TRB Price Prediction 2023-2031

- TRB Price Prediction 2023 – up to $22.55

- TRB Price Prediction 2025 – up to $74.21

- TRB Price Prediction 2028 – up to $222.33

- TRB Price Prediction 2031 – up to $702.87

What’s up with Tellor (TRB)?

The volatility of crypto prices has led to the fragility of the DeFi market, and with it, massive automatic liquidations in DeFi protocols. TRB price predictions can go south, but here’s the main thing: further developments could push the value of Tellor TRB higher.

How much is TRB worth?

According to Coinbase, the price of Tellor has fallen by 6.69% in the past 7 days. The price increased by 0.12% in the last 24 hours. In just the past hour, the price shrunk by 0.68%. Let’s see if this TRB Price Prediction can help you decide on future action.

What is Tellor TRB?

Nicholas Fett, Brenda Loya, and Michael Zemrose co-founded Tellor in early 2018. When it comes to Tellor, it is more than just a group of investors or just an oracle. It comprises a community of data producers, validators, and token holders to form a permissionless network that uses bitcoin to guarantee the blockchain’s record-keeping mechanism for real-world data.

Tellor’s oracle is essentially a permissionless, decentralized interface between blockchains and the real world. TRB is often employed as a mining incentive in the Tellor ecosystem as a utility token.

TRB’s internal procedures

- Querying of data takes place.

The inclusion of a TRB tip allows users to access data queries that will be rectified in the future block.

- The queries are converted into Proof of Work (PoW).

User requests for Tellor’s smart contract are processed, and data providers are given a PoW challenge to mine the most complex queries.

- PoW is converted into data updates via data sources.

Staked data provider systems compete to mine the PoW problem and give the needed fresh data updates. Also, staked data provider systems are competing.

- A read-only on-chain pricing stream contains official statistics figures.

A digestible data stream from the first five proof-of-work (PoW) solvers and submitters is used by the Tellor contract as the official pricing.

- Disputing a submission

Data supplied to token holders might be disputed. Data provider shares are reduced if a legal challenge is successful.

Crypto watchers are a mixed lot, but we can say that those who watch crypto exchanges and crypto events tend to benefit a lot. For example, take a look at the TRB coin of the Tellor Tribute platform.

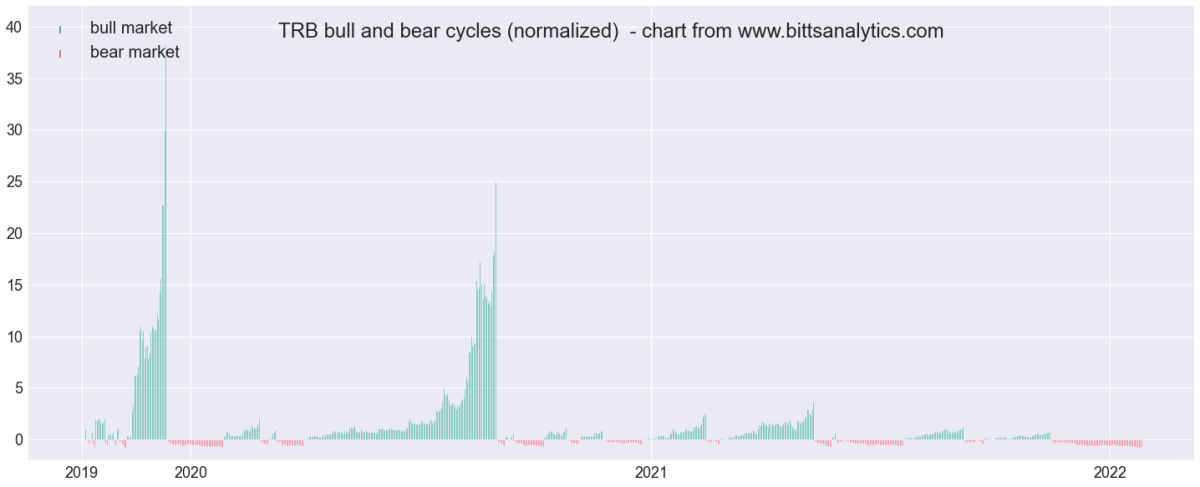

Tellor biggest bull run started on Nov 10th, 2019, and ended on Dec 12th, 2019. During this time, the price of Tellor increased from 0.1823 USD to 7.1404 USD, resulting in a return of 3817.6 %.

