Bitcoin’s mining profitability has plunged as operations become more challenging. Industry expert Kurt Wuckert has expressed his concerns regarding the Bitcoin market and warned against investing in mining, citing uncertainties in the industry.

Also Read: African crypto market is growing under Solana’s influence

The mining industry is experiencing a change in the dynamics of mining operations, which is getting more challenging. The high levels of network hashrate have led to changes in mining profitability even though the crypto has record trading values.

Record Hashrate affects the profitability of mining firms

Data on Bitinfocharts shows that the hashrate of mining Bitcoin has increased to 635 exahashes per second (EH/s), intensifying the difficulties in mining. The mining hashrate has nearly tripled since November 2021. In 2021, the hashrate was 161 EH/s, yet the price of Bitcoin was almost the same as today when the hashrate is at 635 EH/s.

Explaining mining economics to a Palm Beach County crypto audience tonight. pic.twitter.com/k6EN4YHwRt

— Kurt Wuckert Jr | GorillaPool.com (@kurtwuckertjr) June 27, 2024

Hashrate Index data indicates that the “hash price,” the daily profits per terahash per second (TH/s), has dropped to its lowest level in five years. It is now at $51.13 as of 16 July. The decline highlights an increase in the cost of mining one block, leading to low profitability for individual miners even though Bitcoin has a relatively good market value compared to its ATH.

Mira Hurley, a crypto analyst, revealed that only two mining firms, Antpool and Foundry, managed to extract 54% of all Bitcoin blocks in the last 12 months. A report published on Bitcoin.com in June revealed how the two mining firms have become dominant players in the industry. The report highlighted that miners are collaborating to improve their odds of extracting a block. The collaboration of Bitcoin miners has reportedly led to an increasingly centralized operation, which may affect the integrity of the mining network.

Bitcoin miners express their concerns

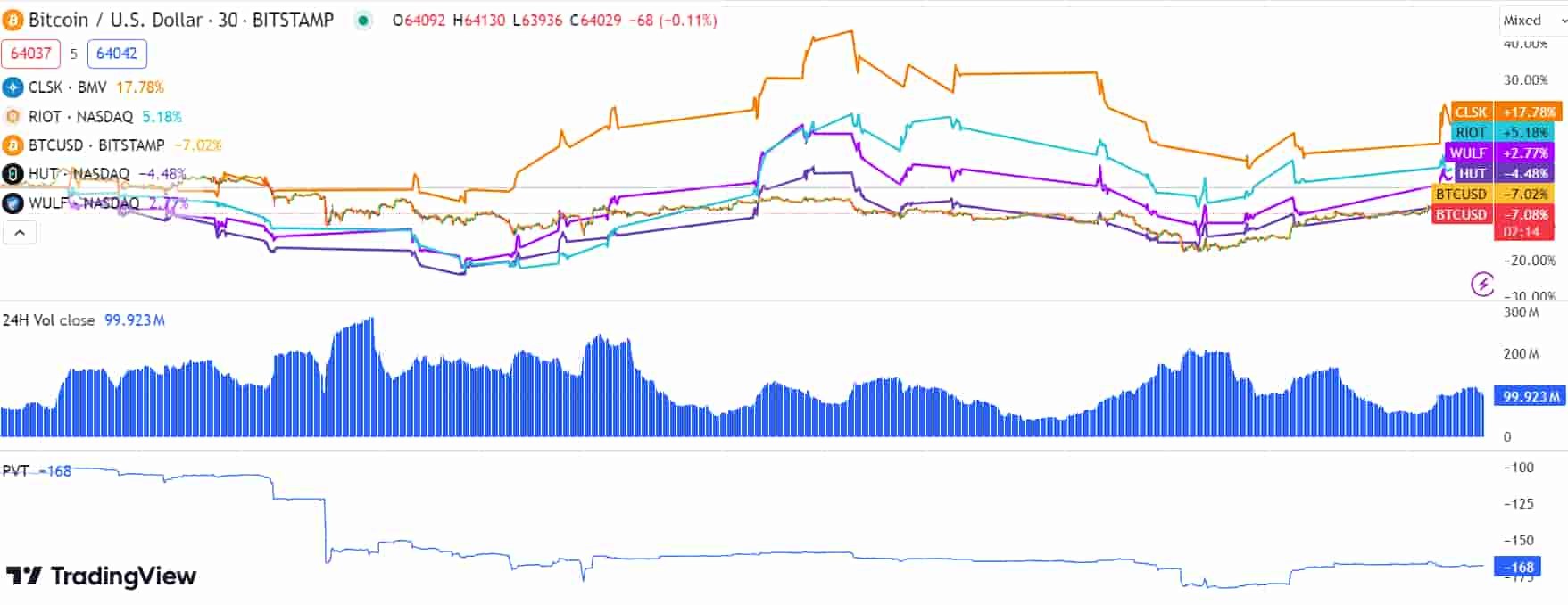

Kurt Wuckert, the founder and CEO of Gorilla Pool (a Bitcoin SV mining pool), expressed his concerns regarding the current situation. Wuckert revealed that Bitcoin miners who utilize SHA256 blockchains are experiencing low returns, the first case in about six years. Kurt mentioned that some US-based BTC miners are still operating, and the value of their stock improves their profitability level since they are publicly traded entities.

While addressing an audience at a crypto event in Miami, Wuckert expressed his concerns about the current state of the crypto market. The CEO cautioned investors and industry enthusiasts against investing in new mining or blockchain assets because of the overall uncertainty in the crypto industry.

Wuckert highlighted the challenges brought about by using electricity in mining operations. The CEO further alluded to Bitcoin miners being big electricity consumers by hashing. This aspect offers a profit opportunity through power arbitrage, worsening the hashing economics.