Just when you think you’ve got the U.S. economy figured out, along comes a curveball to throw you off balance. In this case, it’s the infamous yield curve in the bond markets, throwing a wrench into our neatly laid out theories about the economic trajectory of the U.S. This isn’t just your run-of-the-mill financial hiccup; it’s a red alert, a classic recession predictor that’s still flashing its ominous red lights.

The yield curve inversion is like that awkward guest at a party who just won’t leave. Typically, the longer the bond’s term, the higher the yield. But now, short-term bonds are yielding more than the long-term ones. It’s a scenario that traditionally spells trouble, suggesting that interest rates will likely drop in the future to kickstart growth.

Inversion Intuition: Signaling Recession or Red Herring?

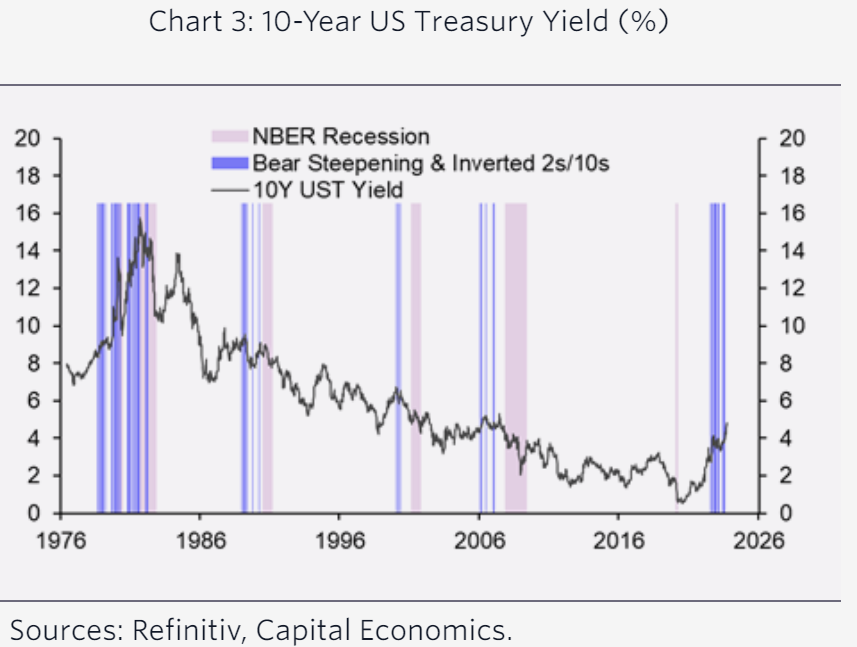

This isn’t just a financial tongue-twister; it’s a crucial question. The most-watched measure of this phenomenon is the gap between the two- and 10-year yields. This gap has been upside down since July 2022, the longest such spell since the early 1980s. But what’s it really telling us? The yield curve has been a reliable harbinger of doom, correctly predicting recessions for the last 60 years, with a single false alarm in 1965.

Theories abound as to why this happens. Some say it’s a straightforward forecast of market expectations. Others argue it’s a self-fulfilling prophecy, with banks tightening lending and investors playing it safe with short-term bonds, choking off long-term growth potential. It’s a debate that could rival any detective novel’s complexity.

Historical comparisons bring their own flavor of confusion. The 2000 tech bubble burst and the 2006 global Treasury bond buying spree by China both saw yield curve inversions but were dismissed for various reasons. In retrospect, they were the canaries in the economic coal mine, signaling crises.

The Current Conundrum: Pandemic Spending and Market Reactions

Now, we’re dealing with the aftermath of Washington’s pandemic spending, which might have distorted the yield curve’s usual predictive power. With consumer spending still robust, a recession seems like a distant threat. But there’s a catch: economic downturns often follow yield curve inversions with a delay. Strategists at JPMorgan suggest a recession risk peaks between 14 and 24 months post-inversion, which puts us squarely in the danger zone for at least the first half of 2024.

Goldman Sachs echoes this sentiment, highlighting the significance of the duration of inversion, with longer ones being more worrisome. They’ve dropped their recession probability for this year to 30%, a dip from last year’s 45-55% range. But let’s not pop the champagne yet. Remember, fictional detectives might have the luxury of neat, tidy conclusions, but the real world of economics and financial markets is far messier.

The market is currently betting on over five quarter-point rate cuts by the Fed. Why such a drastic measure if not to save a faltering economy? It hints at a deeper malaise than the optimistic forecasts suggest.

Inflation is on a downward trend, and unemployment rates are low, giving a glimmer of hope. Wells Fargo’s recent shift from a recession forecast to predicting a soft landing reflects this changing sentiment. However, optimism should be tempered with caution. Economic data, while mostly positive, reveals underlying weaknesses, especially in the labor market.

The Trio of Recession Triggers

- Post-Hike Economic Turbulence: The Federal Reserve has been on a mission to tame inflation with sharp rate hikes. Their goal is a tricky one: reduce inflation without causing widespread job losses. However, this balancing act is precarious. As the cushions provided by consumer savings and corporate reserves start to deflate, the risk of tipping the economy into a recession escalates.

- Inflation’s Potential Comeback: There’s a looming danger that inflation might rear its head again. Should this happen, the Fed finds itself in a bind. Cutting rates to stimulate the economy might not be viable, and raising them could exacerbate the situation, potentially steering the economy towards a downturn.

- Unforeseen Economic Shocks: The global stage is rife with unpredictability, from geopolitical unrest to potential new health crises. Any of these could send shockwaves through the economic landscape, disrupting the fragile balance the Fed is striving to maintain.

Economists are navigating a landscape filled with uncertainties, balancing cautious optimism for a soft economic landing against the backdrop of potential risks. The ongoing inversion of the yield curve serves as a stark reminder that economic stability is not guaranteed, and vigilance is key in these unpredictable times.