Warren Buffett’s empire, Berkshire Hathaway, just showed everyone how it’s done – again. Saturday came with the news that not only did Berkshire crush it last year, but they’ve also got a piece of the crypto pie. And before you think Buffett’s gone all in on Bitcoin, I’m gonna tell you right now; he hasn’t. He’s still the same old Buffett.

Berkshire’s Profit Party

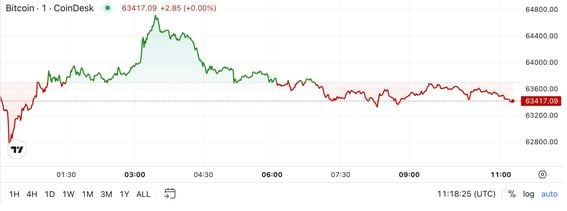

Berkshire Hathaway set a new record last year. Thanks to some smart stock moves and their insurance biz doing better because of higher interest rates, they’re swimming in cash. Their operating profit for just the last quarter of the year was $8.48 billion, up by 28%. For the whole of 2023, they reported a net profit of $96.2 billion. Yeah, you read that right. And remember 2022 when the stock market went belly up? Berkshire felt that too, with a $22.8 billion loss.

But don’t start thinking my man Buffett’s just sitting pretty, happy with how things are going. He’s out here saying that finding big, juicy deals for Berkshire to gobble up is getting tougher. The company is just too big now, and the market’s too picked over. It’s like looking for a needle in a haystack, except the needle’s got to be massive, and there aren’t many of those lying around.

And then there’s the crypto twist. Just a day before these bombshell earnings were announced, word got out that Berkshire’s thrown about $1 billion into Nubank, a digital bank that’s all cozy with crypto. That’s right, the same Buffett who’s been side-eyeing crypto for ages. Looks like even he can’t ignore it when there’s money to be made. Personally, I respect him for that.

The Buffett Blueprint

Warren Buffett, the man, the myth, the legend, straight-up told his shareholders not to expect any fireworks. The days of Berkshire pulling off game-changing deals like they did with Geico or BNSF Railroad are getting rare. And it ain’t just a U.S. problem. Looking globally doesn’t help much either.

Berkshire’s been busy, though, snapping up businesses here and there, like Pilot Flying J and Alleghany. But even shelling out billions hasn’t made much of a dent in their cash pile, which hit a record $167.6 billion at the end of 2023.

Losing Charlie Munger, another crypto skeptic I respect and Buffett’s right-hand man, last year was a blow. Munger was the guy who helped shape Berkshire into what it is today. Now, Greg Abel, along with Todd Combs and Ted Weschler, have some pretty big shoes to fill. Berkshire’s been a beast in the market since 1964, but keeping that up is going to be a challenge.

Even with all this, Berkshire’s been buying back its own stock, spending over $9bn last year. It’s a sign they’re not finding a lot of other places where they want to put their money. Then there’s the legal headaches. Berkshire’s utility biz is in the hot seat over wildfires, with settlements and charges stacking up. And their real estate arm, HomeServices of America, is caught up in a bunch of antitrust lawsuits. It’s not all smooth sailing, even for a giant like Berkshire.