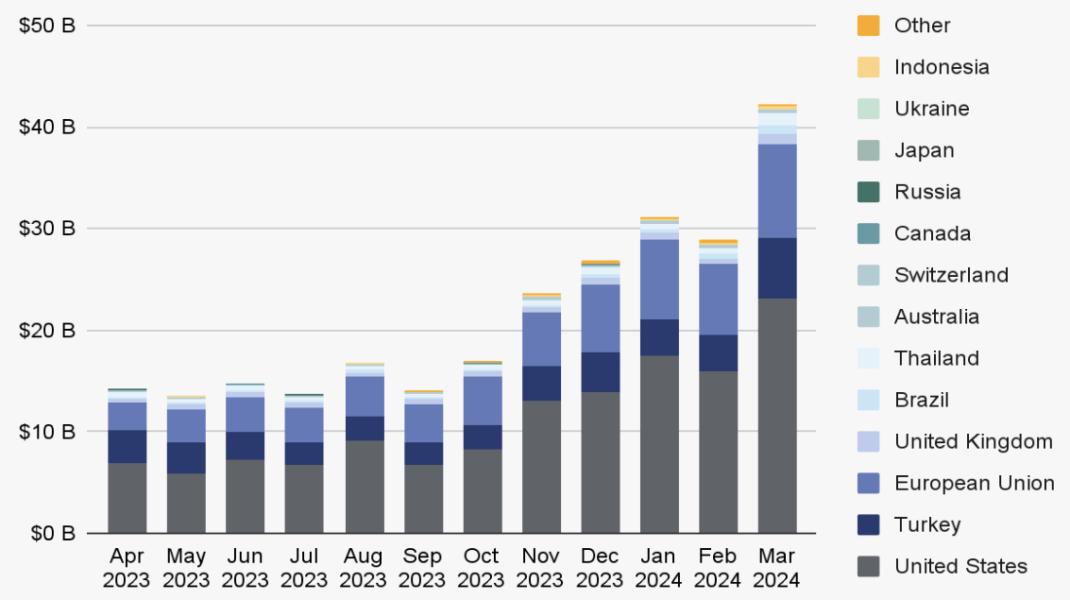

Turkey has surpassed the United States and other global leaders in the proportion of stablecoin purchases relative to its gross domestic product (GDP). This finding comes from the “2024 Crypto Spring Report” by Chainalysis, released on April 25.

The Rising Role of Stablecoins in Global Markets

Stablecoins, which are usually tied one-to-one with the U.S. dollar, offer the same efficiency, security, and transparency as other cryptocurrencies but without the volatility. This feature makes them particularly valuable in countries like Turkey, where the national currency often fluctuates dramatically.

