Uniswap price analysis reveals that the coin has been on an upward trend in the past 24 hours. Prices have managed to push higher, with trading currently above the $5.18 level. There is some resistance around the $5.52 level which is a key level to watch. However, with strong bullish momentum in place, it seems likely that UNI/USD will continue to consolidate higher and break above this resistance level.

The digital has seen some strong buying pressure as of late and looks poised to continue its upward momentum in the medium term. Uniswap prices have been hovering around the $5.15-5.52 level for the past few days and a breakout above this could see prices move toward the $6.00 region in the near term. The 24-hour trading volume is currently around $66,721,530 billion and the total market capitalization is at $4,191,961,260.

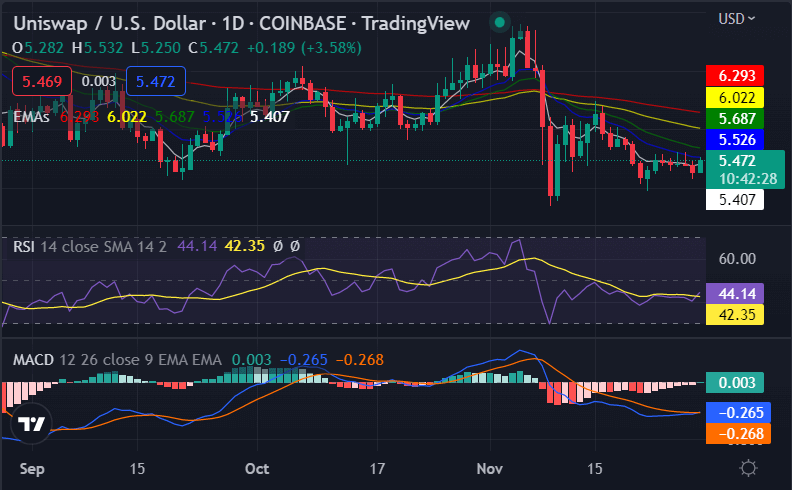

Uniswap price analysis: UNI moves into a narrow consolidation zone on a daily chart

On the 24-hour candlestick chart for Uniswap price analysis, the price can be seen forming an uptrend after a distinct decline. Over the past 24 hours, UNI’s price gained more than 11 percent to reach as high as $5.50 and looks to regain that level by the end of today’s trade. The 24-hour relative strength index (RSI) can also be seen forming a favorable uptrend in market valuation for Uniswap at 35.23 and is expected to rise further till the price corrects.

The $5.52 resistance is the immediate target for the UNI price which sits along the crucial 50-day exponential moving average. However, the price is currently oscillating within a narrow zone between support at $5.18 and resistance at $5.52. This is also indicated by the moving average convergence divergence (MACD) curve that moved from a negative reading to a positive when the RSI advanced.

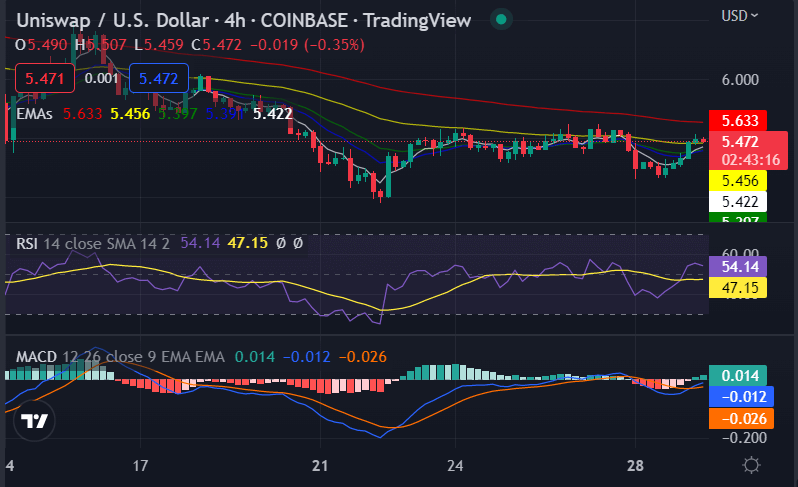

UNI/USD 4-hour price chart: Recent developments

The 4-hour chart for Uniswap price analysis shows that the bulls have managed to push prices higher after a period of consolidation. Prices are currently trading above the $5.50 level as the market has formed higher highs and higher lows. The MACD indicator has also moved into the bullish zone as the signal line crossed above the MACD line. The MACD histogram is also flashing bullish signals and shows that the upward momentum is likely to continue in the near term.

The 50 -day EMA is a key level to watch in the near term for Uniswap price analysis. If prices manage to break above this level and consolidate higher, it could signal that a further upside movement may be in store for UNI/USD in the coming days. However, as long as prices remain below this resistance level, there is a possibility that we may see a retracement in the near term. The RSI is also indicating that there is further upside potential for UNI/USD, as long as it continues to maintain above the 40 levels.

Uniswap price analysis conclusion

In conclusion, Uniswap price analysis on both the 1-day and 4-hour timeframe shows that the market is in a bullish trend in the near term. The technical indicators are also in favor of the bulls. So, we can expect prices to continue to rise in the near term with the next target being the $5.52 level.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.