U.S. inflation dipped to 2.5% in August, paving the way for the Federal Reserve to cut interest rates during its next meeting. The year-on-year consumer price index numbers settled at 2.5%, a 0.4% decline from the previous 2.9% figure.

The U.S. inflation decreased to 2.5% in August, preparing the way for the U.S. central bank, the Federal Reserve, to begin chopping interest rates in its next meeting scheduled for September 18th. This is long anticipated by market participants.

U.S. YoY CPI falls while Core CPI maintains its previous levels

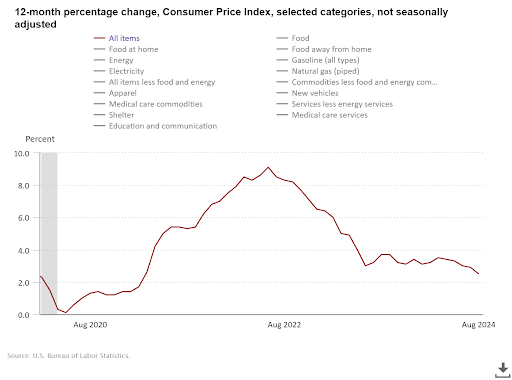

The year-on-year Consumer Price Index (CPI) fell to 2.5% from the previous 2.9% recorded in July, which marked the slowest pace since February. The decline was in the margin of what economists had anticipated. Data from the U.S. Bureau of Labor Statistics indicates July’s Consumer Price Index increased by 0.2% from June’s 0.1% decline.

The August year-on-year Core CPI numbers retained their previous levels at 3.2%, which economists had also anticipated. The Consumer Price Index tracks the prices consumers pay for goods and services, while the Core Consumer Price Index tracks all items except food and energy. The CPI numbers measure inflation from a consumer perspective of their daily living expenditures.

Inflation data from CPI releases serves as a major economic pillar that could determine the fate of interest rates ahead of the scheduled Fed meeting next week. The latest interest rate decision meeting in the U.S. was chaired on July 31st, 2024, where the Federal Open Market Committee (FOMC) members leveled the rate at 5.50%.

The Fed is expected to cut interest rates, as Fed Chair Jerome Powel hinted in August in his dovish comments: “The time has come.” The comments foretold the imminent September rate cuts, and economists are waiting for the meeting’s final output.

A struggling job market could trigger more aggressive rate cuts from the Fed

After the inflation data was released, the yield on two-year Treasury bonds rose 0.08 percentage points to 3.69%. The yield on two-year Treasury bonds moves opposite to price trails interest rate expectations. The publication of the inflation numbers caused the contracts tracking the tech-rich Nasdaq 100 and those tracking the S&P 500 share index to lose 0.5%.

The July Non-Farm Payroll report released by the Bureau of Labor Statistics (BLS) on September 6 showed the unemployment rate rising to 4.3% from 4.1%, raising concerns over the economic trajectory of the United States.

The data released last week showed that employers in the U.S. jurisdiction had introduced 142,000 new jobs that month. These new jobs increased from the previous July figure of just 89,000. Despite the increase, the new job numbers still failed to meet the economists’ forecasts of 164,000 jobs.

The Fed had been looking for economic signals that the U.S. inflation rate was slowing down to gradually cut rates. However, a declining job market could initiate a more aggressive approach to rate cuts by the U.S. central bank.