On January 3, 2009, Satoshi Nakamoto mined the Genesis Block on a small server in Helsinki, Finland, and received a reward of 50 bitcoins, which marks the beginning of crypto mining.

From CPU to ASIC

In Satoshi Nakamoto’s initial vision, BTC mining could be performed using CPUs installed on PCs. During its infancy, Bitcoin remained obscure and offered no value.

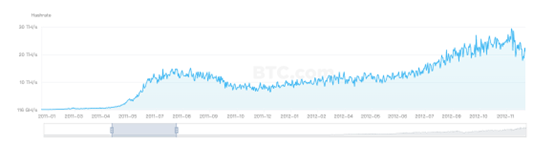

It wasn’t until 2010 when Bitcoin enthusiast Laszlo Hanyecz argued that GPUs could perform more computations per second than CPUs and tried to use GPUs for mining, and he was correct. After Hanyecz shared his GPU mining code with the community, Bitcoin saw its first hashrate surge by 20,000 times, from 6 MH/s in January 2010 to 120 GH/s in December 2010.

What’s interesting is that Hanyecz, who introduced GPU mining, was also the one who started Bitcoin Pizza Day. Hanyecz earned plenty of bitcoins through the GPU mining approach he invented and spared no efforts to promote the crypto. For instance, the guy bought two pizzas with 10,000 BTC, giving real value to the new currency for the first time.

The appearance of GPU mining and the surging BTC price led to a mining arms race, and miners were constantly seeking new ways to improve their hashrate. In 2011, someone shared the code of FPGA mining machines on GitHub, which started a new era dominated by specialized mining rigs. In 2011, the Bitcoin hashrate rose from 116 GH/s at the beginning of the year to nearly 30 TH/s at the end of the year, a nearly 300X growth.

2012 saw the birth of ASIC mining machines, which are superior models, and the Bitcoin hashrate skyrocketed from 20 TH/s to 12 PH/s, an increase of 600 times. Since then, ASIC models have replaced CPUs, GPUs, and FPGA machines as the mainstream BTC mining machine.

From Solo Mining to Pool Mining

The growing hashrate raised new concerns — Is bitcoin mining still profitable as more and more miners join the business? Upon realizing the limitations of solo mining, Czech programmer Marek Palatinus found a solution: unite BTC miners, pool the resources, and share the profits. In 2010, Marek started slushpool, the world’s first mining pool. Since then, BTC mining has gradually transitioned from solo mining to pool mining.

Although mining pools gather a large number of miners, miners are not always tied to one pool, which has led to the sudden rise and fall of many pools. For instance, in 2013, GHash.IO attracted plenty of miners with its zero-fee policy. By 2014, the pool’s peak hashrate had even surpassed 51%, raising concerns in the Bitcoin community. However, this giant pool eventually shut down in 2016 due to repeated large-scale DoS attacks.

Clearly, mining pools demand strong technical capacity. In the early days, many pools underestimated the technical requirements of the industry. As a result, they suffered attacks and eventually shut down, just like GHash.IO.

Having realized the immature technologies and products in the pool industry, Haipo Yang, an early Bitcoin builder, decided to build a stabler and more efficient pool to empower BTC mining, a key channel for maintaining the normal operations of the network. In just two months, he independently completed the coding of ViaBTC Pool, which officially went live on June 5, 2016.

ViaBTC Riding the Waves

Born in a time of fierce competition, ViaBTC has remained a top player in terms of hashrate, thanks to its stable technologies, innovative products, and satisfying user experiences.

Shortly after its launch, ViaBTC invented the PPS+ payment method based on the conventional PPS and PPLNS methods. This new approach guarantees stable mining revenue while sharing miner fees, allowing ViaBTC miners to earn more coins than their peers in other pools. Later on, mainstream pools started to embrace the PPS+ payment method. ViaBTC’s invention of PPS+ has catalyzed changes in industry rules and brought higher and stabler mining revenue to miners.

At ViaBTC, technology is always a priority. For instance, the pool optimized the broadcasting and transmitting process of the BTC network through its independently developed BTC client. Thanks to its high-speed block updating networks distributed around the world, miners can discover and broadcast new blocks more quickly. Furthermore, these efforts have lowered the orphan rate, ensured stable mining revenue, and improved the operating efficiency of the network. To date, ViaBTC remains the mining pool with the lowest orphan rate.

Over the years, ViaBTC has also introduced a wide range of functions and tools, including the Transaction Accelerator, Auto Conversion, Smart Mining, Hedging Service, Crypto Loans, Hashrate Fluctuation Notification, Revenue Sharing, and Referral Commission, to provide users with faster, stabler, and more lucrative mining and derivative services.

Looking back at the past seven years, ViaBTC has seen the ups and downs of crypto mining. GHash.IO is just one of many pools brought down by network attacks. Moreover, there are also pools hurt by disrupted cash flows, as well as pools abandoned by miners due to unstable block output. ViaBTC, on the other hand, has remained committed to products and technology, with a focus on users. These efforts have paid off as it becomes one of the few crypto companies to celebrate its seventh anniversary.

ViaBTC now provides mining services for more than one million users in over 130 countries and regions, covering 10+ cryptos that include BTC and LTC. Moreover, the pool is a top player in terms of the mining hashrate of cryptos including BTC and LTC, with multi-billion dollar worth of cumulative mining output.

Going forward, ViaBTC will continue to provide professional, efficient, secure, and stable crypto mining services for miners, while developing comprehensive, reliable, secure, and satisfying crypto products through dedicated efforts. At the same time, ViaBTC will drive the progress of the mining industry to witness the new blockchain future together with its users.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.