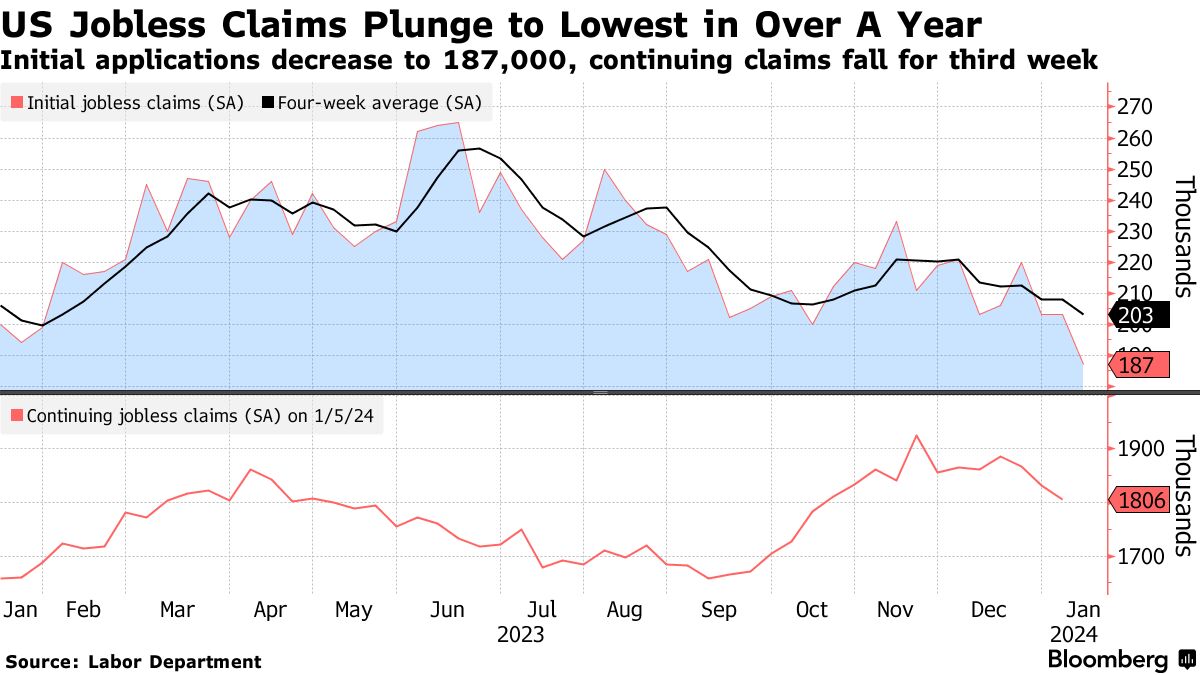

Defying the usual economic forecasts and leaving analysts scratching their heads, U.S. unemployment claims have plummeted to their lowest level since the latter part of 2022. In a striking show of labor market strength, initial claims for unemployment benefits in the U.S. took a sharp dive, landing at 187,000 for the week ending January 13. This figure doesn’t just whisper but rather bellows the resilience of the U.S. labor market as we step into the new year, brushing off the cobwebs of economic uncertainty.

Labor Market Defies Gravity

When it comes to economic predictions, it seems the U.S. labor market has decided to play by its own rules. Initial claims, a telltale sign of layoffs, saw a significant drop of 16,000 from the previous week, as reported by the Labor Department. This plunge surpassed the predictions of economists surveyed by Bloomberg, who apparently need to tweak their crystal balls.

It’s not just a nationwide trend; specific states are showing impressive numbers too. New York, for instance, reported a sharp decline of over 17,000 claims. However, this isn’t just a New York show – the trend of decreasing claims is echoed across various states.

Continuing claims, which track those receiving unemployment benefits, also shrank for the third consecutive week, touching down at approximately 1.81 million. This is the lowest we’ve seen in almost three months, further cementing the job market’s robustness.

Despite being sandwiched between elevated interest rates and the looming shadow of economic uncertainty, the U.S. job market has shown an astonishing ability to keep unemployment at bay. But it’s not all sunshine and rainbows; there are signs of moderation in the labor market, as noted in a recent Federal Reserve survey. As the Fed plays with the idea of interest rate cuts, these indicators are being watched with a hawk’s eye.

A Closer Look at the Numbers

Let’s talk numbers, but not the snooze-inducing kind. Weekly claims are known to be fickle, often swayed by holidays and temporary factors. To smooth out these hiccups, the four-week moving average is our go-to, and guess what? It’s dropped to a cool 203,250, the lowest in nearly a year.

Peeling off the seasonal adjustments, the raw data also tells a compelling story. Unadjusted initial claims nosedived by nearly 30,000, landing at 289,228. New York led this charge, but other states like Michigan and Wisconsin weren’t far behind.

Shifting gears to Wall Street, where the pulse of the economy is often felt first, there was a noticeable reaction. U.S. stocks saw an uptick, with the S&P 500 and Nasdaq Composite making modest gains. This movement came amidst investor speculation about potential interest rate cuts later in the year.

On the housing front, there was a mix of news. Residential starts saw a dip, mainly due to a decrease in single-family home construction, yet building permits experienced an uptick. This suggests a potential rebound in new construction, driven by lower mortgage rates and a steady demand for housing. Interestingly, housing starts varied regionally, with the West witnessing a significant increase.

As we eagerly await the government’s initial estimate of the fourth-quarter GDP, these housing starts will no doubt play a crucial role in shaping economists’ outlook. Upcoming data on home sales will further clarify the picture of the U.S. housing market.

In a nutshell, the U.S. labor market has pulled a rabbit out of its hat, surprising us with its tenacity and resilience. With jobless claims hitting a remarkable low, the stage is set for an intriguing economic narrative in the upcoming months. Stay tuned, because if there’s one thing certain in this economic saga, it’s that predictability is not its strong suit.