Oil prices are influenced by a complex interplay of global supply and demand dynamics, geopolitical events, and market speculation. While U.S. presidents can influence energy policy, they do not directly control oil prices.

Oil Prices During and After President Trump’s Tenure

COVID-19 Pandemic Impact: In early 2020, the COVID-19 pandemic led to a significant drop in global oil demand, causing prices to plummet. In April 2020, U.S. oil prices briefly turned negative for the first time in history, reflecting the unprecedented market conditions.

Investopedia

OPEC+ Agreement: In response to the price collapse, the Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, agreed in April 2020 to cut oil production by 9.7 million barrels per day—the largest reduction in history—to stabilize prices.

Columbia University - Energy Policy

Post-2020 Trends: Following these cuts and the gradual recovery of global demand, oil prices began to recover. By 2023, U.S. oil production reached approximately 12.9 million barrels per day, surpassing pre-pandemic levels and setting a new record.

World OilU.S. Oil Production Trends

2019 Production Peak: In 2019, U.S. crude oil production averaged 12.3 million barrels per day, marking a significant increase due to advancements in extraction technologies and shale production.

Forbes

Pandemic-Induced Decline: The onset of the pandemic in 2020 led to a reduction in production as demand fell and storage capacities were strained.

Recovery and Growth: Despite the 2020 downturn, U.S. oil production rebounded, reaching 12.9 million barrels per day in 2023, indicating a resilient industry that adapted to market challenges.

World OilPresidential Influence on Oil Prices

While the U.S. president can influence energy policy through regulations, strategic petroleum reserves, and diplomatic engagements, oil prices are primarily determined by global market forces. Factors such as international production agreements, geopolitical tensions, natural disasters, and technological advancements play more substantial roles in price determination.

The fluctuations in oil prices during and after President Trump’s administration were largely driven by global events, notably the COVID-19 pandemic and subsequent OPEC+ production decisions. U.S. oil production has demonstrated resilience, with output in 2023 surpassing previous records, reflecting the industry’s capacity to adapt to changing market conditions.

