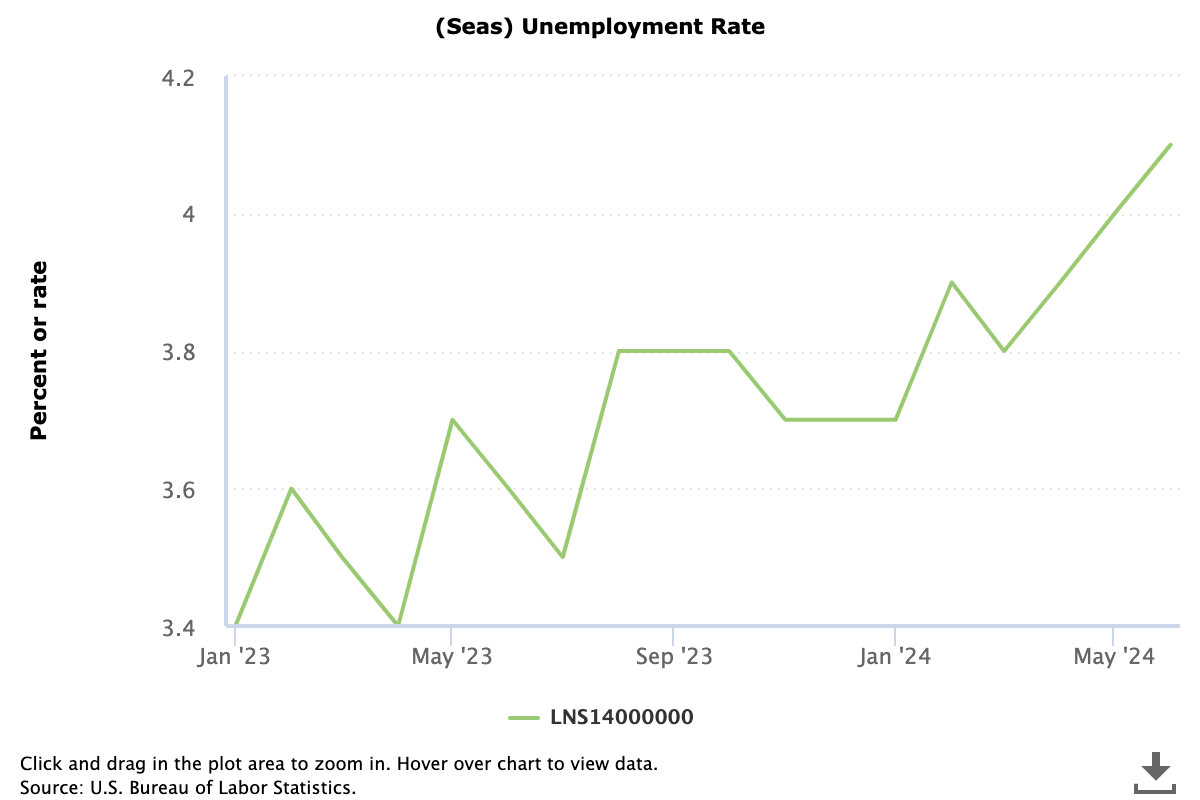

The U.S. unemployment rate rose to 4.1% in June, the highest since November 2021. This unexpected rise in joblessness has raised eyebrows among economists and policymakers alike.

The Labor Department announced that non-farm payrolls increased by 206,000 in June, compared to 272,000 in May, and above the 190,000 expected.

The labor force participation rate increased slightly to 62.6%, up by 0.1 percentage point. However, this increase in participation did not offset the rise in unemployment.

The adjusted unemployment rate, which includes discouraged workers and part-time workers, is at 7.4%.

Household employment saw a rise of 116,000 in June. Despite this, surveys show a decrease of 28,000 full-time workers and an increase of 50,000 part-time workers.

The Bureau of Labor Statistics (BLS) revised May’s payroll count, reducing it from the initial 272,000 to 218,000. April’s figures were also revised downwards by 57,000 to 108,000.

Long-term unemployment rate plagues Americans

Long-term unemployment saw a sharp increase in June, rising by 166,000 to a total of 1.5 million. This is a jump from the 1.1 million long-term unemployed reported a year ago.

The share of long-term unemployed individuals now stands at 22.2% of the total unemployed, up from 18.8% last year.

The unemployment rate for Black workers rose to 6.3%, the highest since March. For Asians, the rate increased by a full percentage point to 4.1%, the highest since August 2021.

This comes as Federal Reserve officials deliberate on their next tricks on monetary policy. At their most recent meeting, the policymakers were all about needing to see more progress on inflation before considering cutting interest rates.

Despite signals to the contrary, market expectations include two rate cuts before the end of 2024. Traders are anticipating quarter percentage point reductions, with the first expected by November. However, Fed officials only penciled in one cut at their meeting.

The two-year Treasury yield fell by 0.06 percentage points to 4.63% after the unemployment report. This is its lowest level since early April. The S&P 500 has seen a modest increase, rising by 0.1% after the opening bell today.

The Fed’s key lending rate remains targeted between 5.25% and 5.50%, the highest in 23 years.

Reporting by Jai Hamid