The latest Bitcoin (BTC) rally took the holdings of the Royal Government of Bhutan above $1B for the first time. The country is both a miner and a long-term holder, and is one of the governments to supplement their income with a dedicated BTC mining facility.

The wallets of the Royal Government of Bhutan contain more than $1B worth of Bitcoin (BTC). After the leading coin broke a series of records above $84,000, long-term holders are now sitting on even more outsized gains. BTC not only broke its nominal all-time high but is close to its inflation-adjusted all-time value, showing its capabilities of outperforming other assets in the short term.

The total holdings of the government are 12,568K BTC, a much lower range compared to the holdings of the US government. Despite this, the small Himalayan country is the fourth-largest holder of BTC, after the UK government with more than 61K BTC.

The wallets even surpassed El Salvador, now holding more than $468M, or 5.93K BTC. Both Bhutan and El Salvador owe their coins to mining, and not to confiscated assets.

Royal Government of Bhutan started selling at above $71,000 BTC price

As a miner, the government facility has faced issues with breakeven prices. The current price far surpasses the breakeven price for all miners, independent of cost savings. The Royal Government of Bhutan mines through Druc Holdings, the country’s premier holding company for innovations. Bhutan’s BTC are mined using local hydropower and local data centers, reusing a site from a previous educational project.

The Royal Government of Bhutan can mine up to 5 BTC per day, through its contracts with AntPool and FoundryUSA. The two pools are currently the most productive ones, creating 50.8% of all blocks. This puts Bhutan’s hashing power at under 1% of the aggregated rate for the two pools, consistent with the data of small, localized mining centers. The country controls its own ASIC and mining revenues, with regular wallet withdrawals.

The newly mined coins are held in four known wallets, with mostly inbound transactions. The wallets also contain a few hundred ETH, though the data centers of Bhutan have not switched to other coin or token mining. The Royal Government of Bhutan’s top wallet also contains dust amounts of other assets, including airdropped memes.

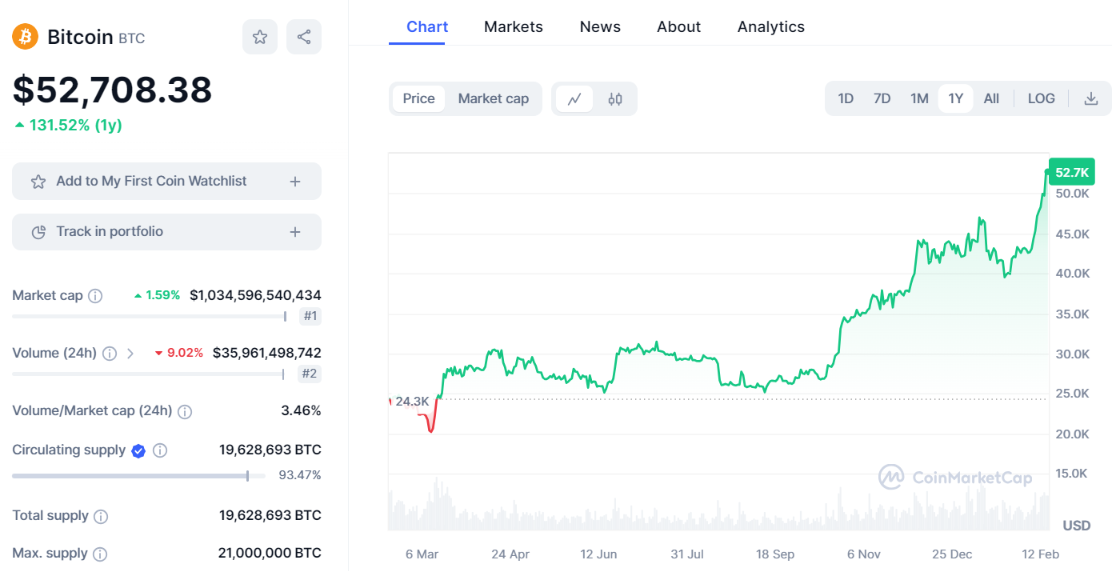

Balances in most wallets are at an all-time high, as the government has only sold a fraction of the mined coins in the past months. The last deposit to Kraken for 500 BTC was a year ago, at prices under $40,000.

On October 29, however, the Royal Government of Bhutan deposited 929BTC on Binance, with the potential to sell.

Not all BTC in Bhutan’s reserve have been mined. The government also purchased some of the assets, at an undisclosed price from 2020 onwards. The Royal Government of Bhutan now has the makings of a national Wealth Fund, along with other investments by Druc Holdings.

Is BTC fit for a national reserve?

The large-scale holdings of the USA raised the question whether BTC was fit for a national reserve. Even at the current market price, BTC is still too small to compete on the government scale. Reserves such as the Norway Silver Fund, backed by oil production, contain $1.74 trillion as of November 2024.

The entire supply of BTC is now evaluated at $1.67B, including nearly 3M locked or unreachable coins, 2M BTC in miner reserves, and other large-scale holdings that may not move soon. This leaves an even smaller share for building strategic reserves, and an even higher hypothetical price for BTC.

BTC reserves, however, serve mining companies and work well on the business scale. Miners recently took some profits, decreasing their reserves from 2.05M BTC to 2.03M BTC in the past few days.

Miners hold significant reserves and are one of the long-term supporters of BTC. Currently, mining activity is happening at a loss, or at a very thin margin. Waiting for higher valuations and a BTC rally above $100K may help miners recoup losses and finance their pivot to AI data centers.