When it was first listed in Binance, its price started shooting up slowly, then up to ~$75 in August 2020.

After a correction in the fall of the same year, TRB was trading around $20-$25 for a while. Its price started to rise again in January 2021, reaching ~$60, but a major technical failure in February sent it tumbling back down to around $35 and even lower.

TRB spiked after Tellor’s listing on Coinbase in early May 2021, reaching a spectacular $163.76 on May 10. By late June, TRB’s price went down, but it was still trading at around the ~$40 mark, keeping its users’ interest by announcing the upcoming upgrade called Tellor X. What’s in store for TRB, the native currency?

TRB Price History

ETH’s smart contracts don’t need off-chain data since they’re entirely self-contained. As a result of Tellor’s approach, parties may demand the value of an off-chain data point (such as ETH/USD), and miners compete to put that value into an on-chain data bank available to all Ethereum smart contracts.

A network of staking miners guards the series’ inputs to prevent unauthorized access. The core Tellor smart contract builds a time series of all required data to become the primary source of high-value data for the decentralized application. These alternative cryptocurrency systems use Tellor’s token, Tributes, produced by the oracle “Tellor,” to demand a particular data series from the miners.

Crypto watchers are a mixed lot, but we can say that those who watch crypto exchanges and crypto events tend to benefit a lot. For example, take a look at the TRB coin of the Tellor Tribute platform. When it was first listed in Binance, its price started shooting up slowly, then up to ~$75 in August 2020.

After a correction in the fall of the same year, TRB was trading around $20-$25 for a while. Its price started to rise again in January 2021, reaching ~$60, but a major technical failure in February sent it tumbling back down to around $35 and even lower.

TRB spiked after Tellor’s listing on Coinbase in early May 2021, reaching a spectacular $163.76 on May 10. By late June, TRB’s price went down, but it was still trading at around the ~$40 mark, keeping its users’ interest by announcing the upcoming upgrade called Tellor X. What’s in store for TRB, the native currency?

TRB New Developments

The Teller TRB team has been active on social media platforms to update their network users on the latest developments. Through their official Twitter Channel, TRB has announced the exciting news that the Teller team has launched their initial testnet deployment of Tellor360 to 0xPolygon Mumbai Testnet.

The team published a blog to clarify the changes suggested in the recently launched Tellor360 upgrade. They first suggested a TellorFlex upgrade for the mainnet. For all chains other than Ethereum, this entails modifying the name of the TellorFlex structure.

The token’s separation from the oracle contract is the primary distinction in this instance. This modification is entirely structural, and TRB will continue to work as it now does to streamline Teller’s architecture between chains and boost decentralization via modularity on the mainnet.

According to the blog, other essential areas they proposed to change are removing any upgradeability (fully modular), redoing governance (make similar to polygon governance), stake amount fixed in dollar terms, messaging/branding changes, and monitoring teller’s changes. This involves Tellor360’s flexible incentive structure (vs. timeBasedRewards) should herald an entirely new set of reporters making desired inquiries across multiple networks as part of the monitoring Telliot modifications.

TRB Technical Analysis

Due to several macro events, the crypto market has experienced a significant sell-off, resulting in the Tellor token forming a solid bearish channel over the past few days. Additionally, the financial crisis at crypto-friendly bank Silvergate and SVB have depegged several stablecoins, including USDC. Hence it creates an uncertain zone for investors, forcing traders to withdraw their funds, resulting in high selling pressure in the TRB price chart. Additionally, SEC’s crypto crackdown has dampened investors’ bullish sentiments, causing a sharp drop in the TRB price chart. The Tellor token has already breached the crucial support level of $14.89 and is continuing to extend its bearish rally, aiming to break through multiple critical price levels. However, there is still a chance for a bullish reversal, as the TRB token may prepare for a recovery rally after finding support below its 23.6% Fib level. Our objective with this Tellor price prediction is to provide a comprehensive technical analysis that employs expert technical indicators, allowing investors to make informed decisions during the current market trend and develop a profitable investment strategy.

