Blockchain technology has built its reputation as a revolutionary force in numerous sectors, including healthcare, finance, gaming, and even supply chain management. One of its most transformative applications is in the realm of modern payment systems. This article explores how blockchain is reshaping the way we conduct financial transactions, offering enhanced security, transparency, and efficiency.

Enhanced Security

One of the most significant advantages of blockchain technology in payment systems is its heightened security. Traditional payment methods often rely on centralized databases that can be vulnerable to hacks and fraud. In contrast, blockchain operates on a decentralized ledger, making it inherently more secure. Each transaction is encrypted and linked to the previous one, creating an immutable chain of data. This makes it very difficult for hackers to alter or tamper with any records of transactions.

Moreover, blockchain employs advanced cryptographic techniques that add an additional layer of security. These techniques ensure that only authorized parties can access and verify transactions, reducing the risk of unauthorized access & fraud.

Increased Transparency

Transparency is another critical benefit that blockchain brings to modern payment systems. In traditional financial systems, transactions are often opaque, and it can be challenging to trace the flow of funds. Blockchain technology addresses this issue by providing a transparent and easily auditable transaction records.

Every transaction recorded on the blockchain is accessible to all the network’s participants, creating a transparent and trustworthy environment. This level of transparency is particularly beneficial in industries where trust and accountability are paramount, such as online gambling and online slots. Users can verify that transactions are conducted fairly and without manipulation, fostering greater confidence in the system.

Improved Efficiency

Blockchain technology also offers significant improvements in the efficiency of payment systems. Traditional payment methods often involve multiple intermediaries, each adding time and cost to the transaction process. Blockchain makes these intermediaries obsolete by enabling peer-to-peer transactions, which can be completed almost instantly.

Smart contracts, a feature of blockchain technology, further enhance efficiency by automating and streamlining complex transaction processes. These self-executing contracts automatically enforce the terms of an arrangement when preset conditions are met, reducing the need for manual intervention and minimizing the risk of errors.

Lower Transaction Costs

The traditional payment system often involves various fees, including processing fees, currency conversion fees, and charges levied by intermediaries. Blockchain technology can significantly reduce these costs by cutting out the middlemen and enabling direct transactions between parties. This is particularly advantageous for cross-border payments, where traditional methods can be both slow and expensive.

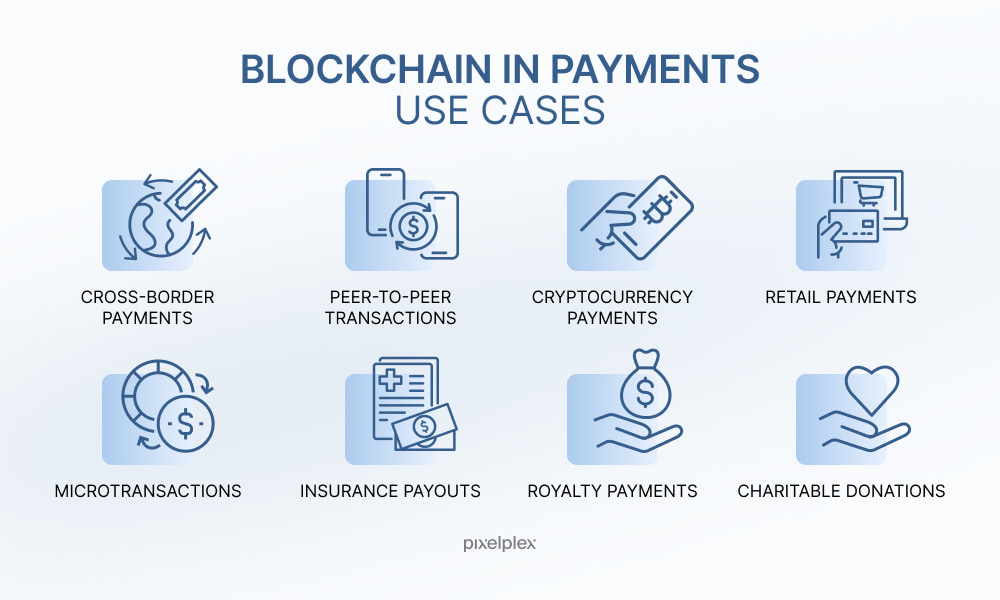

Real-World Applications

Several industries are already leveraging blockchain technology to enhance their payment systems. For instance, the remittance industry is using blockchain to facilitate faster and cheaper cross-border money transfers. Similarly, online retailers and service providers are integrating blockchain-based payment solutions to offer more secure and efficient transactions to their customers.

The financial sector is also exploring the potential of blockchain to improve various aspects of banking and finance, from clearing and settlement processes to identity verification and fraud prevention.

Blockchain technology is playing a pivotal role in transforming modern payment systems. Its ability to provide enhanced security, increased transparency, improved efficiency, and lower transaction costs makes it an attractive solution for a wide range of industries. As blockchain continues to evolve and mature, its impact on the payment landscape is likely to grow, offering even more innovative and effective solutions for conducting financial transactions.