Uniswap price analysis shows that the market is in a bearish trend as the price has been on a constant decline in recent days. The market has formed a bearish pennant, which is a continuation pattern, indicating that the downtrend will continue. The market is currently facing strong rejection at the $5.70 resistance level as it attempts to move higher.

The next support level for UNI prices is set at $5.25, and a break below this level could see the price decline further to $5.00 levels. The digital asset is currently trading at $5.32 and is down by 6.59 percent in the last 24 hours. The market cap is decreasing and is currently at $4,055,890,071, while the 24-hour trading volume is currently at $111,297,095 the market has been in a downtrend since the beginning of today as it dipped below the $5.70 level.

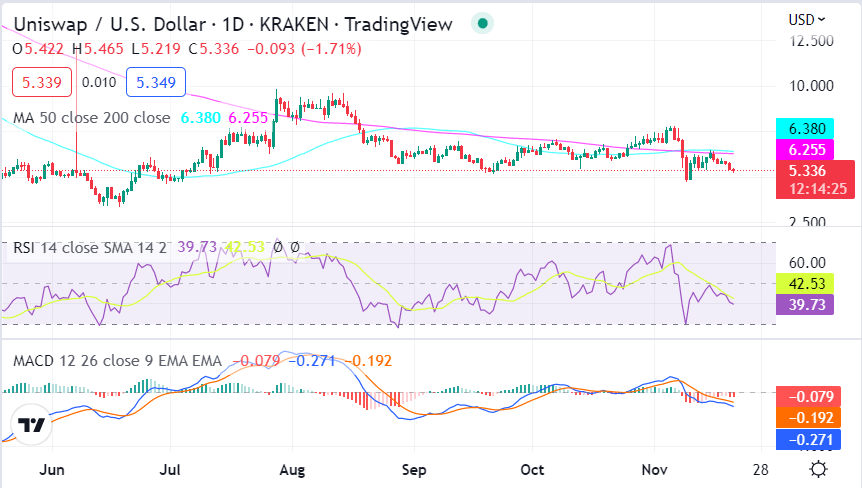

Uniswap price analysis for 1 day: Uniswap flips $5.70 into resistance

The 1-day price chart for Uniswap price analysis shows that the market is currently in a downtrend as it has formed lower lows and lower highs. The UNI/USD pair is trading at $5.32, and is facing resistance around the $5.70 level, which is likely to act as a hurdle for further upside in the market. The market opened at $5.52, and has seen a consistent sell-off over the past few hours as bears managed to push prices below the $5.70 level.

The RSI indicator is currently at 36 and is showing no signs of a bullish reversal, indicating that the market could remain bearish for the next few hours. The MACD indicator (blue line) is currently well below the signal line (red line), indicating that prices could continue to fall in the short term. The 50-day moving average has also turned downward and is currently providing resistance near the $5.70 level. while the 200-day moving average has turned downward as well and is providing support at the $5.25 level.

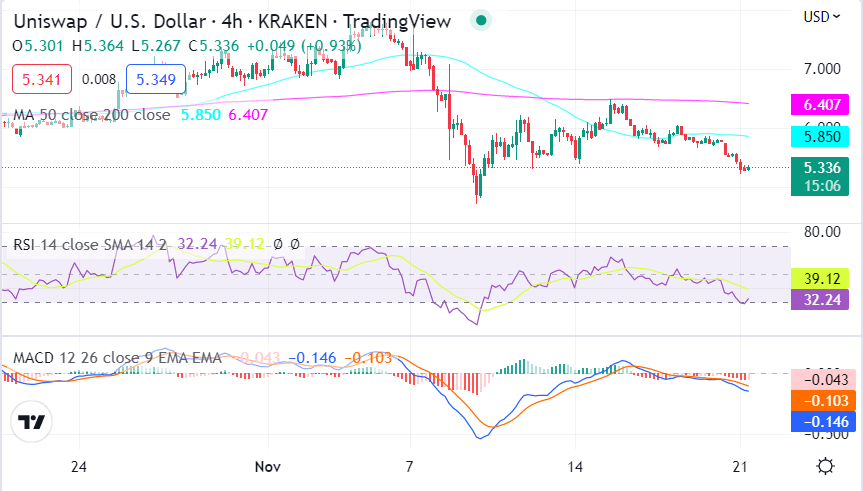

Uniswap price analysis: Recent developments and further technical indications

The four hours Uniswap price analysis shows the support has appeared at $5.25 after a small bearish correction. The market was following an ascending trend line for the last few days, but the recent downward correction has broken this ascending trend line. The price has dropped significantly as the bears are gaining control over the market.

The four-hour technical indicators are currently pointing to a bearish market as the MACD indicator is indicating a strong bearish move, and the RSI indicator is currently well below the 50 levels. The 50-day and 200-day moving averages are both showing a downward trend as the 50 -day MA is currently at $5.85 and is, while the 200-day MA has turned downward as well and is trading at $6.40.

Uniswap price analysis conclusion

Uniswap price analysis is bearish in the short term as the market has slipped below the $5.70 level. The market may test the $6.00 level in the near term if the bears mount further pressure. The price analysis of Uniswap shows that UNI/USD is currently in a bearish trend as it slides to $5.32. The technical indicator analysis is also bearish in the short term as all indicators are pointing towards a further downside.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.