Recent Developments in Global Oil Production and Pricing

FaviconThe Wall Street Journal

Saudi Minister Warns of $50 Oil as OPEC+ Members Flout Production Curbs

97 days ago

Saudi Minister Warns of $50 Oil as OPEC+ Members Flout Production Curbs

FaviconReuters

US energy production exceeds consumption by widest-recorded margin

195 days ago

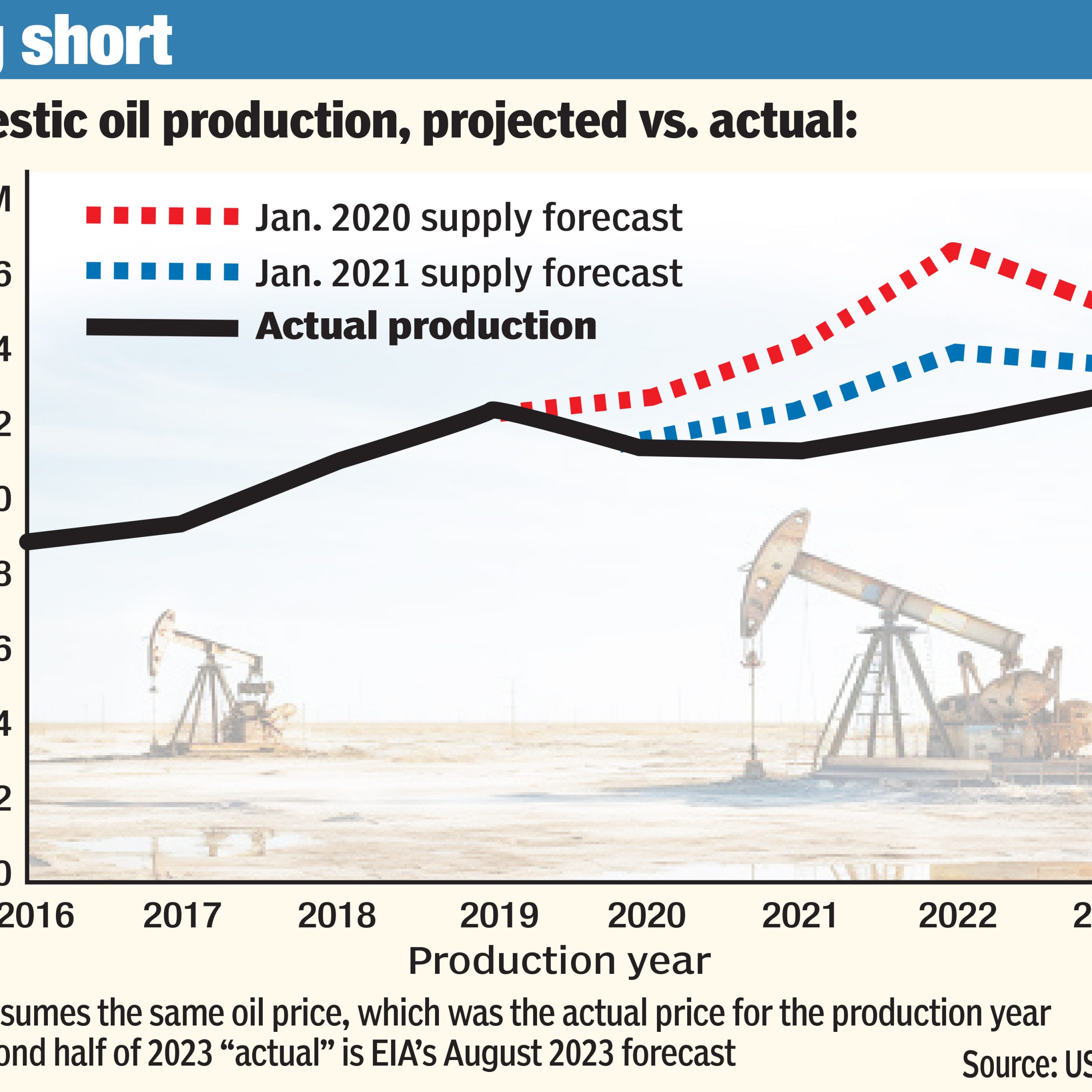

Over the past four years, the United States has maintained its position as a global leader in oil production, with output reaching unprecedented levels. Despite narratives suggesting that the Biden administration has significantly curtailed American drilling, data indicates that U.S. oil production has continued to thrive.

U.S. Oil Production Trends (2019-2023)

2019: U.S. crude oil production averaged 12.3 million barrels per day (bpd), totaling approximately 4.49 billion barrels for the year.

Forbes

2020: The COVID-19 pandemic led to a temporary decline in production due to reduced demand and economic slowdown.

2021-2022: As the global economy recovered, U.S. oil production rebounded, approaching pre-pandemic levels.

2023: The U.S. set a new record with an average production of 12.9 million bpd, surpassing the previous peak in 2019.

World OilGlobal Leadership in Oil Production

The United States has led global oil production for six consecutive years, with 2023 marking a significant milestone. This sustained leadership underscores the resilience and adaptability of the U.S. oil industry, even amidst policy changes and global economic fluctuations.

Fox Business

Policy Actions and Industry Narratives

In January 2025, President Biden issued an executive order banning new offshore oil and gas leasing across 625 million acres of ocean, including the entire East Coast, the eastern Gulf of Mexico, and the coasts of Washington, Oregon, and California.

Offshore Magazine

It’s important to note that this ban does not affect existing leases or the central and western Gulf of Mexico, where the majority of U.S. offshore drilling occurs.

Despite these regulatory actions, U.S. oil production has continued to grow, indicating that the industry’s overall output has not been significantly hindered. Claims that the Biden administration has drastically reduced American drilling are not supported by the production data, which shows sustained growth and record-breaking figures.

The United States remains a dominant force in global oil production, achieving record outputs in 2023. While policy decisions, such as the recent offshore drilling bans, have been implemented, they have not resulted in a decline in overall U.S. oil production. The narrative that American drilling has been severely restricted under the Biden administration is not substantiated by the empirical data.

Recent Developments in U.S. Offshore Drilling Policies

FaviconFinancial Times

Joe Biden bans new offshore oil and gas drilling along most of US coastline

Yesterday

FaviconReuters

Trump says he will revoke Biden offshore drilling ban immediately

Today

FaviconPolitico

Biden climate event blown off course

Today

Biden climate event blown off course

To dive deeper into the truth about oil prices, U.S. drilling, and the factors influencing global energy markets, visit BitlyFool.com. Get unbiased insights, fact-based analysis, and updates on how global and domestic forces shape the energy landscape.