Based on CoinMarketCap, the current price of the TRB token is $12.49, experiencing an uptrend of 2.33% in the past 24 hours. Our technical analysis of Tellor crypto suggests that if the digital asset breaks through its bearish triangle pattern and garners enough buying pressure for a sustained bullish rally, it may soon achieve new highs. The daily price chart illustrates TRB’s struggle to surpass the EMA-100 trend line at $15.77, as the current market conditions lean towards a bearish scenario, increasing the likelihood of a crash. Our analysis indicates that the TRB token could recover if it breaches the MA slope trend line, initiating a fresh rally. The Tellor community has recently experienced significant volatility, with prices fluctuating between $16 and $12 over the past few days. The TRB token currently trades near the bearish territory after losing support from bulls at $13.73. However, the asset has prevented further decline by finding support at $12.31 and is now experiencing a slight upward retracement towards its 31.8% Fib retracement. The BoP (Balance of Power) indicator trades in a slightly bearish region of 0.14, potentially pushing the TRB coin to test its support near $12.

The RSI-14 indicator has recently dropped to the final selling region at the 28-level, signaling a significant decline. However, it is on the verge of a bullish reversal if trading volume increases, which will push the RSI level upwards, leading to an increase in the token’s price. The MACD line has formed a bearish divergence with its signal line, causing concern among altcoin investors as it generates bearish candles below this level. The SMA-14 is also not optimistic as it trades above the RSI level at 40, allowing for more space for a bearish rally. Nonetheless, an upward correction is predicted as the Stochastic RSI has hit its bottom. If the TRB coin breaks above its EMA-100 trend line at $15.77, it may spark a clear uptrend toward the upper limit of its Bollinger band at $19. If Tellor’s price surpasses its monthly resistance at $23, it may attempt to break its crucial resistance at $28. On the other hand, if the price falls below the critical support level of $10, a more severe downtrend is anticipated. If this happens, Tellor may plunge toward the lower limit of its Bollinger band at $7.96. If the TRB token fails to hold above $8, it may trigger a bearish bloodbath and trade around $5.

TRB Price Prediction By Cryptopolitan

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2023 | 18.82 | 19.41 | 22.55 |

| 2024 | 27.78 | 28.75 | 32.5 |

| 2025 | 42.7 | 43.85 | 49.46 |

| 2026 | 61.97 | 63.72 | 74.21 |

| 2027 | 88.51 | 91.7 | 106.89 |

| 2028 | 125.75 | 129.42 | 150.09 |

| 2029 | 188.41 | 193.58 | 222.33 |

| 2030 | 281.81 | 289.56 | 329.52 |

| 2031 | 401.1 | 412.69 | 482.59 |

| 2032 | 554.64 | 571.15 | 702.87 |

TRB Price Prediction 2023

Our TRB price prediction for 2023 expects a maximum trading price of $22.55, with an average trading price of almost $19.41. TRB might retrace downward with a minimum price of $18.82 by the end of 2023.

TRB Price Prediction 2024

Tellor boasts of developing solid and overwhelming fundamentals for the crypto space. TRB price prediction for 2024 predicts that the token will extend its bullish momentum and likely achieve a maximum price level of $32.50. After that, Tellor crypto might record a low of $27.78, with an average trading price of $28.75.

TRB Price Prediction 2025

Our TRB price forecast for 2025 predicts a minimum price value of $42.70, a maximum price value of $49.46, and an average value of $43.85.

TRB Price Prediction 2026

TRB may rise by a significant value in 2026 and bring a great return on investment to its long-term holders. Our TRB price prediction for 2026 expects a maximum trading price of $74.21 with an average trading price of $63.72. TRB may trade at a minimum level of $61.97.

TRB Price Prediction 2027

The crypto market may soon bring bullish hopes to investors and overcome its current turmoil as it is building potential for a bullish comeback and is expected to skyrocket in the next few years. Our TRB price prediction for 2027 suggests that it may touch a maximum trading price of $106.89. TRB may trade at an average price of $91.70 with a minimum level of $88.51.

TRB Price Prediction 2028

Our TRB price prediction for 2028 states that it may touch a maximum value of $150.09 and an average trading price of $129.42. The minimum value for the Tellor cryptocurrency is predicted to hit $125.75.

TRB Price Prediction 2029

In the upcoming years, TRB may gain impactful partnerships due to its user-friendly environment that can push its price to the North. Our TRB price prediction for 2029 expects a maximum price of $222.33 and a minimum price of $188.41. Tellor crypto may reach an average value of $193.58.

TRB Price Predictions 2030

Depending upon the future market potential and response from the community, Tellor coin can see a maximum price level of $329.52 with an average trading price of $289.56. However, TRB is projected to hit the bottom level at $281.81 by the end of 2030.

