The world of cryptocurrency has exploded in popularity, attracting both seasoned traders and newcomers seeking a piece of the digital gold rush. However, this dynamic market, characterized by 24/7 operation and relentless volatility, presents unique challenges for traders. Here’s where the landscape is undergoing a significant shift – the rise of artificial intelligence (AI) is transforming how traders approach crypto trading.

The need for AI in this fast-paced environment is becoming increasingly clear. The sheer volume of data constantly generated in the crypto market – price fluctuations, news sentiment shifts, social media buzz – is simply beyond the capacity for human analysis alone. This information overload creates a significant disadvantage for manual traders, who struggle to keep pace with the ever-evolving market forces.

The growing presence of institutional traders further tilts the playing field. These major players, with their vast resources and sophisticated technology, have already embraced AI-powered trading tools. They leverage AI’s ability to analyze vast datasets and identify subtle trends, gaining a significant edge in this data-driven market. Without similar tools, individual traders risk being left behind in an “algorithmic arms race,” where success hinges on the ability to process information and react swiftly.

AI’s Role in Supercharging Analysis

The human brain excels at many things, but sifting through mountains of data isn’t necessarily one of them. AI, on the other hand, thrives in this domain. AI-powered crypto trading tools can analyze vast troves of historical price data, news sentiment, social media trends, and other relevant factors – all in real time. This comprehensive analysis allows for the identification of subtle patterns and a deeper understanding of the forces driving market movements. Imagine having a tireless analyst constantly working to uncover hidden insights – that’s the power AI brings to the table.

Removing Emotion from the Equation

Let’s be honest, emotions can be the enemy of sound trading decisions. Fear and excitement can cloud judgment, leading to impulsive trades that might not align with long-term goals. AI, however, removes emotions from the equation entirely. By following pre-defined trading strategies based on market analysis, AI can execute trades objectively. This helps to minimize losses caused by emotional reactions during periods of market volatility, allowing traders to stick to their plan with a cool head.

24/7 Market Coverage

The beauty (or perhaps the curse) of cryptocurrency is that the market never sleeps. Traditional traders might be limited by market hours, but AI doesn’t have that problem. AI tools can continuously monitor price movements and market conditions around the clock, identifying potential trading opportunities even when traders are offline. This vigilance allows for the capture of fleeting market movements that human monitoring might miss, potentially leading to more profitable outcomes.

Optimizing Strategies and Managing Risk

AI’s capabilities extend beyond real-time analysis and emotionless execution. By analyzing historical data, AI can backtest different trading strategies, helping traders refine their approach and identify those most suited to current market conditions. This data-driven approach can significantly improve overall trading performance in the long run. Additionally, AI tools can be programmed to consider risk tolerance and implement predefined risk management protocols. This helps traders stay within their comfort zone and potentially minimize losses during periods of high volatility.

QuantWise: A Platform Powered by AI Insights

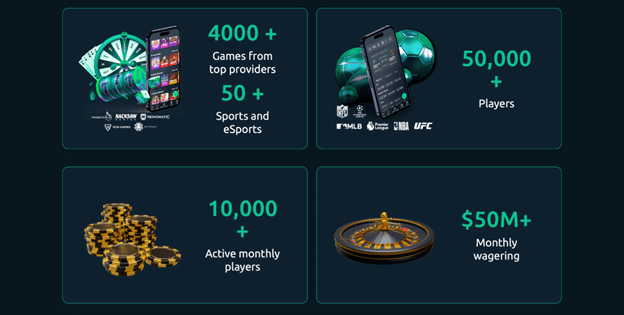

Platforms like QuantWise are at the forefront of this AI revolution in crypto trading. Their CryptoGPT exemplifies how AI can be leveraged to enhance trading efficiency. CryptoGPT provides real-time market analysis, identifies trends, and offers actionable insights that traders can utilize to make informed decisions.

While AI offers undeniable advantages, it’s important to remember that it’s a tool, not a replacement for human judgment. The most successful crypto traders will likely be those who can leverage the power of AI analysis alongside their own experience and risk management strategies. As AI continues to evolve, we can expect an even more symbiotic relationship between human and machine intelligence in the ever-dynamic world of crypto trading.

About QuantWise

QuantWise equips you with AI-powered tools, market intelligence, and unparalleled learning resources to help you become a powerful trader.

Disclaimer: This article blends human insight with content enriched by AI technologies. While we strive for accuracy and reliability, neither QuantWise nor the author can vouch for the complete correctness or comprehensive nature of the information presented and is subject to further changes and updates at any time.

QuantWise content aims to provide up-to-date information about the crypto market and various crypto assets. However, the crypto market is influenced by various factors and external events that may not always be predictable. Users should be aware that market data and analysis provided by QuantWise may not be error-free or exhaustive. Cryptocurrency trading carries substantial risks and isn’t for everyone. Before venturing into crypto trading, assess your financial objectives, experience, and appetite for risk. You might face a total or significant loss, so only invest what you’re prepared to lose. Always acquaint yourself with all associated risks and consider seeking advice from an independent financial professional.