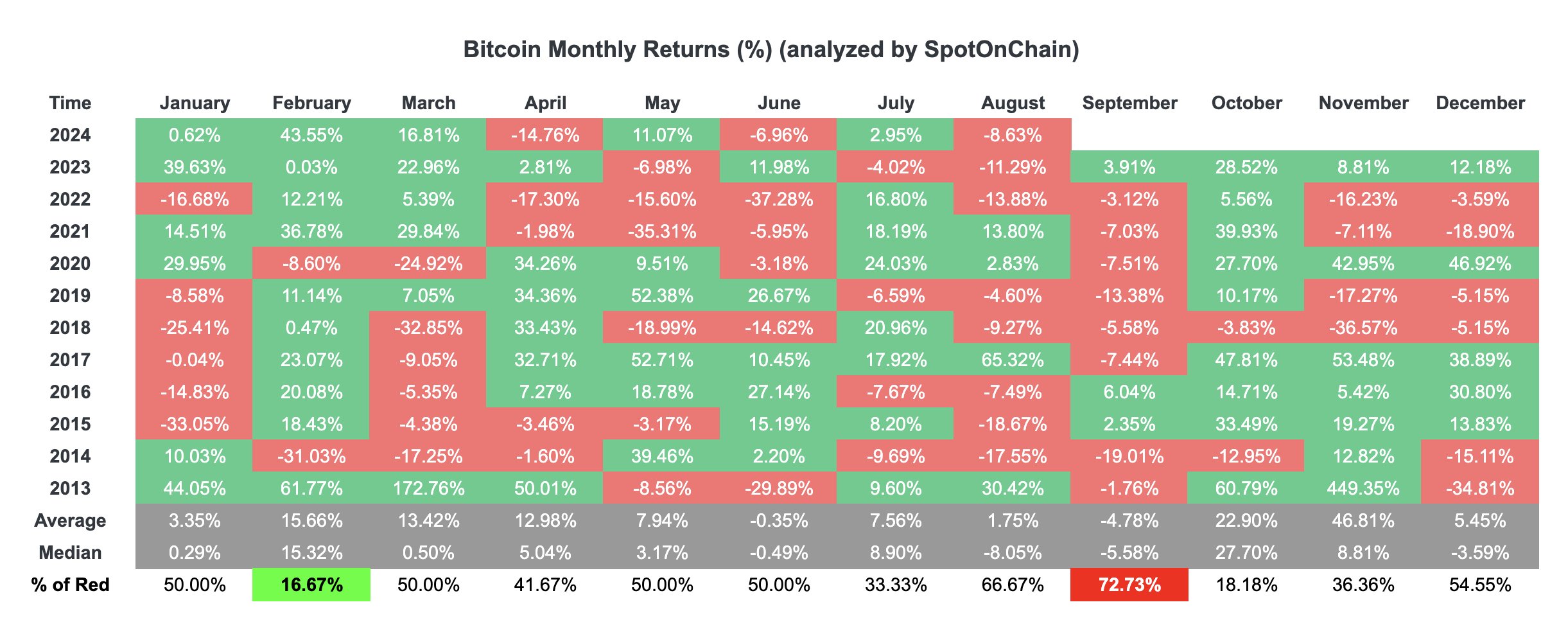

September is often a wild ride for Bitcoin. Since 2013, this month has earned the nickname “Rektember” among traders. Why? On average, Bitcoin’s return in September is -4.78%. And it gets worse. There’s usually a peak-to-trough drop of around 24.6%.

In August, traders cashed out around $4.251 billion in profits. That’s a big chunk of change, and it’s creating some selling pressure.

One interesting trend is the drop in big-money moves. Transactions over $100,000—typically involving whales—are at their lowest in nearly four years.

Usually, when the whales are quiet, it means they’re holding onto their Bitcoin, possibly expecting the price to go up. Less whale activity can sometimes mean less volatility.

Looking at the MVRV, Bitcoin might be undervalued right now. On both 7-day and 30-day timeframes, the numbers tell us there’s room for price growth if demand picks up.

Not everyone is optimistic, though. Analysts from Bitfinex are throwing some cold water on any bullish dreams. They predict Bitcoin could fall to the $40,000 range this month if the Federal Reserve goes ahead with rate cuts.

They’re talking about a potential 15-20% drop from current levels. Historically, rate cuts have led to price dips before any recovery.

On the supply side, things are getting interesting. The amount of Bitcoin available on exchanges is now at its lowest level since December 2018.

And then there’s the metric of active addresses, which tells us how many wallets are currently in use. This number has dropped sharply, similar to what we saw in the 2017 and 2021 bear markets.

But unlike those times, Bitcoin’s price isn’t crashing. Long-term holders are showing resilience, which could help support the price.

According to CryptoQuant, these holders have increased their Bitcoin supply by 262,000 BTC over the past 30 days, bringing their total holdings to 14.82 million BTC. That’s 75% of the total supply.

Moreover, many top anonymous Bitcoin wallets, which hold large amounts of BTC, remain inactive. Seven of the top 10 wallets, holding a total of 237,816 BTC (worth about $14.04 billion), haven’t moved in over two years.