Wall Street crushed it this week. While European and Asian markets barely managed to tread water, U.S. stocks were off breaking records like they didn’t get the memo about inflation and tariffs.

The S&P 500 gained 1.1% during a week where half of Wall Street was on holiday and Trump’s latest trade threats were making headlines. It wasn’t even close. Europe’s Stoxx 600 scraped up a measly 0.4%, and the MSCI Asia Pacific Index did slightly better with 0.8%.

American markets are running circles around the rest of the world, and they look set to keep doing so. U.S. large-cap stocks are about to close out their best year against global competitors since 1997.

Corporate America’s borrowing machine is running smoothly, even with interest rates, and day traders are raking in profits on everything from leveraged ETFs to crypto. It’s fascinating to witness.

Trump, tariffs, and treasury yields

This week was pure chaos for us geopolitically, but you wouldn’t know it by looking at the S&P 500. Trump announced his pick for Treasury Secretary, sending investors into a frenzy of optimism. A few days later, he stirred up more volatility with brand new threats of aggressive tariffs against close U.S. trading partners.

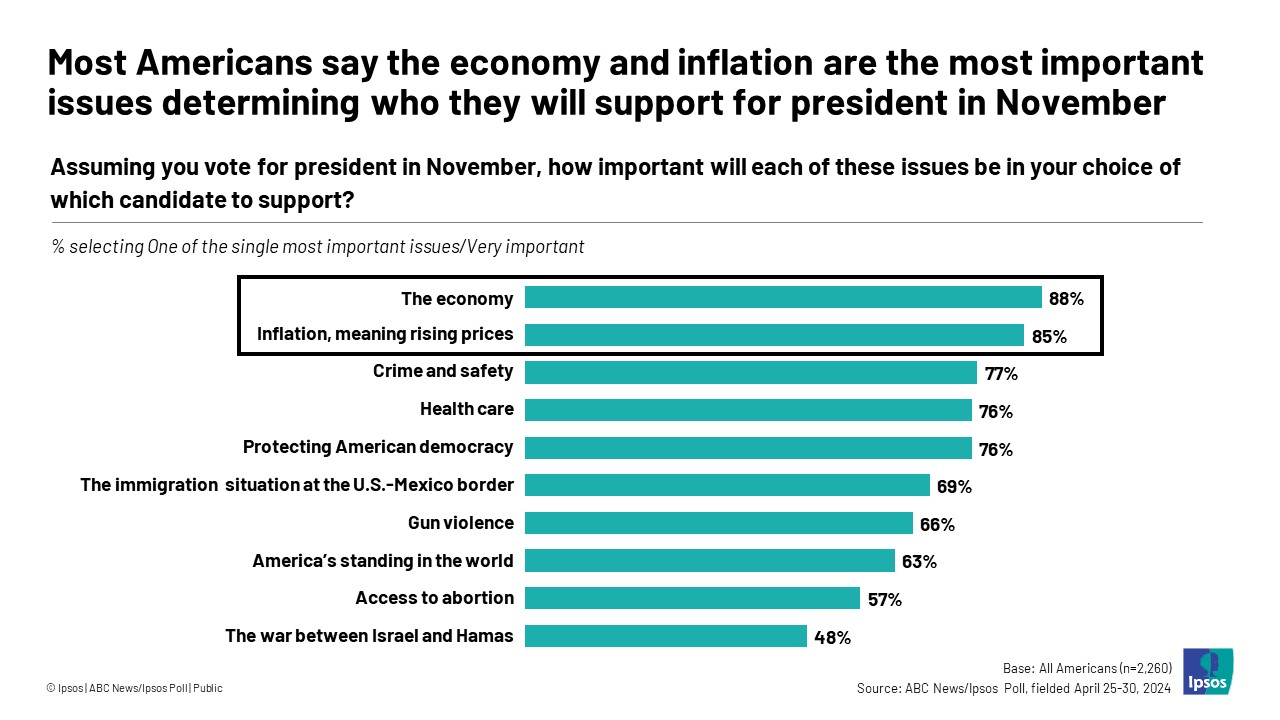

Meanwhile, inflation data for October came in hot, showing prices climbing yet again. Did any of this faze Wall Street? Not even a little.

The S&P 500 ended the week in the green, while the Cboe Volatility Index (VIX) (the market’s fear gauge) dropped to its lowest level in four months. Treasury yields took a nosedive, with the 10-year benchmark falling 22 basis points.

For context, French bonds had a rough week thanks to yet another political drama, hitting their widest yield gap against German bonds since 2012. EPFR data from Barclays showed that while money poured into U.S. stocks, Europe and emerging markets saw outflows.

Japan’s yen was a rare bright spot, strengthening past 150 against the dollar for the first time in over a month. Tokyo inflation data came in higher than expected, with core prices rising in line with estimates. Traders are now betting on a 60% chance that the Bank of Japan will hike rates next month.

That’s big news for Japan, but it’s not enough to steal Wall Street’s thunder. China, meanwhile, is struggling to keep up.

Miners like Anglo American Plc got a boost from speculation that Beijing might roll out new stimulus measures, but overall, Asian markets are lagging. Wall Street has beaten global markets in 13 of the last 15 years. Frankly, Europe and Asia are just background noise at this point.

The Wall Street machine

Why does Wall Street keep winning? Simple: the U.S. economy is literally built differently. Since the pandemic, American growth has outpaced every other developed nation.

Trump’s policies—whether you love them or hate them—are laser-focused on boosting domestic markets. Economists are raising their growth forecasts for the U.S. next year while cutting projections for Europe. The numbers don’t lie.

Ben Kumar, head of equity strategy at Seven Investment Management, explained it like this: “You have to own the U.S. because it’s just doing something different.”

He’s not wrong. The S&P 500 is packed with companies that print money like it’s a hobby. Tech giants like Apple, Amazon, and Microsoft are leading the charge, and the market is rewarding them handsomely.

For UBS, it’s all about operational leverage. The U.S. has the lowest among major markets, meaning it’s better positioned to weather a global slowdown.

Add potential tax cuts and deregulation to the mix, and you’ve got a recipe for continued dominance. “The U.S. should benefit from Trump relative to elsewhere,” the strategists wrote.

The risks are still real

Of course, it’s not all sunshine and rainbows. Trump’s tariff threats could backfire spectacularly if other countries retaliate with their own trade barriers. Adam Slater at Oxford Economics warned that the market’s optimism might be “premature” if this turns into a full-blown trade war. That’s a valid concern, but investors are too busy raking in profits.

The Federal Reserve is also in play. Speculation about rate cuts has been a major driver of this year’s gains, especially for speculative assets like crypto. Max Kettner, chief strategist at HSBC Holdings, pointed out the parallels to 2019, when trade tensions were at their peak, but the Nasdaq was on fire. “This is still a cutting cycle. It’s a fantastic set-up,” he said.

Nobody knows for sure how long this streak will last, but Wall Street isn’t showing any signs of slowing down. With $141 billion flowing into U.S. equities this month alone, the market is firing on all cylinders.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap