Uniswap price analysis shows that the UNI/USD pair has been on a strong uptrend for the last 24 hours. The market opened at $7.26 and has risen to its current price of $7.33. The bullish momentum is expected to continue as the strongest resistance level at $7.35 has not yet been reached. However, traders should also keep an eye on the strong support level at $6.85 in case of any sudden pullbacks in the market. Overall, it appears that the UNI/USD pair is well-positioned for continued growth in the short term.

The Altcoin has also seen strong growth as the coin has gained a whopping 0.87% in the last 24 hours. The 24-hour trading volume for Uniswap is currently at $233 million, with a market cap sitting at $5.58 billion.

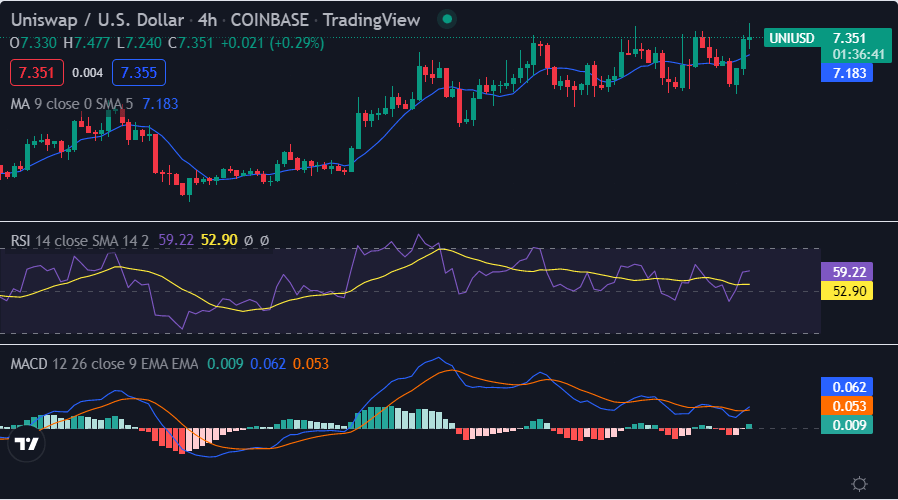

UNI/USD 4-hour price analysis: Expanding volatility with strong bullish momentum

The hourly chart for Uniswap price analysis shows that the market has been steadily rising for the last 4-hour trading period. The market has formed higher highs and higher lows, indicating strong bullish momentum. The bullish might continue if the market breaks above the $7.35 resistance level, with potential targets at $7.45 and $7.60. However, in case of any sudden downturns, traders should watch out for the support levels at $6.98 to potentially enter into long positions once again.

The UNI/USD price appears to be crossing over the curve of the Moving Average, which indicates a bullish movement. The market’s momentum shows positive signs. However, the Relative Strength Index (RSI) is currently at 52.90, indicating that the market may be overbought and could potentially see a correction in the near term. The MACD is also showing bullish signals as the histogram and the signal line are above the axis line.

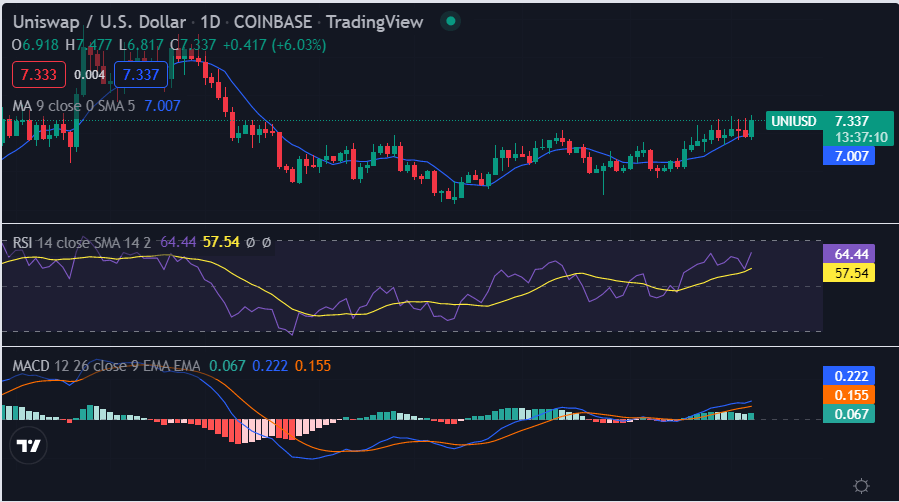

Uniswap price analysis for 1 day: The market succeeds in switching the trend

The one-day chart for Uniswap price analysis shows that the market has successfully switched from a bearish trend to a strong bullish trend. The UNI/USD pair has broken through the $6.85 support level and is currently trading above it. The bear was in control of the market before the switch, with lower highs and lower lows forming.

The RSI for Uniswap is currently at 57.54, indicating that the market may still have room for growth before reaching overbought levels. The RSI appears to be following an upwards approach causing the UNI/USD price to increase and move towards stability until the RSI fluctuates. The buying activity exceeds the selling activity, which causes the RSI score to increase. The MACD is showing bullish momentum as the signal line is above the axis line and the histogram is expanding. The Moving average (MA) daily chart is currently at $7.007 indicating the possibility for further growth in the market.

Uniswap price analysis conclusion

Overall, Uniswap price analysis shows that the market is currently bullish with strong momentum and room for growth before reaching overbought levels. Traders should watch out for any potential pullbacks to enter into long positions and continue riding the bullish wave.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.