In a revelation that’s more eye-popping than a Hollywood blockbuster, the U.S. national debt has skyrocketed to over $34 trillion. This staggering figure isn’t just a number; it’s a neon sign flashing a warning about the economic hurdles and political tug-of-war awaiting America’s future. As the U.S. Treasury Department unveils this daunting financial reality, the political divide in Washington sharpens, threatening to turn budget discussions into a high-stakes drama.

The U.S. Debt Spiral: A Rapid Ascent

Gone are the days when the U.S. national debt was a distant concern. The debt, once projected to reach this level in 2029, has outpaced expectations and hit $34 trillion years ahead of schedule. Thanks to the pandemic starting in 2020, which put the economy in a sleeper hold, the government opened its fiscal floodgates. Both the Trump and Biden administrations pumped money into the economy, stabilizing and stimulating it. However, this fiscal CPR came with a side effect – inflation, a beast that turned the government’s debt service into a more costly affair.

Economists like Sung Won Sohn from Loyola Marymount University aren’t mincing words. The U.S. has been splurging like there’s no tomorrow, but the reality check is here. The outlook is grim, with the country’s debt now towering like a financial Everest over America’s economic landscape.

The Long-Term Outlook: Navigating Uncharted Waters

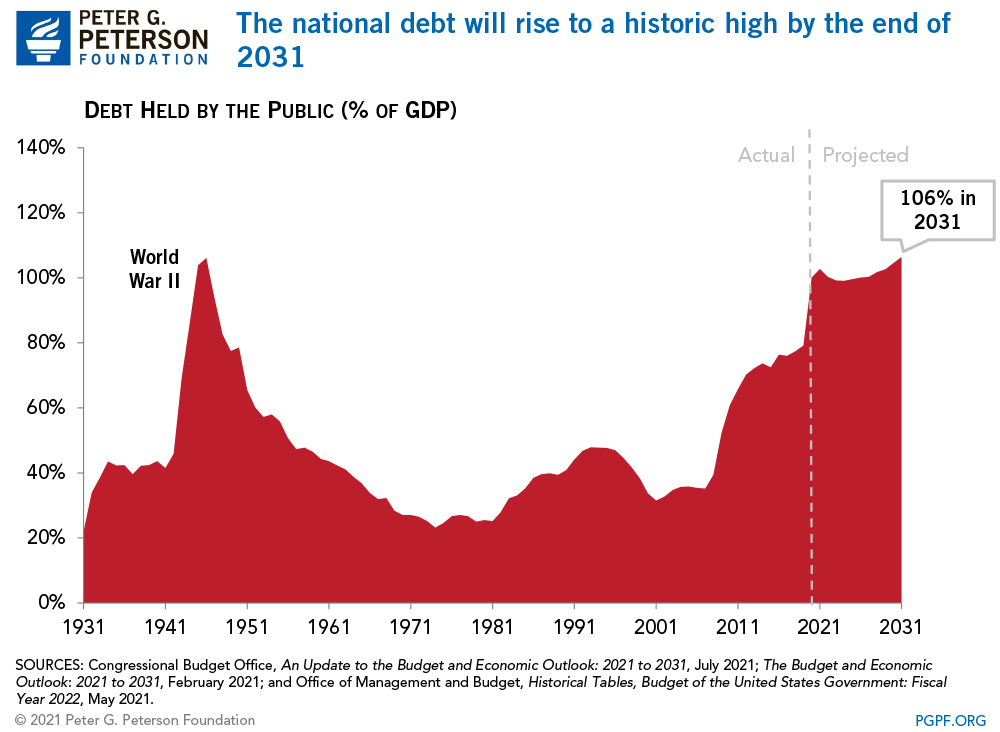

This gargantuan debt, roughly on par with the U.S. GDP, might not be an immediate anchor dragging down the economy, but its long-term implications are akin to dark clouds looming on the horizon. The U.S. government, buoyed by investors still willing to lend, continues to fund its programs. However, the debt’s trajectory poses risks to national security and key programs like Social Security and Medicare. The political circus around the debt limit only adds to the uncertainty.

Foreigners, who once queued up to buy U.S. debt, are now backing away. Countries like China and Japan are trimming their holdings of U.S. Treasury notes. The Peterson Foundation paints a stark picture: foreign holdings of U.S. debt have dwindled from 49% in 2011 to a mere 30% by the end of 2022.

Michael Peterson, CEO of the Peterson Foundation, rings the alarm bells louder than a siren in a silent movie. With the Treasury poised to borrow nearly $1 trillion more by the end of March, the U.S. is on a financial tightrope.

The debt, breaking down to about $100,000 per U.S. citizen, hasn’t yet choked U.S. economic growth. But if this debt juggernaut keeps steamrolling ahead, it could pump up inflation and keep interest rates in the stratosphere, further escalating the cost of managing the national debt.

Political Football: The Blame Game and Solutions

Both the Democrats and Republicans agree that the debt needs trimming, but their playbooks couldn’t be more different. The Biden administration is batting for tax hikes on the wealthy and corporations to shrink budget deficits, while also beefing up the IRS to go after unpaid taxes. This move could potentially recover hundreds of billions over a decade.

The Republicans, on the other hand, are waving the banner for slashing non-defense spending and repealing clean energy tax credits. They also aim to trim Biden’s IRS budget and cut taxes further – moves that could potentially send the debt spiraling even higher.

This political ping-pong over the national debt is set to be a headliner in this year’s presidential election. White House spokesman Michael Kikukawa labels the situation as “trickle-down debt,” pointing fingers at Republican policies. In contrast, Republican lawmakers argue that borrowing under the Biden administration fueled the 2022 inflation spike, tarnishing the president’s approval ratings.

Shai Akabas from the Bipartisan Policy Center warns of the unsustainability of this path. The consequences, if not addressed, could be dire – think interest rate spikes, recessions, unemployment, and more inflationary chaos.

In short, the U.S. national debt is more than just numbers on a balance sheet. It’s a ticking time bomb, with the clock hands inching closer to midnight. As America grapples with this financial behemoth, the path ahead is fraught with challenges and tough choices, making this an economic thriller where the stakes couldn’t be higher.