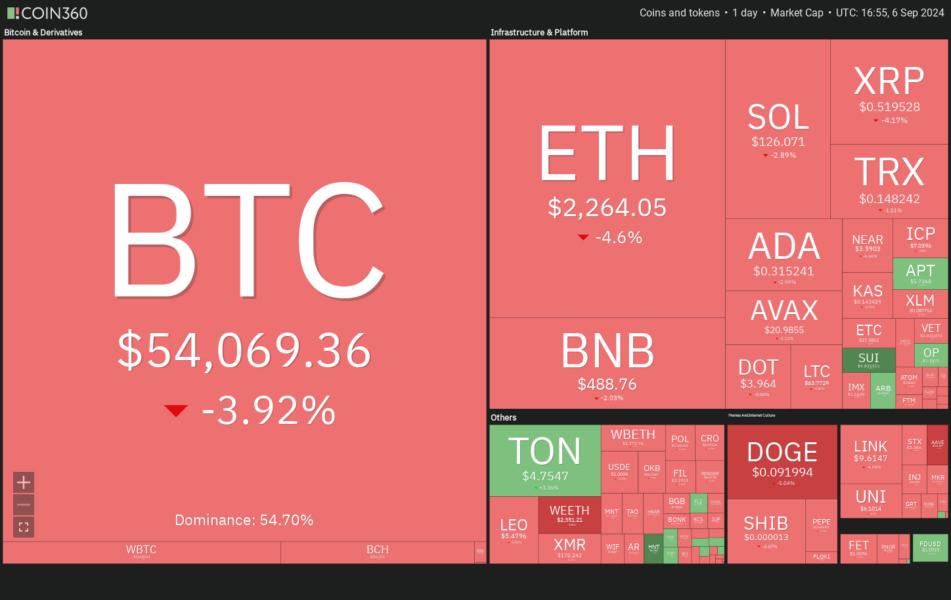

Trump’s win has also fueled a crypto bull run, which has been among the longest experienced since the 2021 market surge. On December 5, Bitcoin hit a new all-time high of $103,900, the first time the coin hit a 6-figure price.

According to multiple analysts, including CryptoQuant’s founder and CEO Ki Young Ju, BTC was set to hit above $100,000 before the end of the year. Young Ju had previously mentioned that by the last day of this year’s trading day, Bitcoin might achieve a price of $112,000.

Ethereum, which has also been surging since the Trump win, has surged by over 28% in the past month. U.S. spot Ether ETFs have further seen more inflows since the Trump win. BlackRock’s ETHA has been one of the top gainers, getting nearly $2 billion in inflows since its launch.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan