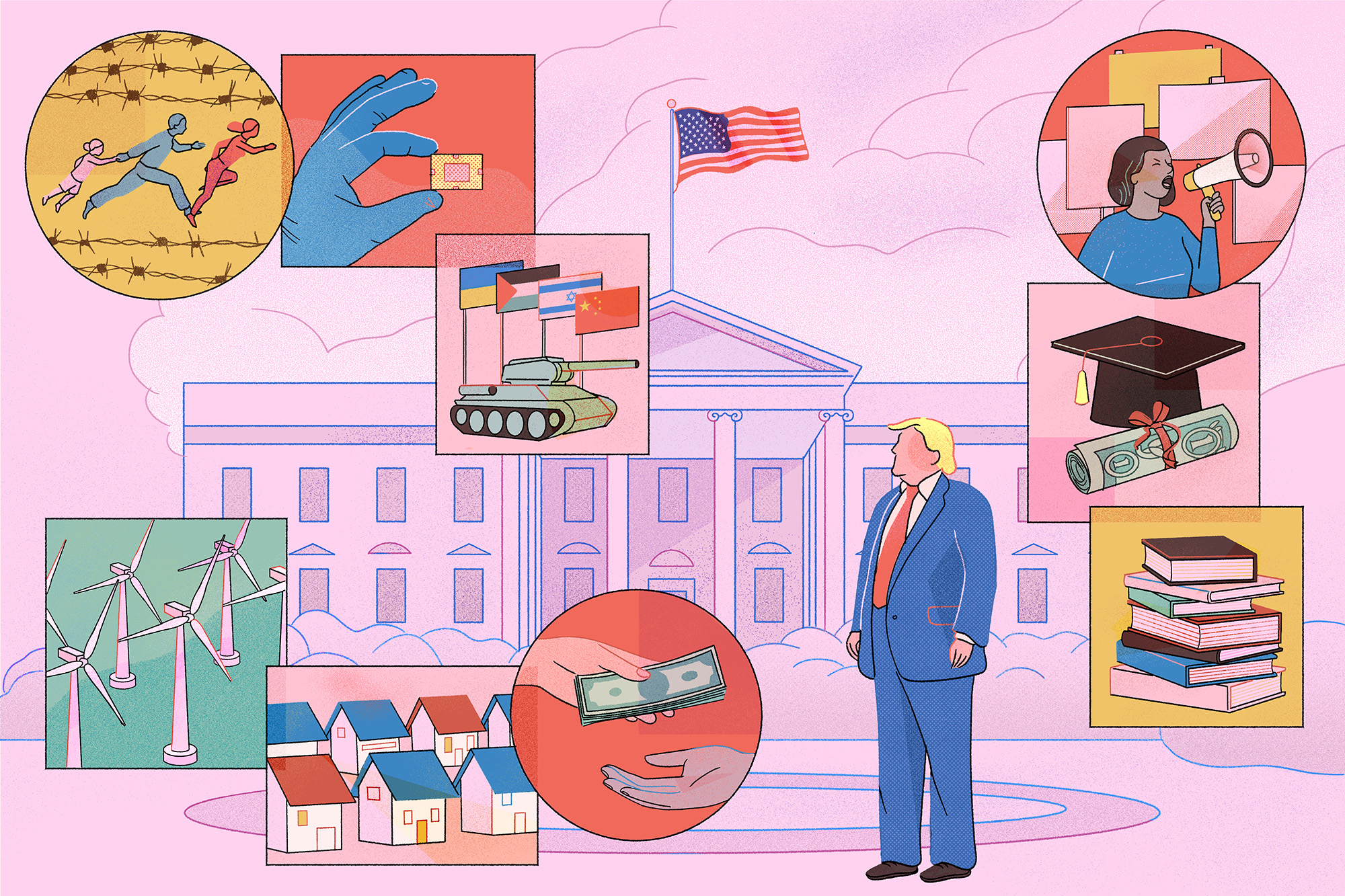

Donald Trump’s upcoming administration looks like a masterclass in loyalty and Wall Street pull. With Republicans likely grabbing control of both the Senate and House, the president has every reason to believe his nominees will sail through the confirmation process.

No endless hearings, no deadlock, no stalling from the other side. And with over 4,000 positions up for grabs, he’s aiming to stack the deck with familiar faces, industry heavyweights, and those who didn’t bolt post-2020.

Trump’s transition team was set in motion months ago, helmed by Cantor Fitzgerald’s CEO Howard Lutnick and Linda McMahon, co-founder of World Wrestling Entertainment.

You can bet these two have been parked at Mar-a-Lago, strategizing over lunches, poring over lists of the faithful and the powerful, figuring out who’ll be the right fit for cabinet roles, including some of the biggest positions in the country.

On Thursday, Trump handed his campaign manager, Susie Wiles, a position few expected. She’ll be the new White House chief of staff—the first woman ever in this position under Trump’s administration. She’s got the authority to control his schedule, gatekeep meetings, and manage policy coordination with Congress.

Think about it: no decision goes to Trump without passing Wiles first. She’s the filter, and Trump, ever the loyalist to his loyalists, has clearly staked his trust in her.

The big Treasury job: Who’s on deck?

The Treasury Secretary role is where things get fascinating. This is not a gig for the faint-hearted. Whoever lands this role will be handling more than just America’s economy—they’ll be the international face of the almighty dollar.

From controlling the world’s reserve currency to acting as a watchdog over Wall Street, and even dipping their toes into international economic diplomacy, it’s a heavyweight job.

Scott Bessent is right at the front. This guy’s not your typical hedge fund honcho; he’s been a diehard Trump advocate. He’s the brain behind Key Square Capital Management and someone who helped Trump shape some of his major economic policy speeches. Bessent hasn’t shied away from public life, either.

He’s been on TV defending Trump’s policies, and he didn’t hesitate to lay into Treasury Secretary Janet Yellen, calling out her alleged political moves with the debt issuance. And just recently, he had some choice words about the Fed’s half-point rate cut in September, claiming it’s time to boost the US currency in line with Trump’s protectionist stance.

Then there’s Jay Clayton, former SEC chair. Clayton’s work in Washington is well-documented, especially for loosening regulations on public companies. And he’s another one who didn’t mind stirring the pot in defense of his legacy.

He’s repeatedly questioned Gary Gensler, the current SEC chair, accusing him of going overboard with regulatory crackdowns. Clayton’s track record has him leaning slightly bipartisan, which, in Trump’s circle, could go either way—either it keeps him out, or it gets him in.

And here’s one name that’s bound to stir the waters — Senator Bill Hagerty. This Tennessee senator doesn’t just know finance; he’s deep in it. Before Trump, he worked as an economic adviser under George H.W. Bush and then pivoted into private equity.

Hagerty’s a known face in the Senate Banking Committee, which holds sway over key financial policies. The tricky part? If Trump appoints him, Hagerty’s Senate seat might not stay Republican.

Speaking of old faces, Robert Lighthizer, Trump’s former Trade Representative, could be back. Lighthizer’s loyalty never wavered even after Trump left the Oval, and his aggressive stance on China speaks directly to Trump’s agenda. Lighthizer’s presence would likely mean a return to a hard line with China, with tariffs and trade battles galore.

Howard Lutnick, though, is the true wild card. As Cantor Fitzgerald’s CEO and Trump’s transition co-chair, he’s arguably Trump’s top Wall Street confidant. Lutnick’s raised massive sums for Trump, with one event pulling in $15 million.

He could very well end up in an unpaid role, classified as a “special government employee,” sidestepping some disclosure rules that come with typical appointments.

John Paulson, the billionaire investor known for his billion-dollar bet against subprime mortgages, has been a longtime Trump supporter. Paulson and Trump share more than just a Queens origin—they’ve both weathered messy divorces, lawsuits, and seem to see the world the same way.

But Paulson holds a huge stake in Fannie Mae and Freddie Mac, both government-controlled. If he wants the Treasury job, he’d need to divest, possibly losing millions.

Glenn Youngkin, Virginia’s governor and former Carlyle Group exec, is a darker horse in the Treasury race. He didn’t buddy up to Trump right away during his own campaign, keeping his distance. But recently, Youngkin’s shown a more Trump-friendly face. His term ends in 2025, which might make him available for a job in Trump’s economic war room.

National Economic Council: Trump’s inner brain

The National Economic Council (NEC) director job might not be the flashiest, but it’s important. This person shapes Trump’s economic policies and does the heavy lifting in Congress. Kevin Hassett, an economist who already served as Trump’s top economic adviser, could be back.

Known for his economic theories, Hassett fits the mold for NEC. Alongside him is Kevin Warsh, an ex-Federal Reserve governor with a more hawkish view on monetary policy. Either could make Trump’s inner brain trust for a term that’s shaping up to be just as turbulent as the first.

And then there’s the Secretary of State—someone who’s going to be Trump’s diplomatic bulldog worldwide. Ric Grenell is one option. He served as Trump’s ambassador to Germany and then stepped up as acting national intelligence director.

Grenell has been a fierce Trump loyalist, backing him even during post-election controversies. For Trump, Grenell’s undying loyalty and bulldog reputation make him a solid candidate for the State Department.

Bill Hagerty could also fit here. His background as the US Ambassador to Japan gives him the credentials, and his recent experience on the Senate Foreign Relations Committee doesn’t hurt, either. He’s one of the few people with a foot in both financial and foreign policy worlds, making him a flexible choice.

Steven Mnuchin, Trump’s Treasury Secretary during his first term, could shift into this role, too. Mnuchin’s tenure was heavy on sanctions—he had Iran, Russia, and Venezuela in his sights, turning Treasury into a quasi-national security department.

Since leaving office, Mnuchin has launched Liberty Strategic Capital, a private equity firm backed by billions from the Middle East. If he becomes Secretary of State, that money connection might raise a few eyebrows.

Robert O’Brien, Trump’s national security adviser toward the end of his first term, might also take this spot. O’Brien took a hard line on China and was involved in the drone strike that took out Iranian General Qasem Soleimani. He’s a classic conservative on foreign policy, which could balance Trump’s more unpredictable approach.

And, last but not least, Marco Rubio—the one Trump once called “Little Marco.” Rubio has stayed close to Trump, advising him on Latin America and Venezuela, sticking to Trump’s vision on immigration, and backing his decision to end the Ukraine war. Rubio’s strong support for Israel and anti-Iran stance put him on Trump’s shortlist for Secretary of State.

Commerce Department: A new frontier

During Trump’s first term, the Commerce Department didn’t make many waves. Secretary Wilbur Ross, infamous for nodding off in meetings, didn’t help its reputation. But under Biden, Commerce took on a new level of importance, thanks to the Chips and Science Act.

With $280 billion allocated, the department is supposed to bring semiconductor manufacturing back to the U.S. Trump is eyeing this department for a serious makeover, with an America-first agenda in mind.

This time around, Commerce is holding the keys to major tech and trade policies that could define America’s stance against China and other rivals. Trump’s got two contenders for this seat who fit his playbook like a glove.

Robert Lighthizer is in the running here too. This guy is practically synonymous with Trump’s trade war, having driven the US-China policy and advocated for those heavy tariffs we all remember. If he steps in as Commerce Secretary, expect no love lost between the U.S. and its competitors.

Lighthizer would take the reins on trade policy, potentially expanding export controls and using every tool Commerce has to block tech from falling into the hands of China and Russia. He’s not just a name on the list—he’s the likely architect if Trump wants a full-scale trade offensive.

Then there’s Linda McMahon. Co-founder of World Wrestling Entertainment and former head of the Small Business Administration under Trump, McMahon has spent years in Trump’s circle. She’s got the fundraising chops, too, pulling in big bucks from her connections across business and politics.

McMahon knows how to manage money, and if she leads Commerce, she’ll be charged with directing resources for U.S. trade and manufacturing, keeping it all stateside. The odds look good for McMahon if Trump decides he wants Commerce in the hands of someone with hardcore business grit.

Trade Rep: Reigniting populism

If Trump’s going all-in on populist trade policy, the U.S. Trade Representative role is very important. The Trump-era trade rep will have a heavy hand in reshaping America’s trade relations, especially with countries like China, India, and possibly Mexico.

Two Trump-era insiders are on the shortlist here: Jamieson Greer and Stephen Vaughn. Greer was chief of staff under Lighthizer during Trump’s first term, so he knows the drill and has experience running interference with global partners while staying laser-focused on America-first policies.

Vaughn, on the other hand, was general counsel for the USTR and one of the legal backbones of Trump’s trade policies. These are seasoned, tough-as-nails veterans who’ve already spent time battling the big trade partners.

If either of them lands the role, the game plan will be tariffs, regulatory barriers, and trade policies that circle back to Trump’s favorite mantra: bringing American jobs back home.