As the gears of the global economy grind and groan under the weight of various pressures, one player has been particularly noteworthy for sending ripples – or rather, waves – across the world’s financial seas. China, a titan in the realm of export, has been on a rollercoaster that’s not just internal but is spilling over borders with the force of a deflationary deluge. The phenomenon of falling prices, reminiscent of the eerie quiet before a storm, is not just a local headline anymore; it’s a global bulletin.

Global markets, already a mosaic of complexity, are finding this new pattern both a challenge and a paradox. As the world’s manufacturing behemoth, China’s recent trend of slashing prices on exports is casting a long shadow over international inflation rates, potentially offering a sigh of relief to some while presenting a conundrum to others.

A New Wave of Economic Dynamics for China

Behind the curtain of falling consumer prices, which in January saw a dive deeper than any Olympic diver aiming for gold, lies a narrative of excess capacity and a slowing juggernaut. The Producer Price Index (PPI) took a slide down the slope too, indicating a trend that’s more than just a blip on the radar. The fall in prices, while a boon for consumer wallets, is a testament to a cooling engine in China’s economic machine, which for years has been firing on all cylinders.

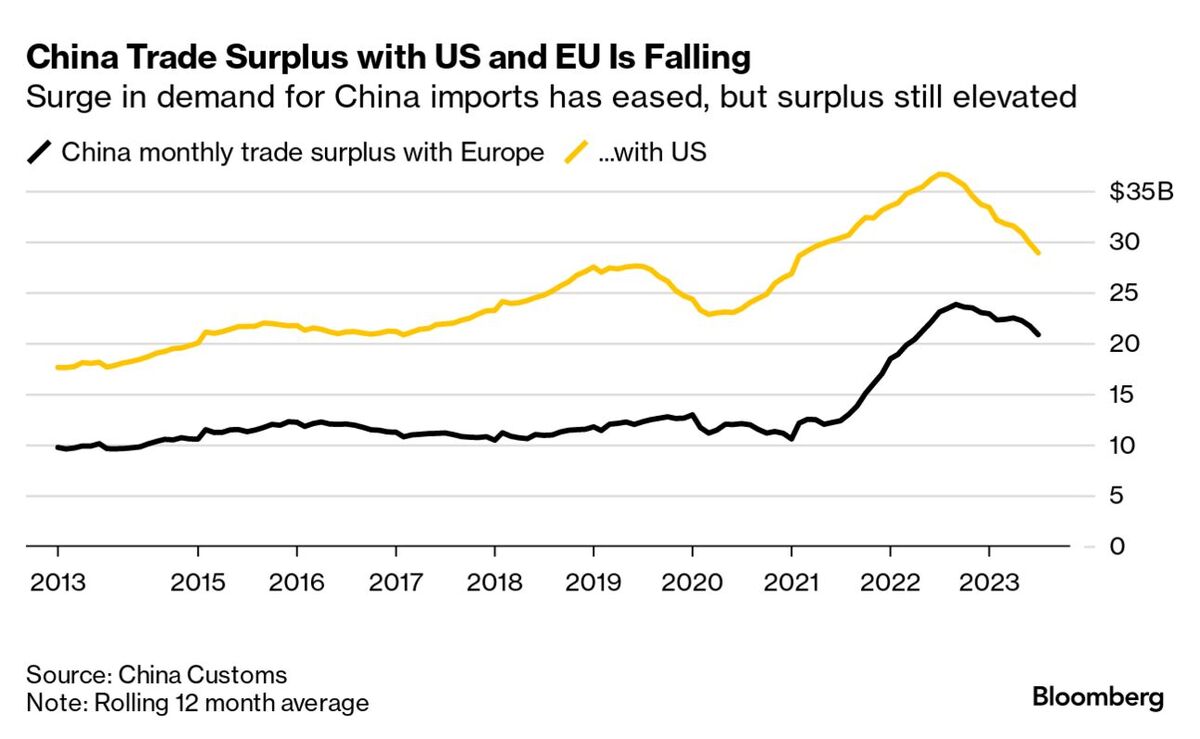

As prices tumble, whispers of deflation are turning into loud conversations in boardrooms and market floors around the world. The specter of deflation, often a ghost story told to scare economists, is becoming all too real as China’s goods become cheaper, tipping the scales of trade balances and potentially rewriting the rules of global commerce.

The Ripple Effects

This shift is not just a number on a balance sheet; it’s a transformative force in the fabric of global trade. Emerging markets, traditionally buoyed by high commodity prices, are now navigating through uncharted waters as they balance the boon of cheaper imports against the bane of lower export revenues. The deflationary pulse emanating from China is like a double-edged sword; it offers relief in the form of lower inflation but challenges growth models built on pricier exports.

Moreover, the global chessboard of trade is witnessing moves that are both bold and uncertain. Central banks, those guardians of monetary stability, are recalibrating their strategies, potentially easing rates to keep pace with the changing tides. This monetary maneuvering, while tactical, underscores the interconnectedness of our global economy and the outsized role China plays within it.

The narrative extends beyond economics into the realm of policy and politics. Western manufacturers, already grappling with the challenges of innovation and competition, find themselves at a crossroads. The influx of cheaper Chinese goods is a litmus test for trade policies and protectionist instincts, with implications for industries ranging from automobiles to electronics.

China’s deflation export is more than just a shift in prices; it’s a harbinger of change in the global economic order. As nations and corporations chart their courses through these turbulent waters, the implications of China’s economic recalibration will be far-reaching, touching every shore from the bustling ports of Europe to the growing markets of Africa and Latin America.

Despite the undercurrents of concern, some analysts suggest a silver lining, pointing out that this could be a momentary dip, a blip in the grander scheme of China’s economic narrative. Yet, as we stand at this crossroads, it’s clear that the impact of China’s deflation export is a multifaceted saga, weaving together threads of economics, policy, and global trade dynamics in a tapestry that’s as complex as it is compelling.