A look into Bitcoin’s historic bottom and now

Historically, this has been the look of a $BTC bottom, with both short-term & long-term holders now being underwater on average.

— Dylan LeClair

The attention now is turned towards the denominator of BTC/USD; more USD strength could place further pressure on the market short-term. pic.twitter.com/6Qcx6m3UDJ(@DylanLeClair_) September 26, 2022

Currently ~71% of circulating supply hasn't moved in approximately 6 months.

— Dylan LeClair

27% of circulating supply has been held for ~6 months and is currently underwater. These coins likely are not selling.

The supply inelasticity of $BTC cuts both ways. Something to keep in mind… pic.twitter.com/pLKV0SsoD1(@DylanLeClair_) September 26, 2022

Given that such a large percentage of the supply looks to be price agnostic, a small amount of marginal selling/buying can dramatically influence the exchange rate.

— Dylan LeClair

USD strength is bearish short-term, but it allows the maximalist cohort to acquire a greater share of the float…(@DylanLeClair_) September 26, 2022

Not calling bottom, but from a fundamental standpoint, in hindsight the best time to buy BTC is when everyone is underwater.

— Dylan LeClair

We're there, but a volatility panic in legacy would assuredly send the market lower in the interim.

Check out 30d change of the average holder cost basis pic.twitter.com/yqFkyVRdAQ(@DylanLeClair_) September 26, 2022

