Uniswap’s price analysis shows that cryptocurrency is currently in a downward trend. The price is hovering around $7.00 and has been steadily declining; it is now trading at $6.61 since the beginning of today. As the bears have once again made a reappearance, the UNI/USD pair predicts a price decline. For the previous several days, the trend line was moving upward, but today it proved to be quite depressing for the market because the bears are now in control and have brought about massive losses by downgrading the price. The resistance level is $6.87, with a strong support level of $6.59. Therefore, the current market trend is bearish, meaning that the price of Uniswap is likely to continue to fall. The 24-hour trading volume is around $117 million, and the market capitalization is $5.03 billion.

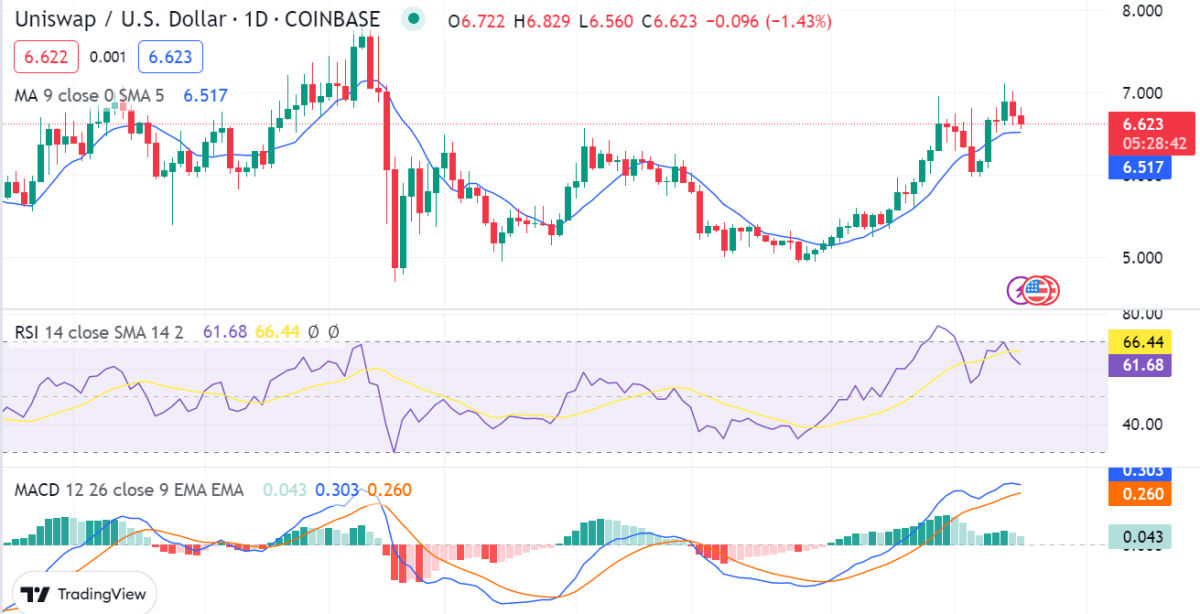

Uniswap price analysis 1-day chart: UNI/USD prices drop below $6.61 as the market deteriorates

The one-day Uniswap price chart shows a downward trend, with the price dropping from $7.00 to $6.61 since yesterday morning. This is an indication that the market sentiment is bearish and that traders expect the price to continue to decline. The price is currently trading at the flag’s support level, or roughly $6.59, and if the bears can gain control of the market, we might see prices slide down to the $6.5 level. Therefore, the 50 SMA line is below the 200 SMA line, indicating that the path of least resistance for UNI/USD will be downward.

Looking at the technical indicators, the Relative Strength Index (RSI) is currently at 66.4, which is in the bearish zone, indicating that Uniswap’s price could continue to decline. The Moving Average Convergence Divergence (MACD) histogram is in red, confirming that the bearish sentiment is strong and that the price could continue to decline in the short term.

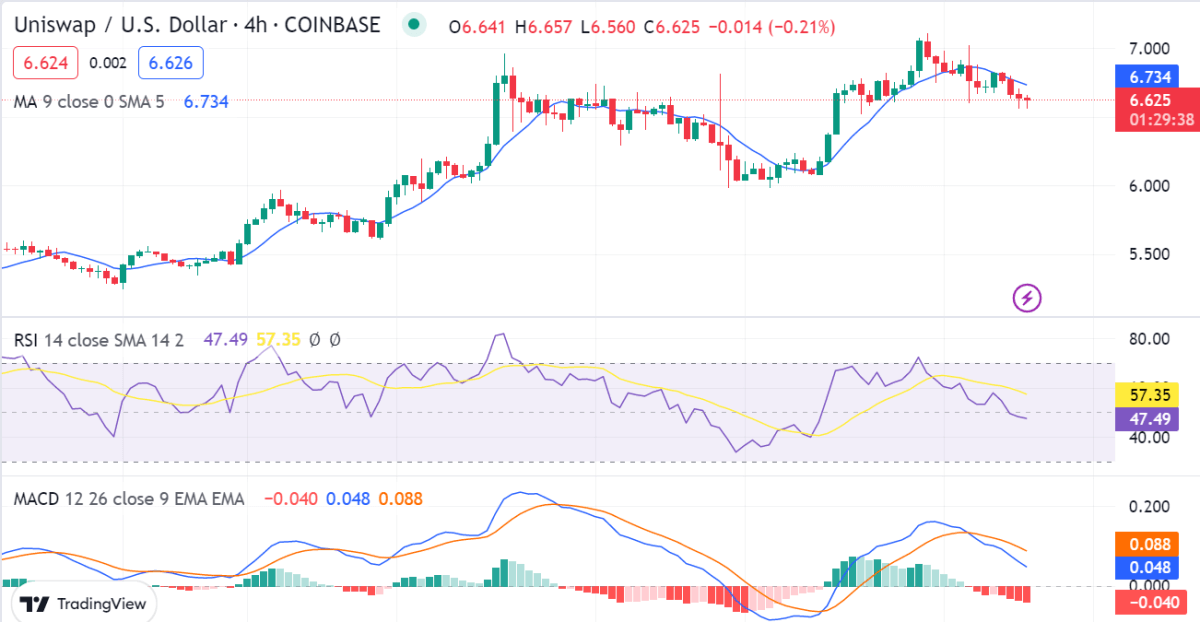

UNI/USD 4-hour price chart: Latest development

The 4-hour Uniswap price analysis shows a continued bearish sentiment as the UNI/USD prices consolidate below the previous support level of $6.59. Prices have dropped well below the $6.61 level and have been on a downward trajectory since then. Although the bulls were in control of the market yesterday and tried to push the prices up, sellers have taken control of the market in the last few hours and are pushing it down.

The RSI is currently at 57.35, which indicates that the market is neither overbought nor oversold. Furthermore, the MACD histogram is also in red, which confirms the bearish sentiment. The 200-day SMA line is lower than the 50-day SMA line, indicating a bearish trend in the market. The fact that the 20-day SMA line is currently below the other two moving averages supports the market’s negative trend.