Forex (FX) trading, the distinctions between automated trading, traditional artificial intelligence (AI), and generative AI are becoming increasingly difficult to distinguish. This confusion is a fundamental obligation that may compromise the sustainability of trading services with unrealistic needs. There is a great need to make clear the differences among these technologies so that they will be incorporated effectively and keep a competitive edge.

Automation vs. traditional AI

Automation is a procedure of establishing the rules that will determine the order of carrying out predefined actions. Such computer systems are very effective for tasks that are repetitive and have high precision and efficiency.

In this way, these systems smooth the whole process without being a part of it, thus reducing the risk of human error. Nonetheless, one key factor to bear in mind is that automation deprives AI of the aptitude to learn and make autonomous decisions, which is where AI intercedes.

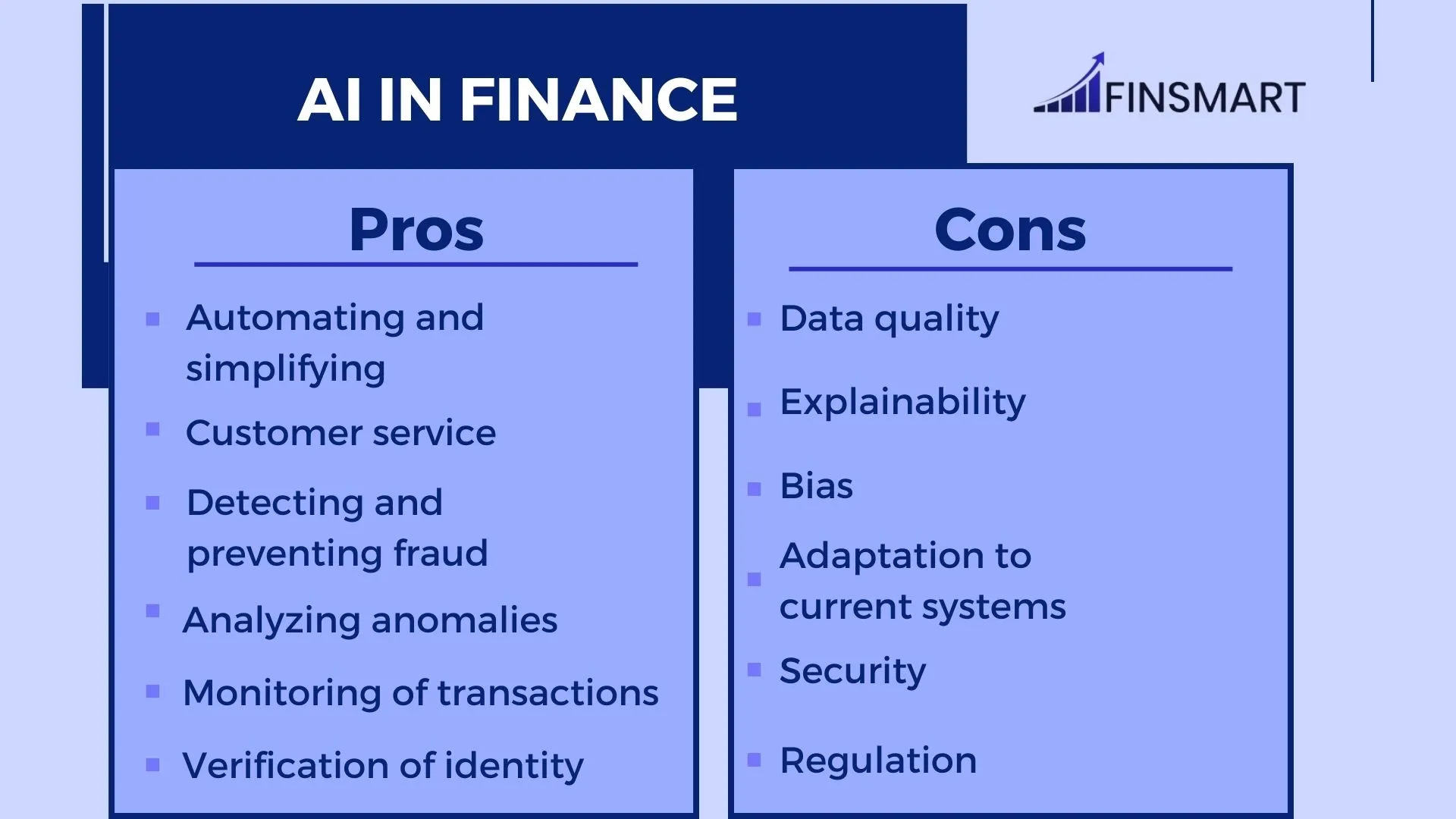

While AI norms make machines emulate human decision-making processes, conventional AI induces machines to learn from data and reason themselves. The technology could bring the change in the strategy of trade by spotting trends and making predictions, therefore, the system can easily adapt to the situations. Though AI can be very helpful, the fact that its use may be too much for some simple and repetitive tasks that can be done with automation is very important to note.

The Perceptions of AI and automation

The financial services business, as a new trending term, has generated the term “generative artificial intelligence” (GenAI), where such terms are normally taken to mean the two tools: large language models and sophisticated automated workflows and machine learning tools. Nevertheless, this practice may result in the wrong understanding of the technologies and their capabilities and, therefore, in allocating the technological investments and expectations, as the technologies have distinct functionalities and applications that are not clearly defined.

The head of product strategy trading at SwissQuote points out that confused AI-automation perception makes it difficult to clearly realize the capabilities, limitations, and dynamic features of AI trading systems. She suggests that it sums up to having a balanced investment portfolio while budgeting some resources for both AI research and automation programs. This approach is diversification at its best. It makes the technology implementation more resilient and reduces the risks associated with dependence on a single technology solution.

Overreliance and risk exposure

David Morrison, senior market analyst at Trade Nation, highlights another potential pitfall of unrealistic expectations regarding automation’s capabilities: automation overspending and the risk of playing directly into the hands of hackers being another factor. As per him, automation is not omnipotent, so companies need to find the mean between using technologies for the benefit of time and keeping the skills of human workers in the loop

Eugene Markman, COO of Ion Markets (FX), stresses the importance of clear communication. Marketing AI and marketing automation interchangeably could mislead and cause disconnection to technological investments and expectations, mainly because AI and marketing automation are more likely to have essential features that are not the same as the intended ones.