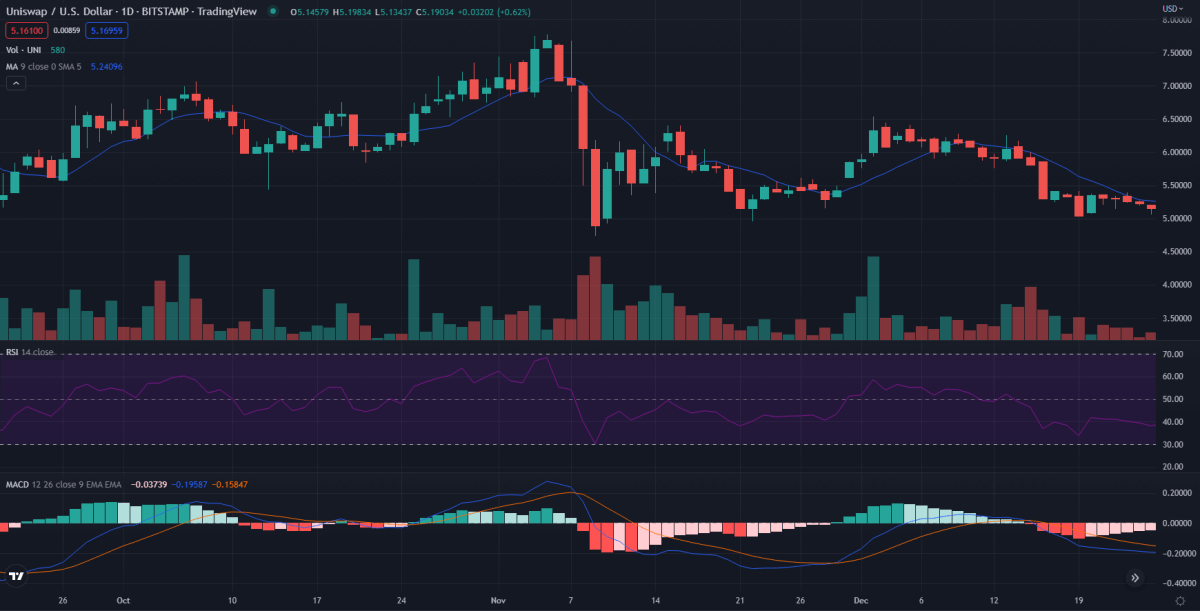

Uniswap price analysis was bearish today as the price started dipping two days ago after testing the resistance around $5.4. Today, Uniswap set a low around the $5.0 mark and it looks like it may bounce off due to strong support around this area.

Overall, it can be seen that Uniswap has been forming the candles below the 9-period moving average. Furthermore, the RSI is slowly on the decline with a negative gradient, suggesting that the market is moving toward the oversold side. However, the MACD has been giving a positive indication as the strength of the negative histograms is constantly decreasing. So, this might be the time for the bulls to take control. However, due to the uncertainty factors in the market, all of this is mere speculation.

Uniswap 24-hour price analysis

In the last 24 hours, Uniswap has set a high at $5.20 and a low at $5.059. The market has remained slightly volatile today and Uniswap faced a decent amount of support at the day’s low. Now in the short term, it is expected to recover a little bit. However, let us not forget that Uniswap is still stuck in the range of $5.4 and $5.0 on the bigger picture. So, $5.4 is still the resistance zone.

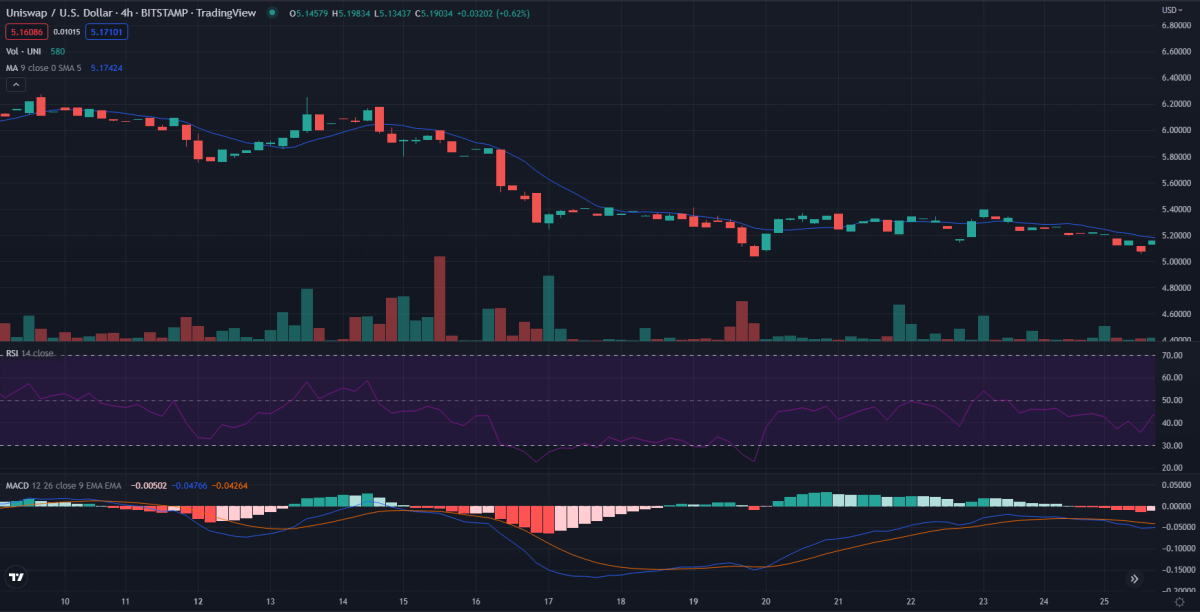

4-hour Uniswap price analysis

The 4-hour graph is showing some recovery near the end of the day after Uniswap touched the support levels. At the same time, the MACD has also started showing some improvement. The RSI, on the other hand, is very balanced as it is just above 40 but less than 50.

Considering the fact that the bullish sentiments are not considered high right now, we can expect Uniswap to continue moving in a range and traders should make their trading decisions accordingly.

Uniswap price analysis: Conclusion

Uniswap bounced back after touching the support level at $5.059 today. At the same time, the local resistance is currently at $5.40 and Uniswap price analysis continues bouncing between these two levels. Since it is consolidating sideways, traders can make their trading decisions in a more predictable manner. But as always, it is important to only invest what can be lost. For a more detailed analysis of Uniswap’s performance in the future, consider reading our detailed Uniswap price analysis.