TL;DR Breakdown

- Uniswap price analysis suggests a downward movement to $6.000

- The closest support level lies at $6.400

- UNI faces resistance at the $6.700 mark

The Uniswap price analysis shows that the UNI price action has struggled to break above $7.000 and has fallen below the $6.500 mark

The broader cryptocurrency market observed a bullish market sentiment over the last 24 hours as most major cryptocurrencies recorded positive price movements. Major players include AVAX and DOT, recording a 4.30 and a 4.78 percent incline, respectively.

Uniswap price analysis: UNI falls below the $6.500 mark

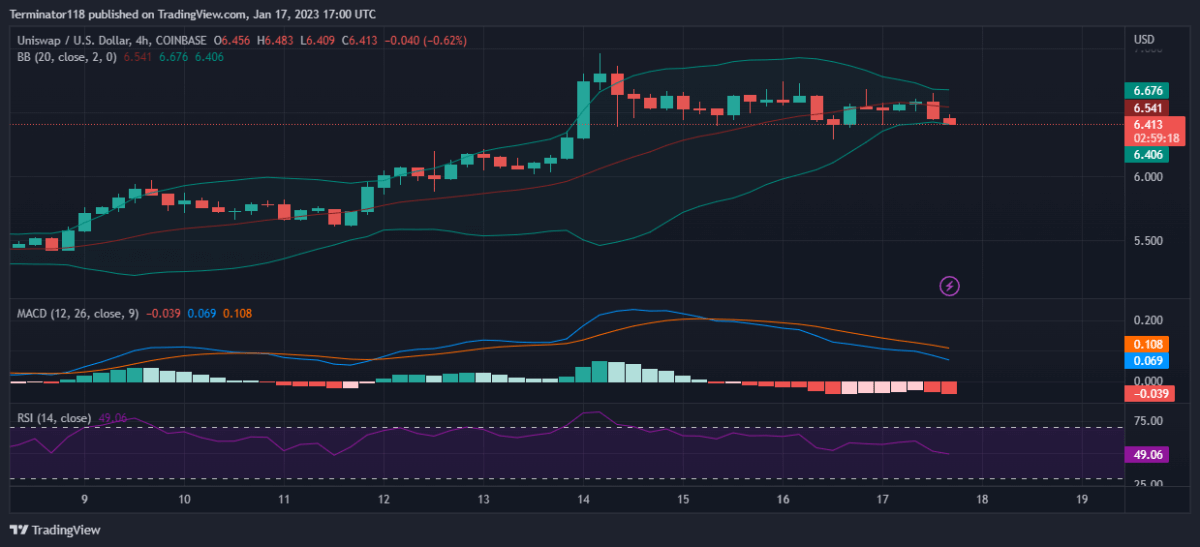

The MACD is currently bearish, as expressed in the red colour of the histogram. However, the indicator shows low bearish momentum as the indicator has only recently exhibited a bearish crossover. On the other hand, the darker shade of the histogram suggests an increasing bearish momentum as the price struggles to climb past $6.700.

The EMAs are currently trading high above the mean position as net price movement over the last ten days remains positive. However, the EMAs move close together suggesting low momentum across the timeframe. Moreover, the diverging EMAs suggest an increasing bearish pressure for the asset.

The RSI briefly rose to the overbought region but has since gone back into the neutral region as UNI got rejected at the $7.00 price level. Currently, the index is trading at the 49.06 mark showing steady low momentum on either side with a downward slope suggesting an increasing bearish activity in the markets.

The Bollinger Bands are narrow at press time as the price action observes relatively low volatility across the 4-hour charts. Currently, the price is trading close to the indicator’s bottom limit suggesting increasing price volatility as the Bollinger Bands start to diverge. The indicator’s bottom line provides support at the $6.406 mark while the upper limit presents a resistance level at the $6.676 mark.

Technical analyses for UNI/USDT

Overall, the 4-hour Uniswap price analysis issues a sell signal, with 10 of the 26 major technical indicators supporting the bears. On the other hand, only seven of the indicators support the bulls showing a low bullish presence in recent hours. At the same time, nine indicators sit on the fence and support neither side of the market.

The 24-hour Uniswap price analysis does not share this sentiment and instead issues a buy signal with 12 indicators suggesting an upwards movement against five suggesting a downward movement. The analysis shows a struggle for dominance between the bulls and the bears across the daily charts. Meanwhile, the remaining nine indicators remain neutral and do not issue any signals at press time.

What to expect from Uniswap price analysis?

The Uniswap price analysis shows that the Uniswap market is enjoying a strong bullish rally as the price rose from $5.000 to the current $6.400 in the last 20 days. Currently, the price is facing strong resistance at the level and the bulls have been rejected at the $7.000 mark to fall back below the $6.500 mark.

Traders should expect UNI to move down towards the $6.00 mark but with low volatility as the bears wrest control of the market. While the mid-term technical analyses appear bullish, they are shifting towards the bears as the short-term charts translate across the mid-term timeframes. As such, UNI can be expected to trade between $6.00-6.500 for the next few days.