The ever-evolving crypto realm has witnessed a rise in impressive innovations and crypto products, among them including exchange-traded funds (ETFs) between ProShares and VanEcK. Interest in the ETFs has been released to rise in the past months, and currently, talks on spot Bitcoin ETFs have surged BTC’s market price by over 20% in just a few weeks.

This has shown the anticipated approval of these Exchange-Traded Funds by the US Securities and Exchange Commission (SEC).

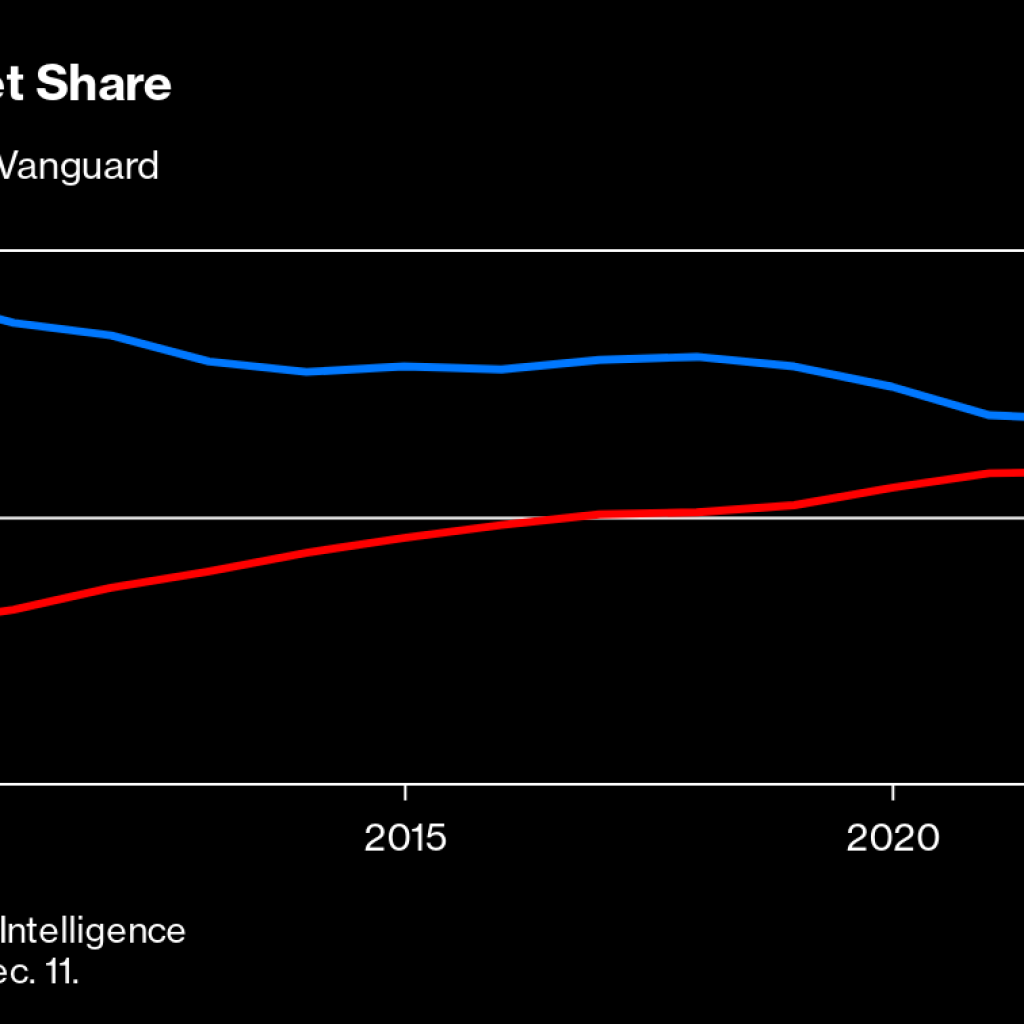

Among the recent developments in the digital space considering ETFs is ProShares ETF. The ETF has outshined its competitors, one being VanEcK’s ETF. According to market analysis, data shows that ProShares spot Bitcoin ETFs have been attracting a significant inflow of investors as it continues to generate more investors’ interest.

This has indicated a potential audience for BTC exposure to potential investors all around the globe using these ETFs.

VanEcK and ProShared Spot Bitcoin ETFs growing investor interest

VanEck recently filed a preliminary prospectus on October 27 for its VanEck Bitcoin Trust exchange-traded funds. The objective of this investment is to mirror Bitcoin’s performance with fewer operating expenses experienced through holding Bitcoin. The preliminary prospectus states that the custodian holding all the BTC on behalf of the Trust will be Gemini Trust Company LLC.

Eric Balchunas, a Bloomberg Intelligence ETF analyst, shared his comments on ProShares outperforming its competitors. According to Balchunas, “Notable: BITO traded $1.7b last week, 2nd biggest week since its wild WEEK ONE. GBTC did $800 million.

That’s $2.5b (top 1% among ETFs) into two less desirable methods (vs. spot) or exposure = while we think spot ETFs are unlikely to set records on DAY ONE, clearly there’s an audience.”

As part of the ProShares Bitcoin ETF strategy, its major aim is to produce substantial returns that correspond to BTC investments in Bitcoin futures contracts. These ETFs allow Bitcoin investment in real-time market data and also aid investors in trading BTC without actually owning any Bitcoin. The ProShares ETF was launched in October 2021, and the Fund currently records a gain of 80% to date.

Social comments on ETFs

On October 28, James Seyffart, another Bloomberg Intelligence’s ETF Analyst, commented on the latest happiness regarding ETF products in the crypto space. He noted on an X post stating, ” “Anddddddd VanEck US joins the amendment filings for spot Bitcoin ETF issuers.” He also shared VanEck’s preliminary prospectus regarding the VanEck Bitcoin Trust.

However, considering ProShare’s dominance based on its already established history in the crypto community, its value in the market is considerably higher. According to Balchunas, as of October 27, ProShares Bitcoin ETFs traded at $1.7 billion, indicating a rise of over $900 million since October 20. This figure also represents a rise from its value of $445.87 million at the beginning of October.

Following their debut, Ether has been noted to be a major ETF rival, and this has made it easier for investors to gain exposure to both assets, as they play an important part in the crypto market.

According to Bitwise CIO Matt Hougan, a registered investment advisor, “I think the long-term buyers of these products are financial professionals — financial advisors, family offices. Retail traders can get exposure to Ethereum through a Coinbase app, but a financial professional can’t invest through a phone,”

The buzz on the ETF products has seen the price of BTC rise, peaking at the $35,000 mark. This has confirmed the influence of these ETFs on the crypto market, including Bitcoin digital currency. Market experts also comment that future ETF approval by the SEC would mean a new digital era for cryptocurrencies.