Just a 3% rebound in Ether’s price would wipe $345 million in short positions amid Grayscale withdrawing its Ether futures ETF application.

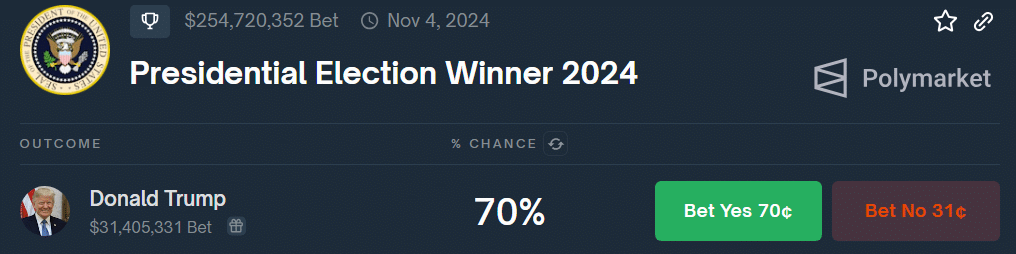

Ether (ETH) traders have stacked up their short positions over the last 24 hours, just as Grayscale Investments pulled its application for an Ethereum futures exchange-traded fund (ETF).

Ethereum is hovering close to a key support level at $3,010, having dropped by 1.85% over the past 24 hours, as per CoinMarketCap data.

However, liquidation maps show traders have more conviction that the price is going down in the near term — with $345 million in short positions set to liquidate if the price goes upward by 3%.