Tellor (TRB) Price Prediction 2031

According to our TRB price analysis, the TRB token may bring a bullish wave to investors’ portfolios as the token has a solid roadmap ahead. The price of Tellor is projected to reach a maximum price value of $482.59, with an average trading price of $412.69. The minimum trading price of Tellor is predicted to be $401.10 by the end of 2031.

TRB Price Prediction 2032

TRB’s price is forecasted to reach a minimum level of $554.64 in 2032. As per our prediction, the Tellor price could reach a maximum value of $702.87 with an average forecast price of $571.15.

TRB Price Prediction By Digital Coin Price

Digital Coin Price’s Tellor price forecast is bullish for the upcoming years as the website expects the TRB token to rise. According to their TRB price analysis, the price of TRB may surpass the $28.23 level in 2024, with a potential maximum price of $29.58. However, it also predicts that the TRB price may experience a decline to a minimum of $26.40 by the end of the year.

In 2032, the TRB token may trade above the level of $233.24. However, it might experience a dip and reach a minimum price of $232.73 before potentially reaching a maximum level of $234.00.

TRB Price Prediction By CryptoPredictions.com

According to CryptoPredictions.com’s Tellor price predictions, in April 2023, Tellor is anticipated to commence trading at $13.131 and conclude the month at $14.168. The projected maximum TRB price for April is $16.933, while the minimum price is expected to be $11.514.

In 2027, the average trading price of the TRB token is predicted to hit $25.06 with a minimum price of $21.3 and a maximum price of $31.33.

TRB Price Prediction By Wallet Investor

Wallet Investor gives a bearish outlook for the Tellor token’s future price as the website predicts a steep decline in TRB’s value. By the end of 2024, the TRB token may reach an average trading price of $1.02 with a minimum price of $0.51 and a maximum price of $1.53.

In 2027, the TRB token may attain an average value of $1.198 with a maximum price of $1.797 and a minimum price level of $0.599.

TRB Price Prediction By Market Sentiments

Network participants are incentivized to provide precise data, enhancing Tellor’s worth as a project. With the surge in popularity of DeFi Dapps, projects like Tellor that offer efficient and cost-effective oracle software have a promising future ahead.

The ongoing massive price fluctuation in the TRB token price chart has drawn the attention of several analysts around the crypto space to give their opinions about Tellor’s future price movements. TRB token has received mixed predictions from the market, where the bullish ones expect a value for the token above $1000 in the next few years. A prominent YouTuber, Crypto.01, predicts that TRB’s price may witness a price rise to $1K in the next altcoin bull run.

Another crypto influencer, popular crypto analyst Daily Altcoin, “TRB is one of the most promising altcoins with a ton of upside potential.” He also stated that he thinks the token could reach $20.08 by the start of 2023.

Conclusion

Blockchain technology may have the potential to evolve the world economy, but without access to off-chain data, it would not be easy to find real-world use cases. This is where Tellor comes in as it resolves the oracle problem and answers the question of the speed and cost of using oracles for connecting off-chain data to smart contracts.

Our Tellor forecast expects a significant price shift in the future as Tellor addresses the challenge of the cost and speed associated with utilizing oracles to link off-chain data with smart contracts, effectively resolving the oracle problem. Moreover, Tellor’s ability to maintain smooth performance during Ethereum’s congestion periods adds to its value proposition.

The value of Tellor is also seen in its ability to provide a smooth experience for users despite high congestion on Ethereum. Network participants are rewarded for their contribution to accurate data, which makes the Tellor network an even more worthwhile project.

Although Tellor appears to have established itself as a viable option, it’s not the most well-liked one, and this might pose difficulties in the future. The predictions mentioned above make it evident that Tellor (TRB) forecasts are rather incoherent. Regarding upcoming TRB price fluctuations, whether favorable or negative, there is no general agreement.

Indeed, a variety of elements, including announcements, new technological advancements made by Tellor projects, the overall crypto ecosystem, legal status, and others, will influence the potential development in the future. However, cryptocurrency investments are a high-risk business, and these predictions are not investment advice.

As Tellor’s team is dynamic and active in enhancing the project, TRB may surpass its previous all-time high and mark a new bullish trajectory.

The above projections are based on the analysis and tracking of historical data. Investors are advised to do their own research and due diligence before investing in cryptocurrencies.