Uniswap (UNI) has reached the end of its token unlock journey, with 100% of its governance tokens now transferable. The Uniswap DEX was among the earlier VC-backed projects, which shared earnings with token owners.

The allocated Uniswap (UNI) tokens reached the end of their unlocking process this September. It means all early investors and VC backers have now received their share. Uniswap went through a four-year unlocking cycle, requiring the market to absorb a growing inflow of tokens.

Even after the completion of the unlocking schedule, around 600M UNI are reported in circulation out of a total supply of 1B UNI. In total, the Uniswap DEX distributed 15.3% during its airdrop, 43.9% from community farming, and 40.8% to insiders.

Uniswap also carries its main treasury of 430M tokens, which may have shed some of the UNI on the market. UNI started with a minimal supply based on liquidity farming, which was easily absorbed during the 2021 bull market.

The top DEX on more than 16 leading chains will now have to balance the issues of its influential VC backers with retail holders and users. Uniswap is among the top DeFi and DEX platforms, and along with Aave, it is considered the prime candidate to revive DeFi activity.

UNI tokens aim to incentivize holding

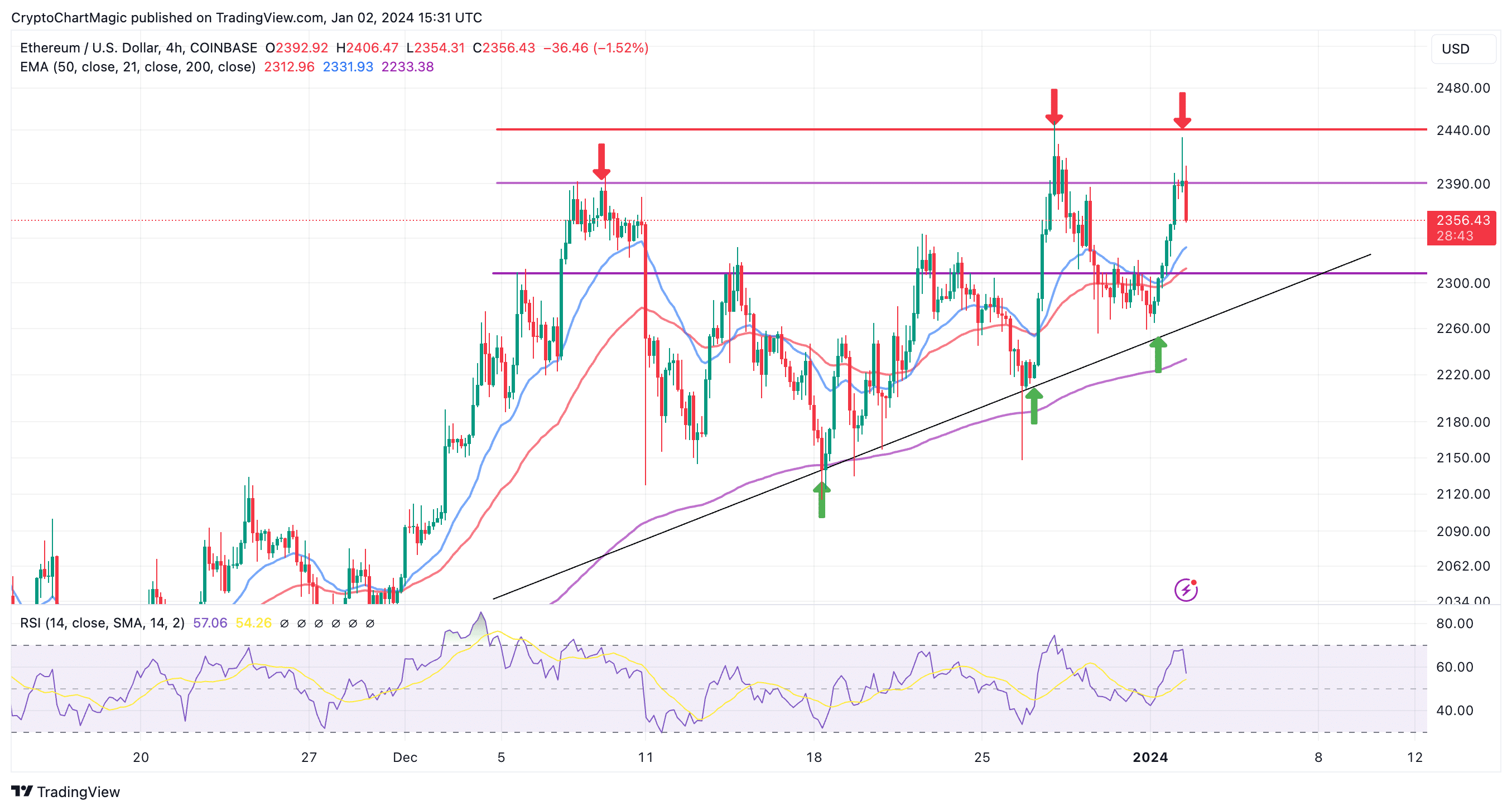

As a result, UNI peaked above $42 before going on an extended downward trend, to trade currently at $6.60. Some of the funds from early wallets entered the market, while others remained in whale wallets, or locked for staking. UNI can also be delegated for extra rewards.

Uniswap insiders helped the DEX raise $176M in two funding rounds, with a total of 11 participants and two lead investors. The top backers of Uniswap include Polychain Capital, Paradigm, Andreessen Horowitz, SV Angel, a16v Crypto and others. The presence of crypto-specific funds raises some hopes that the backers may not sell immediately, as they understand the pressures on crypto tokens.

Among VC backers, a16v Crypto is among the most influential and may lead to changing the payout structure on Uniswap. On its blog, the a16v venture fund recently outlined a general proposal for using app tokens to distribute fees. While the VC fund did not explicitly mention Uniswap, the fund may have an influence in shaping the future of the DEX.

UNI can be staked or used in liquidity pools for rewards. Uniswap produces up to $2M in daily fees, offering an incentive to take UNI out of circulation for staking. The fee switch proposal was declined after a vote in May 2024, but it may come to the table again. UNI may become more valuable with a tool to share fees from DEX swaps.

Additionally, a significant part of the UNI supply is in the timelock smart contract. The tokens in the contract are used to propose and vote on changes in the protocol. Large-scale owners with more than 2.5M in their wallet can make proposals, with a different timelock depending on their demands. Some proposals require a 30-day lockup period.

The governance structure of Uniswap is one of the factors that prevents insiders and whales from divesting their tokens. Holding UNI may be especially appealing in the case of an ongoing DEX revival. UNI is still considered one of the blue-chip projects and the topmost DEX on Ethereum, as well as newer chains like Base.

Uniswap’s plan to secure its treasury

Uniswap is currently trying to secure its governance protocol from attacks. When the UNI delegated for governance runs low, a large-scale whale could sway the vote. The biggest threat to Uniswap is a governance attack to drain the treasury.

One of the proposed safeguards is a veto council. Another possible tool in consideration is a staking requirement, where a proposer’s UNI will be slashed in case of disapproval from the veto council. Uniswap thus wants to limit bad actors trying to exploit the protocol.

The Uniswap protocol locks in $4.35B in value, with a competitive edge against other DEXs. Version 3 carries around $2.27B of that liquidity, while the protocol is currently testing V4.

Uniswap’s most active growth happened through the Base blockchain, as a venue for meme tokens and relatively cheaper swaps. Uniswap has also started offering liquidity pools for the newly launched cbBTC, for both Ethereum and Base versions of the wrapped BTC token.

Cryptopolitan reporting by Hristina Vasileva.