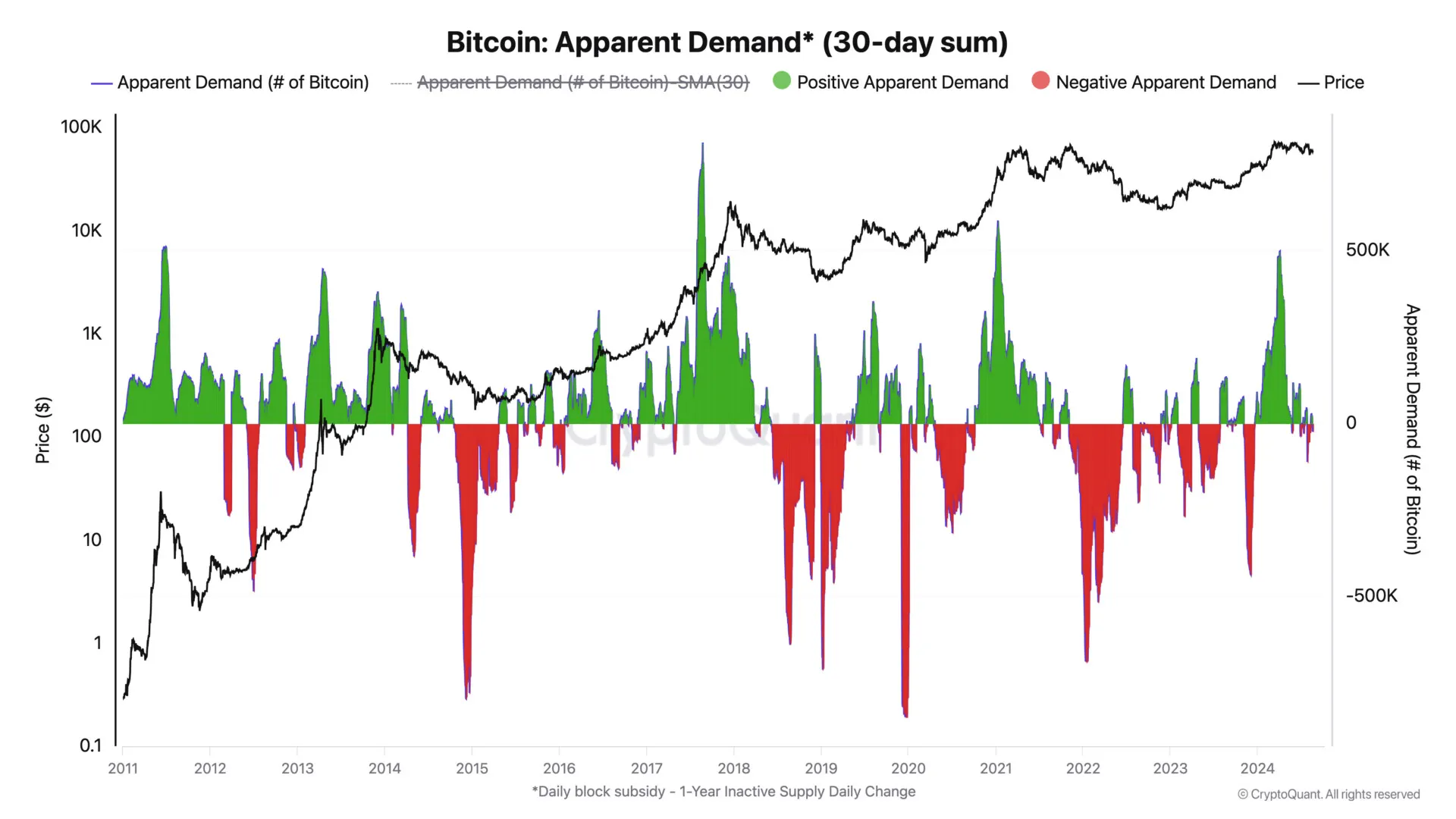

You still need net inflows to push the market higher, which we're not really seeing,

— Dylan LeClair

But as each day passes, crazy bitcoiners from all corners of the planet acquire a greater share of the float.

Similarly, the marginal production cost of BTC will continue to march higher. pic.twitter.com/APHmzRWS5u(@DylanLeClair_) September 26, 2022

Skeptics should really do their best to understand this:

— Dylan LeClair

Hash rate continues to rise.

As hash rate rises, so does mining difficulty. Supply inelasticity + rising miner difficulty = programmatically rising marginal production cost.

(Note: Log scale for both)

Seems important. pic.twitter.com/XtUgkozTvi(@DylanLeClair_) September 26, 2022

To re-emphasize:

— Dylan LeClair

Price is set at the margin, for any asset, but particularly for one that is absolutely scarce & predominately hoarded by price agnostic holders.

Short-term macro headwinds are here, no doubt. But given the info covered above, what's the ultimate outcome?

END/(@DylanLeClair_) September 26, 2022

Binance to burn Terra Classic

1/1 #Binance will burn some #TerraClassic boys! It's the first time in history when a CEX is burning #crypto.

— Satoshi Club (@esatoshiclub) September 26, 2022

How did we get to such an outcome? Who is responsible for this historical event?

Find all the answers here! A thread by @esatoshiclub

2/11 @Binance & @cz_binance are, as always, our #crypto role models. Simply put, if you somehow missed CZ's thread, #Binance will burn $LUNC at their expanse, not at their users'.

— Satoshi Club (@esatoshiclub) September 26, 2022

Binance will collect the trading fees on LUNC/$USDT and LUNC/$BUSD, convert them to $LUNC and burn.

3/11 However, this plan is slightly different from the one CZ tweeted about last week. What changed his mind?

— Satoshi Club (@esatoshiclub) September 26, 2022

Yeah, it was the #LUNCCOMUNNITY. These guys know what they're doing! To make the biggest #cryptoexchange in the world listen to you, man, that's awesome.

4/11 Even after the disappointing #DoKwon saga, they found a way to keep $LUNC going. Pure bravery!

— Satoshi Club (@esatoshiclub) September 26, 2022

United, the #web3 community can achieve wonderful things. Well done guys, appreciate it.

5/11 In the meantime, #CZ is slowly taking over Do Kwon's lost empire.

— Satoshi Club (@esatoshiclub) September 26, 2022

Nothing serious or illegal, just taking over people's hearts by actually listening to what they are trying to say. Well done @cz_binance, we knew you are a man that can hear a community!

6/11 Returning to our question in the first tweet (hey, psst, don't forget to RT) — Yes, there actually were some precedents.

— Satoshi Club (@esatoshiclub) September 26, 2022

Whoa Whoa, slow down, we are talking about non-formal leaders that, due to various reasons, are literally taking over the project.

7/11 Let's start with our beloved @VitalikButerin. Yeah, we'll add him in every thread)).

— Satoshi Club (@esatoshiclub) September 26, 2022

After he pumped the #SHIB price by burning over 50% of the total supply, the #SHIBARMY proclaimed him their non-formal leader and protector. We are talking about that 900% pump from 2021.

8/11 Second in our queue is @elonmusk, the #DOGE godfather. The name comes from his obsession with @dogecoin – a meme coin that with his help gave birth to hundreds of millionaires.

— Satoshi Club (@esatoshiclub) September 26, 2022

Although his relationship with #DOGE is a little weird, DOGE is his pet project now.

10/11 As for $LUNC's nearest future, it has now a slightly bigger chance to thrive again as a reborn #cryptocurrency or… it can repeat #LUNA's fate. Both scenarios are on the table.

— Satoshi Club (@esatoshiclub) September 26, 2022

Don't get tricked by today's pump. This 37% is fueled by the media buzz, nothing more.