A crypto trader has warned that Bitcoin (BTC) could soon become out of reach for ordinary retail investors, comparing its potential trajectory to the Berkshire Hathaway shares trading on the New York Stock Exchange (NYSE).

Wall Street Flocking To Bitcoin: Lessons From Berkshire Hathaway Shares

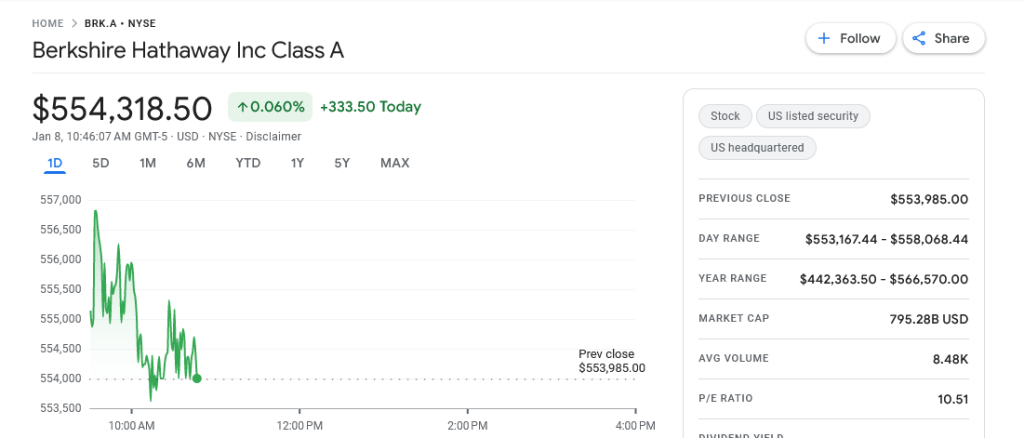

On X, Oliver Velez, a crypto analyst and trader, argued that Wall Street’s newfound embrace of Bitcoin could drive prices higher, making it even more expensive for individual investors to purchase. The trader likened this scenario to Berkshire Hathaway shares. Trading at $554,318 according to Google Finance on January 8, these Class A shares are presently out of reach to most investors.

In the trader’s analysis, BRA shares were Buffett’s “baby” and knowingly zoned off from the ordinary investor because giving them access meant empowering the “wrong group of people.” The analyst claims that Wall Street plans to implement the same “attack” that isolates the masses from Bitcoin, going by the recent turn of events.

Related Reading: Shiba Inu Team Member Breaks Down Process Of Acquiring Shibarium NFTs

Wall Street institutions, who have been critical of Bitcoin in the past, are warming up to Bitcoin and crypto. As the market prepares for institutions’ entry, BTC prices are increasing, with more gains expected once a proper vehicle is greenlit by the strict US Securities and Exchange Commission (SEC).

Based on Velez’s post, Wall Street will deliberately push Bitcoin higher so it is out of reach from retail investors. This way, they will financially cordon off Bitcoin, making it impossible for ordinary users to gain exposure.

With Bitcoin becoming expensive for retailers like Berkshire Hathaway shares, it will be a barrier for users who view it as a potential tool for financial freedom. From the post, the trader believes that buying the coin at spot rates could be a strategy if they want to access financial freedom.

BTC Floats Above $45,000: Eyes On The SEC

The crypto community remains bullish as Bitcoin prices float higher when writing. The coin is trading above $45,000, shaking off weakness, with news that the SEC could approve a spot in Bitcoin ETF in the next few trading sessions.

This product, on authorization, would allow institutional investors to gain exposure to Bitcoin through traditional investment vehicles, potentially driving up demand and further inflating the price.

Bitcoin remains bullish, looking at candlestick arrangement. Expanding on January 8, supporters expect the coin to breach $46,000, completely reversing losses of January 3.

The race towards $50,000 and even 2021 highs of $69,000 might be accelerated if favorable regulatory developments legitimizing BTC and allowing institutions to buy the asset via regulated channels are approved.