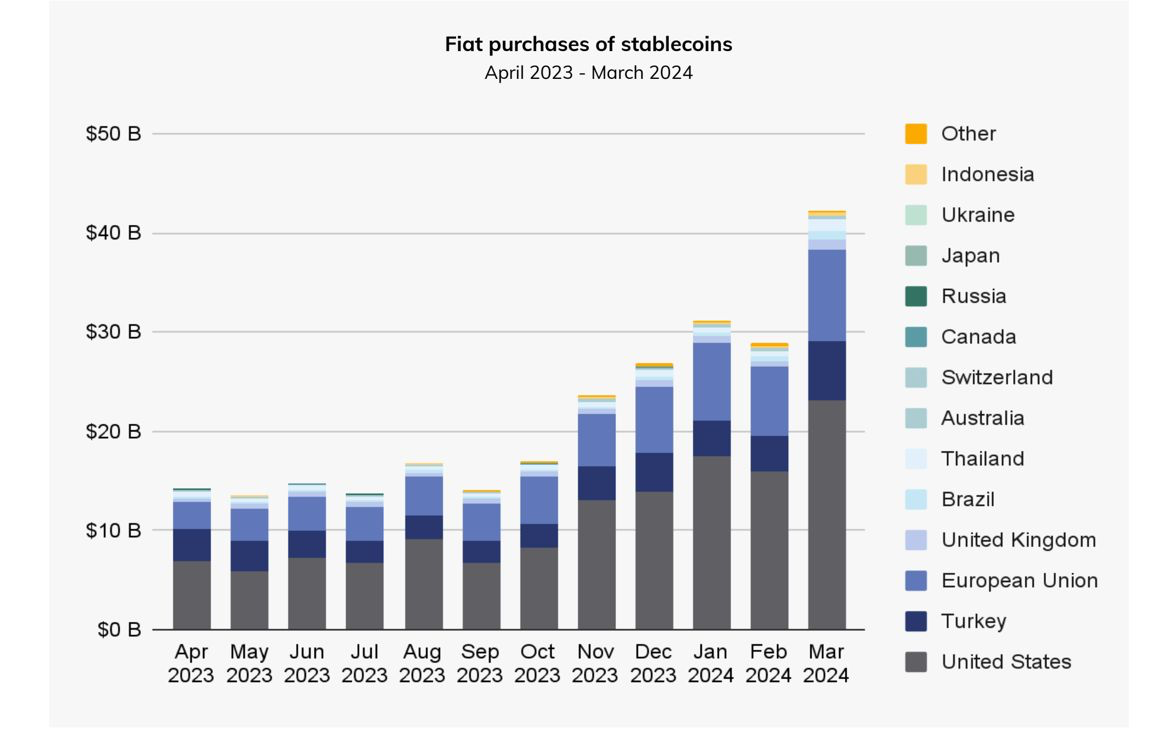

Over $40 billion in stablecoin transactions were recorded globally in March 2024 alone, indicating a significant shift towards these digital assets. Turkey, along with Thailand and Brazil, has been at the forefront of this trend, with stablecoins now representing more than half of all cryptocurrency transactions in recent months.

Residents in countries experiencing currency devaluation, such as Turkey and Georgia, are increasingly turning to stablecoins like USDT (Tether), as per the report. These cryptocurrencies serve as a means of preserving savings and enabling commerce under unstable economic conditions.

The global digital economy’s expansion and the growing adoption of stablecoins like USDT underline their critical role in promoting financial inclusion and easing entry into global markets for those previously excluded from financial services.

DeFi Growth and the Role of Stablecoins

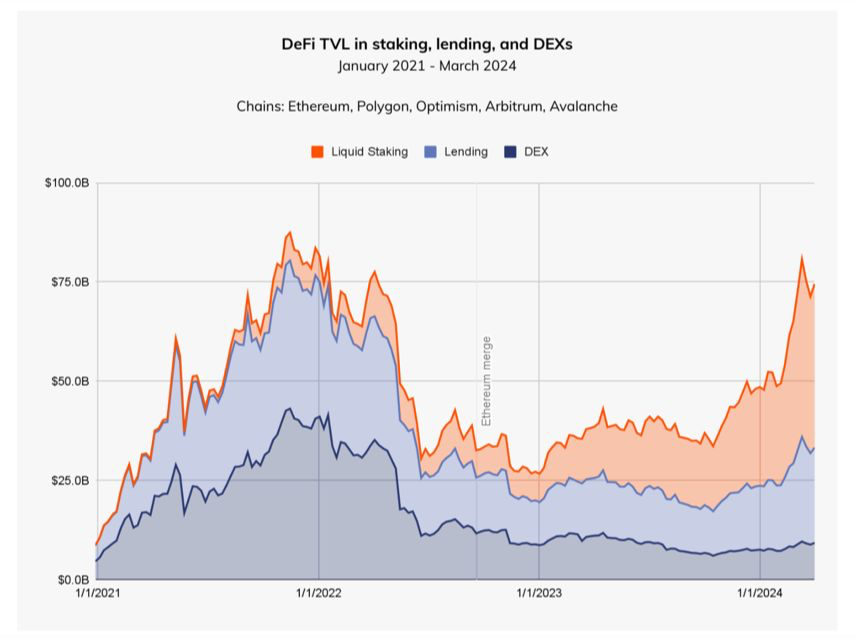

The decentralized finance (DeFi) sector has seen significant development, fueled partly by the adoption of stablecoins. After a period of decline where total value locked (TVL) in DeFi platforms fell by over 69%, shedding around $60.74 billion, there has been a resurgence. TVL in decentralized exchanges (DEXs), staking, and lending is now nearing previous peaks.

