Coinspeaker

USD-backed Stablecoins Are Important to Keep Up with China, Former House Speaker Says

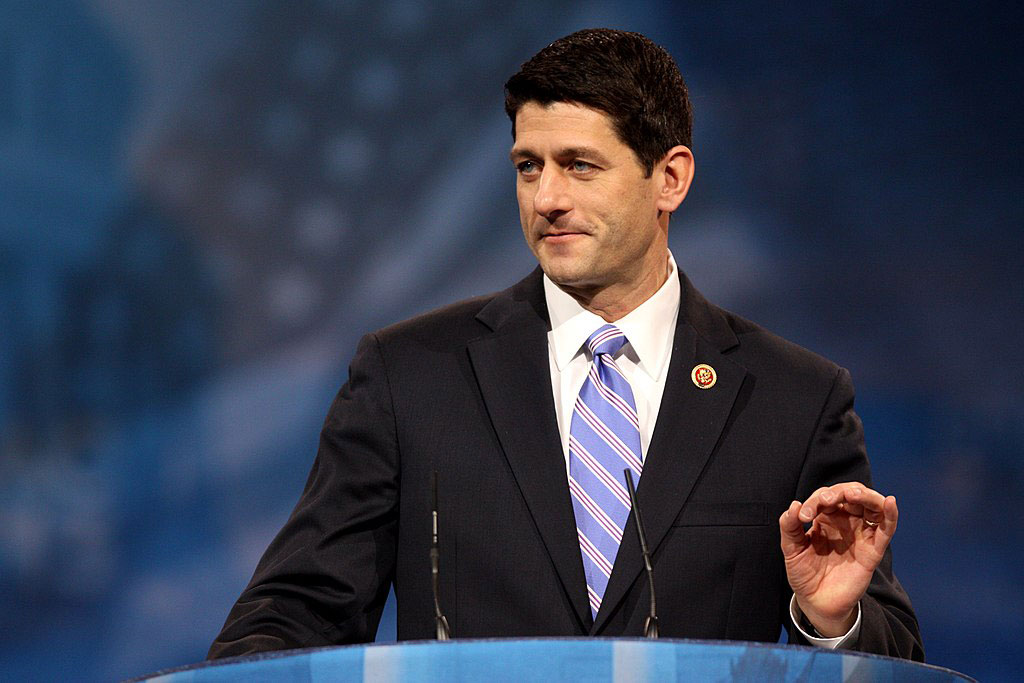

The US government has been cracking down rigorously on stablecoin operators in the country over the past few months. However, former House Speaker Paul Ryan believes that the USD-pegged stablecoins could actually help the US government to alleviate its debt crisis while keeping the value of USD strong against the Chinese yuan.

“The US is headed toward a predictable yet avoidable debt crisis,” and the dollar-backed stablecoins will help keep USD attractive, said Ryan. In the period between 2015-2019, Ryan served as the 54th speaker of the US House of Representatives. The House Speaker is a powerful position with the ability to shape a legislative agenda.

Currently, Ryan serves as the policy council member at the crypto-focused VC firm Paradigm. “There would be an immediate, durable increase in demand for US debt, which would reduce the risk of a failed debt auction and an attendant crisis,” said Ryan.

As just $162 billion, the stablecoin market today still proves to be a huge source of demand for the US Treasury. Ryan stated that USD-pegged stablecoins can play a huge role in preserving the dollar’s dominance.

It enables “affordable, dependable financing for fiscal spending” on blockchain infrastructure, which could help the US dollar maintain its “significant influence over the global financial system”.

Analysts are already expecting the stablecoin market to grow in trillion-dollar valuations by 2030. Thus, it could give the USD a greater dominance in the future.

Competing with the Chinese Yuan

Ryan highlighted that China has been incorporating the Chinese yuan into various digital infrastructure investment platforms across several emerging markets. He emphasized that the US must develop its own solution promptly before it falls behind, explaining that:

“The US can’t afford to sit idly as its largest international competitor taps latent demand for safe and convenient digital money. Stablecoins backed by dollars provide demand for US public debt and a way to keep up with China.”

Ryan stated that a robust regulatory framework for stablecoins, which already has bipartisan support in Congress, could significantly expand the use of digital dollars at this crucial time.

Emin Gün Sirer, CEO of Ava Labs praised Ryan’s view on stablecoins stating that “stablecoins are one of the best things to come out of crypto, and they help maintain the dominance of the dollar around the world”.

USD-backed Stablecoins Are Important to Keep Up with China, Former House Speaker Says