Uniswap price analysis reveals that the market is following a negative trend below the $6 mark and is likely to remain today on March 26, 2023. On March 25, 2023, UNI/USD exhibited substantial upward momentum, as the price rose significantly from $6.1 to $6.4. However, on the following day, March 26, 2023, the cryptocurrency demonstrated a strong bearish trend, experiencing a notable decline to reach $5.7. It is anticipated that the price of Uniswap will continue to hover around the $6 level until the commencement of April.

Uniswap price analysis shows that it is currently trading at a price of $5.70 with a 24-hour trading volume of $219.29M, a market capitalization of $4.42B, and a market dominance of 0.38%. The price of UNI, the native token of Uniswap, has experienced a slight increase of 0.30% in the last 24 hours. At present, the sentiment for Uniswap’s price prediction is bearish, and the Fear & Greed Index indicates a score of 64 (Greed).

Uniswap has a circulating supply of 762.21M UNI out of a maximum supply of 1.00B UNI. The current yearly supply inflation rate for UNI is 10.62%, which means that 73.21M UNI were created over the past year. In terms of market capitalization, Uniswap is currently ranked #2 in the DeFi Coins sector, #2 in the Exchange Tokens sector, #1 in the Yield Farming sector, and #5 in the Ethereum (ERC20) sector.

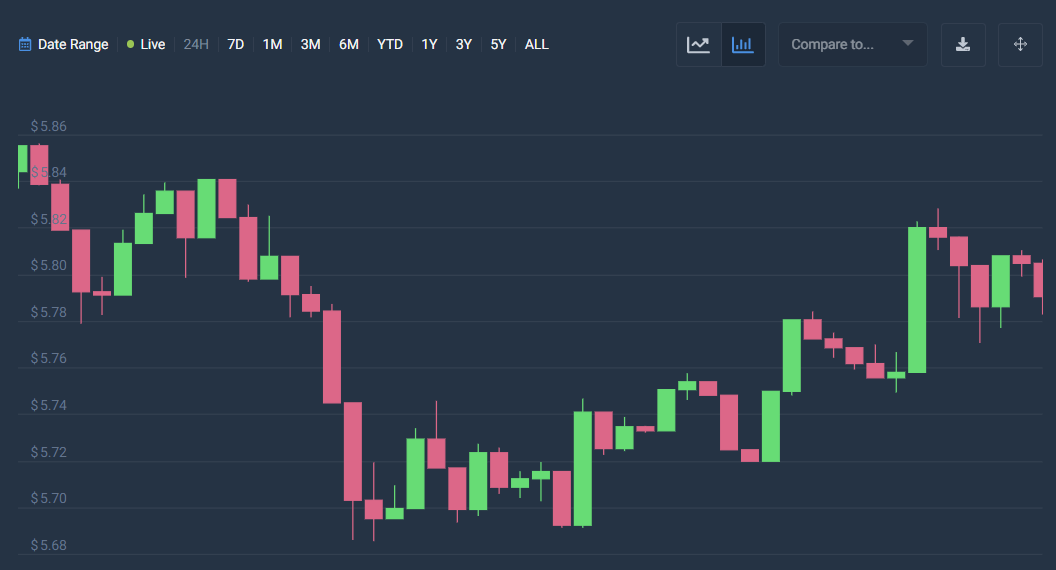

UNI/USD 24-hour price analysis: Latest developments

Uniswap price analysis indicates that the volatility of the market is trending upwards, thereby making Uniswap prices more susceptible to sudden and significant changes on both ends of the spectrum. The open price for the UNI cryptocurrency is $5.81, with the highest price of $5.81. On the other hand, the lowest price for Uniswap is currently at $5.78, representing a change rate of -0.10%, and the closing price is $5.80.

The current price of UNI/USD is showing a bearish trend as it appears to be crossing below the Moving Average curve. However, the price of UNI/USD is also trending upward, indicating that it is attempting to move toward the moving average band. This suggests the potential for a breakout and opportunities for a reversal.

Uniswap price analysis shows that the Relative Strength Index (RSI) is currently at 43, indicating that UNI/USD is stable and falls within the neutral center region. Additionally, the RSI score seems to be moving upward, indicating an increasing market trend toward further increments. This increase in RSI score is due to buying activity dominating selling activity in the market.

Uniswap price analysis for 7-days

Uniswap price analysis reveals that market volatility is showing a decreasing trend, indicating that Uniswap prices are becoming less susceptible to volatile changes. The current open price for Uniswap stands at $5.73, with a high price of $5.83. On the other hand, the low price is at $5.75, indicating a change rate of 0.80%, and the closing price is at $5.80.

According to the Uniswap price analysis, the UNI/USD pair is exhibiting a bearish trend as the price curve is intersecting with the Moving Average in a downward direction. The price path shows a downward movement as it tries to breach the market’s support level, which could potentially trigger a reversal in the market.

Based on Uniswap price analysis, the Relative Strength Index (RSI) of 44 implies that the cryptocurrency has entered the central neutral domain. The RSI value has been observed to decline, indicating a possible declining market. However, if the RSI score continues to decrease, it may fall under the neutral threshold and further into the devaluation region, indicating a downward trend in the market. Additionally, the decreasing RSI score suggests that selling activity is currently dominating buying activity.

Uniswap Price Analysis Conclusion

Uniswap price analysis reveals the current market trend is being dominated by the bears. Despite this, there are indications of a potential reversal as the bulls are attempting a comeback. However, there is also the possibility of a significant incline in the UNI/USD price in the near future. Although the cryptocurrency has displayed a consistent bearish movement over the past few days, the analysis of the charts provides some hope for a potential increase in value.