The U.S. Securities and Exchange Commission (SEC) is coming after OpenSea, the biggest NFT marketplace out there, claiming that the NFTs traded on the platform might be securities.

Now, for those who aren’t glued to the latest SEC antics, this might seem out of left field. What do digital collectibles, art, and in-game items have to do with securities law? It’s bizarre, but for anyone who’s been keeping up with the SEC’s crusade against crypto, this feels like just another day at the office.

The SEC has been gunning for anything remotely crypto-related for a while now, and NFTs are just their latest target. But OpenSea believes this could also screw over creators, collectors, and the entire NFT ecosystem.

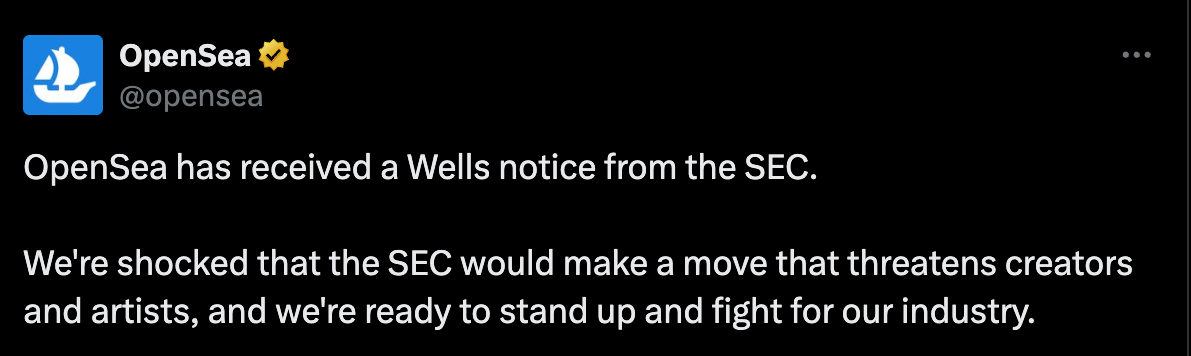

OpenSea objects SEC’s position on NFTs

According to them, NFTs are about everything *but* securities. People buy these digital assets for all sorts of reasons—maybe it’s a game item, an avatar, or even just a way to support their favorite artist.

The idea that these transactions could be classified as securities is downright wrong, says OpenSea. It could mess with artists’ income, rob gamers and collectors of their hobbies, and destroy the innovative ways NFTs are being used. The company said:

“The SEC’s approach threatens the livelihoods of artists and creators who are simply experimenting with a novel, fast-growing technology or have chosen it as their preferred medium.”

Here’s the deal. If the SEC gets away with calling NFTs securities, where does it stop? If an NFT can be a security, what’s next? Digital baseball cards? Fine art? Sneakers? The line between what’s a security and what’s not would be blurrier than ever.

The SEC’s broad interpretation of the Howey test—a legal standard used to determine whether a transaction qualifies as an investment contract—could sweep up every piece of art or collectible under its jurisdiction.

OpenSea explained that NFTs aren’t stocks, bonds, or any other traditional security. The comparison just doesn’t hold up. Yet, the SEC seems hell-bent on treating them like they are.

In another bizarre twist, the commissioners compared the Stoner Cats NFTs—an NFT project tied to a web series—to Star Wars collectibles from the 1970s. After Star Wars hit theaters in 1977, toy company Kenner sold “Early Bird Certificate Packages” that fans could redeem for action figures later on.

These certificates were like early NFTs, offering something digital (well, a promise of something physical, anyway) that fans could hold onto or trade. According to today’s SEC logic, those certificates might have been classified as investment contracts, too. Absurd, right?