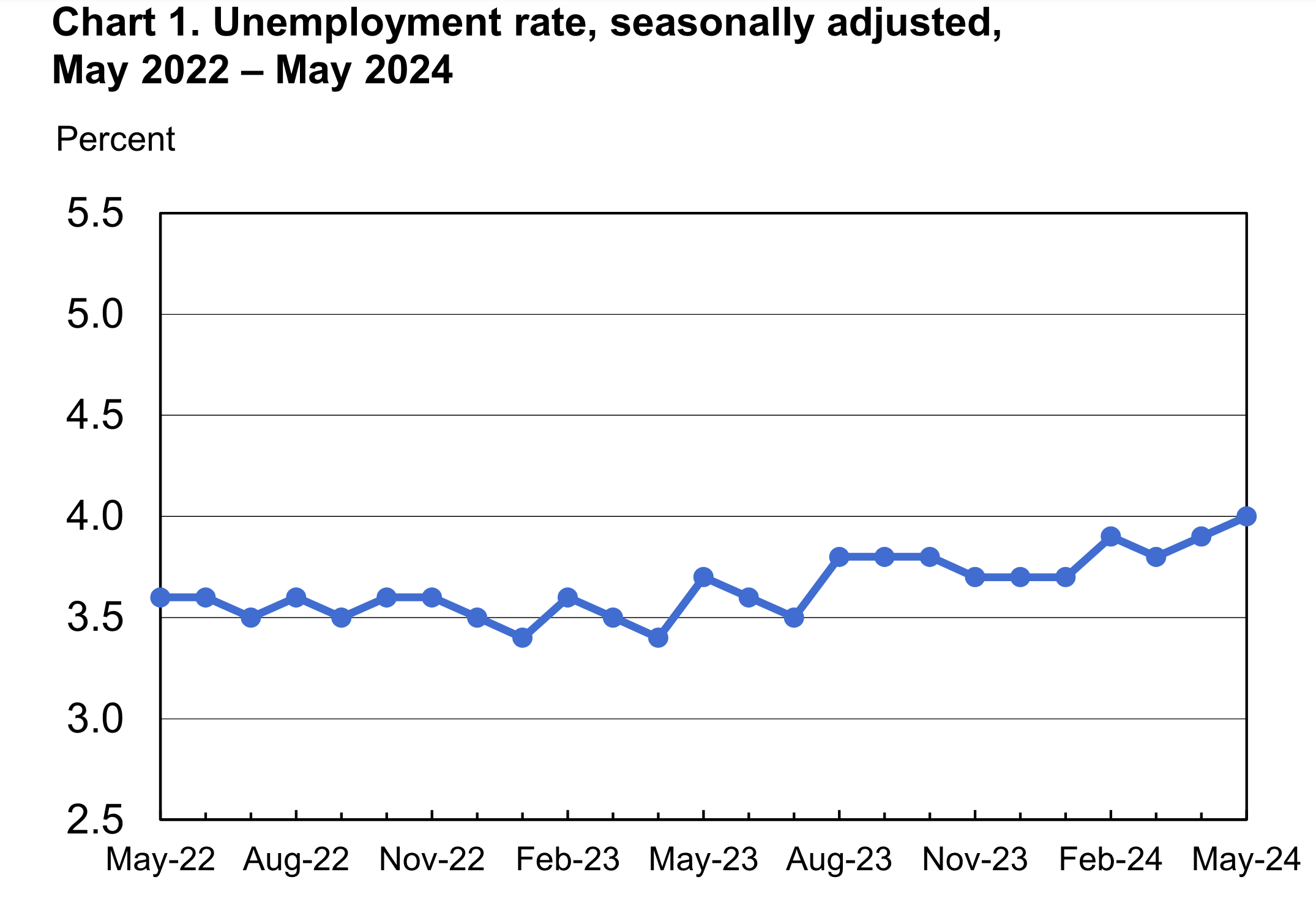

U.S. employers added a surprising 272,000 jobs in May, surpassing predictions and igniting conversations about the labor market’s resilience, according to the latest data. However, this job growth came with an uptick in the unemployment rate, which reached 4.0 percent, the highest level since January 2022.

Also Read: 99% of Americans unable to afford housing right now

February saw the unemployment rate rise to 3.9 percent, the highest in two years, before a slight dip to 3.8 percent in March. April again saw the rate edge up to 3.9 percent, maintaining a narrow range of 3.7 to 3.9 percent since August 2023.

Healthcare and government jobs are on the rise

The rise in employment was notably led by the health care, government, leisure and hospitality, and professional, scientific, and technical services sectors. These industries have been critical in sustaining the job market, with healthcare alone showing massive growth as it recovers from pandemic-related disruptions.

The increase in total nonfarm payroll employment to 272,000 in May stands out, especially compared to the prior 12-month average of 232,000 monthly gains. March and April saw revisions in their employment numbers, with March’s figures adjusted by 5,000 to 310,000 new jobs and April’s figures reduced by 10,000 to a gain of 165,000.

These revisions mean that the combined employment growth for these months is 15,000 lower than initially reported. Despite these adjustments, the job market continues to show strength, even as the unemployment rate fluctuates.

Also Read: America’s 2024 economy saved by old money

The next Consumer Price Index (CPI) report coincides with the conclusion of the Federal Open Market Committee’s meeting, so all eyes will be on inflation trends. Policymakers will need to see slower inflation over the summer to consider cutting rates by fall.

Crypto markets take a hit

Meanwhile, almost as soon as the data hit the headlines, crypto markets went into a freefall. All the cryptocurrencies in the top ten have either lost most of their ETF-induced gains or have completely reversed their bullish momentum. Bitcoin has seen a 1% decrease on the daily chart, and Ether has seen a 2.2% decrease.

Analyzing the BTC/USDt pair on Binance, we see that the 50-period moving average has recently crossed below the 200-period moving average, indicating a bearish crossover. Traders typically consider this a sell signal, meaning the short-term momentum is weakening relative to the longer-term trend.

The RSI is currently near the middle of the range, at approximately 53.61, indicating neither overbought nor oversold conditions. This level usually indicates moderate momentum without immediate indications of a reversal or extreme market conditions. Considering the current technical setup, the outlook appears slightly bearish in the short term.

Cryptopolitan reporting by Jai Hamid