Coinspeaker

US Bitcoin ETFs See $66 Million Inflows, Fidelity Leads Pack

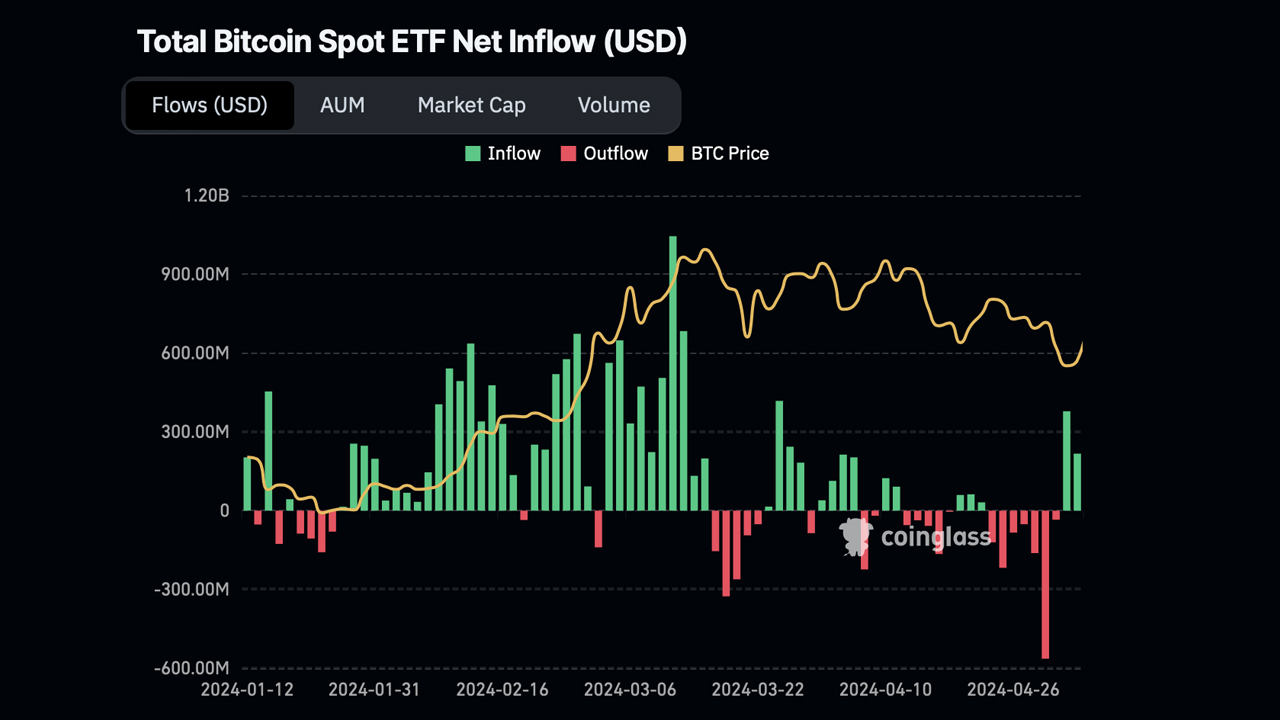

After last week’s strong outflows, the US Bitcoin ETFs registered strong inflows on Monday, May 13. Yesterday, the total inflows across all the 11 spot Bitcoin ETFs in the US were $66 million. Interestingly, both BlackRcok’s IBIT and Grayscale’s GBTC registered zero net flows on Monday.

The Fidelity Bitcoin ETF FBTC registered the highest inflows among other Bitcoin ETFs, at $38.6 million. On the other hand, the Bitwise Bitcoin ETF BITB stood second with $20.3 million worth of inflows.

In the past month of trading, the eleven Bitcoin ETFs experienced a collective net outflow of $297 million, with outflows registered on 17 trading days. This has been due to the uncertainty in the US markets as investors remain careful ahead of the inflation prints in the US this week.

However, during the last week, the Bitcoin investment products registered $144 million in inflows breaking the four weeks of consecutive outflows. It shows that the institutional interest in Bitcoin is once again gaining traction.

On the other hand, the volatile market fluctuations potentially led to Hong Kong’s six spot Bitcoin and Ether exchange-traded funds (ETFs) witnessing their most significant net outflows since their inception at the end of April.

Bitcoin Price Action Ahead

Earlier today, the Bitcoin price dropped under $61,500 levels to the news of crypto exchange Coinbase facing a major outage for four long hours. As of press time, the Bitcoin price is trading 1.58% down at a price of $61,668 with a market cap of $1.214 trillion. For the past few weeks, BTC price has been oscillating in the price range of $61,000-$64,000.

If BTC price drops under $60,000, it will open the gates for correction all the way up to $52,000. On the flip side, if bulls manage to take Bitcoin above $64,000, it will open the gates to $70,000, and new all-time highs ahead.

With spot Bitcoin ETF purchases slowing down considerably, and even dipping into negative territory on some days, macroeconomic catalysts have gained increased significance recently.

The next potential catalysts, whether positive or negative, are expected to stem from US inflation reports. Notably, the Producer Price Index (PPI) is scheduled for release on Tuesday at 8:30 a.m. ET, followed by the Consumer Price Index (CPI) 24 hours later.

Of the two reports, the CPI holds greater importance. Economists anticipate the CPI to have risen by 0.4% in April, aligning with the previous month’s increase. The annual rate of headline CPI is projected to decelerate slightly to 3.4% from March’s 3.5%. Meanwhile, the core CPI, which excludes food and energy prices, is forecasted to increase by 0.3% in April compared to 0.4% in March, with the annual rate moderating to 3.6% from 3.8%.

US Bitcoin ETFs See $66 Million Inflows, Fidelity Leads Pack