Notably, liquid staking has become a crucial driver of this resurgence. Unlike traditional staking, liquid staking does not require participants to lock up their assets, thus maintaining liquidity within the blockchain ecosystem. This innovation followed the Ethereum merge in September 2022, transitioning from a Proof-of-Work to a Proof-of-Stake mechanism, significantly impacting DeFi dynamics.

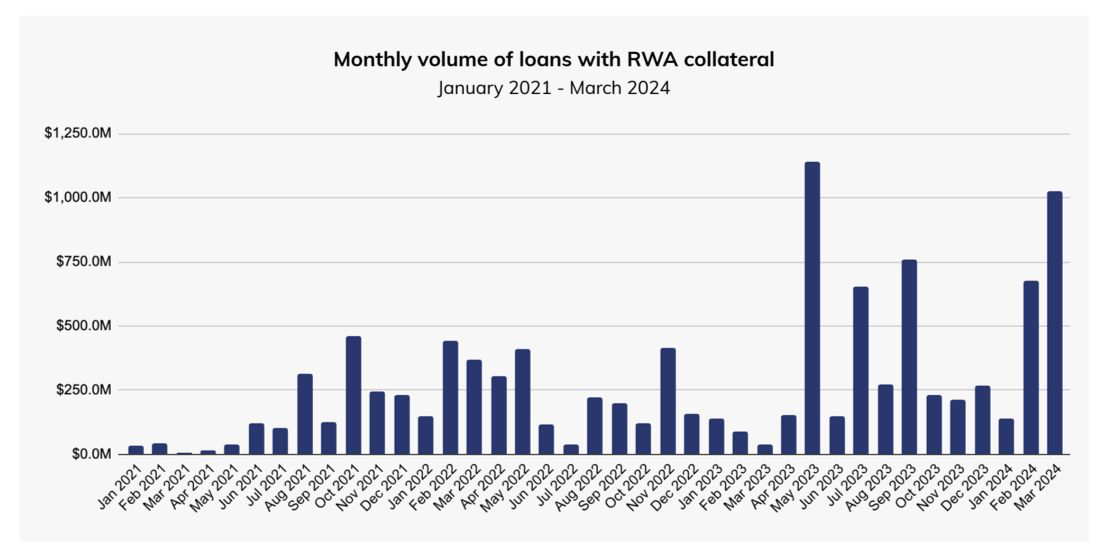

Emerging trends in DeFi also include the integration of real-world assets (RWAs) and decentralized physical infrastructure (DePin), which are changing how assets are managed and invested. The tokenization of tangible and intangible assets outside the blockchain is simplifying transactions, enhancing market liquidity, and promoting transparency. Currently, a significant focus within RWA projects is the tokenization of U.S. treasury bills, with over $1 billion in such assets now tokenized on public blockchains.

The Growing Impact of RWAs in DeFi

The role of RWAs in decentralized finance is expanding rapidly. Platforms like TrueFi, Maple, MakerDAO, Goldfinch, Clearpool, and Centrifuge are at the forefront, issuing loans collateralized by tokenized RWAs. This has become a significant area of growth, with such loans picking up notably since mid-2023. MakerDAO, a major DeFi protocol, has been particularly active in the RWA sector.

Its RWA program has contributed significantly to its balance sheet, supporting over 2.5 billion DAI and generating over $75 million in stability fees in 2023 alone. RWAs now account for up to 80% of MakerDAO’s revenue at times, highlighting their increasing relevance in the DeFi industry.

This emphasis on RWAs indicates a change towards a future where the blockchain handles a majority of value transfers, creating a more open, less frictional global market. This is set to democratize investment across borders and introduce new financial products and investment strategies previously unavailable in traditional markets.