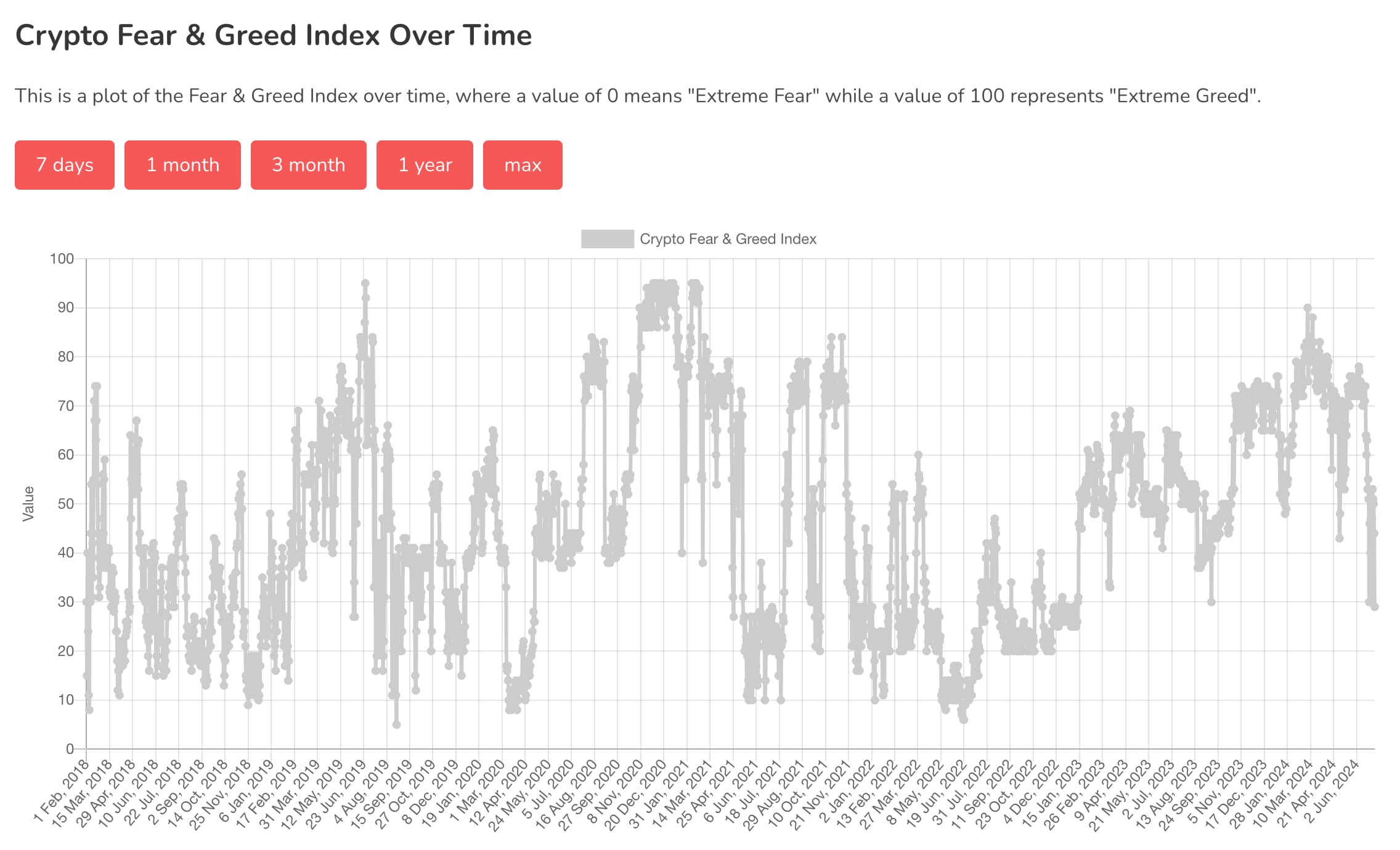

On July 9, multiple on-chain data tracking platforms, including Glassnode and Cryptorank, recorded the Bitcoin Fear and Greed Index at 27. The market sentiment metric is the lowest since the beginning of 2023, when it hit 26. At the time, BTC dropped below $17,000 after the FTX bankruptcy saga.

Also Read: Bitcoin mining difficulty drops by 5% as market price remains below $58,000

On July 8, investor selling pressure increased, leading to bitcoin prices momentarily dropping to $55,000. The BTC market has since recovered, going back to above $57,000. Bitcoin dominance has also increased by over 0.3%, and the coin’s market capitalization has increased by $2.8% over the past 24 hours. Bitcoin is notably at 21% below its all-time high of $73,750, reached in March this year.

Several reasons contribute to investor fear

In June, information spread about the defunct Japanese BTC exchange Mt. Gox beginning its repayment plan to creditors in July. The exchange transferred over $2 billion in BTC to a wallet on July 7 as part of the repayment plan.

Many analysts attribute the current crypto market plunge to the Mt. Gox repayments. Since the Mt. Gox news began to spread, BTC plunged below the $60,000 mark, dropping below $54,000 on July 4. The July 4 plunge was the lowest the top coin experienced since hitting its all-time high.

📉 Bitcoin has plunged to its lowest level in over four months due to concerns around the Mt. Gox repayment plan and government sales. Let's dive into what's happening and what it means for $BTC. 🧵 #Bitcoin #CryptoNews pic.twitter.com/y5pVNvIjuL

— Fundamental Research Corp. (@FRCorp) July 5, 2024

Alongside the Mt. Gox repayment, some governments reportedly began transferring massive amounts of BTC, increasing market uncertainty. Germany and the United States have most notably made several BTC sell-offs of crypto seized from illegal activities since June 19.

According to data from Arkham Intelligence, the German government has transferred over 10,000 BTC since yesterday. Germany still holds considerable BTC, and many in the crypto community expect more transfers soon. The country currently has 23,964 BTC, worth approximately $1.38 billion.

More data from Arkham indicated that the U.S. government sent 3,940 BTC to Coinbase Prime. Arkham explained that the U.S. seized the BTC in January from Banmeet Singh, a drug trafficker.

Observers in the crypto community speculate that the Mt. Gox and German government sell-offs may be the top reasons for market uncertainty. Some analysts, such as 10x Research’s Markus Thielen, believe BTC could fall below $50,000.

Bitcoin ETFs buying the dip

Bitcoin ETFs saw an increased BTC inflow over the past few days, including on July 5, when BTC dropped below $54,000. Data from Farside Investors indicated that Bitcoin ETFs had an inflow of approximately $437 million since July 5. The data showed that ETFs are buying the dip while governments offload their BTC holdings.

Nearly 300 million dollars in inflows for #Bitcoin ETFs yesterday!

Looks like the boomers & institutions are buying the dip here, while Germany offloads a bunch of coins.

Coins moving from weak, to strong hands.

Good stuff. pic.twitter.com/LNXzj5c5XD

— Jelle (@CryptoJelleNL) July 9, 2024

Bitcoin enthusiast Anthony Pompliano explained that bitcoin ETF inflows have significantly reduced the volatility in the crypto markets lately. He mentioned that HODLers believe in BTC’s long-term resilience and continue to accumulate the coin in current conditions.

Also Read: Rogue Company deletes all Dr Disrespect in-game content

The Bitcoin critic, Peter Schiff, noted Bitcoin ETF investors’ lack of panic as they continue holding on to their assets during crypto market turbulence. He observed that it would take larger drops in the coin’s price for the investors to sell their BTC.

Cryptopolitan reporting by Collins J. Okoth