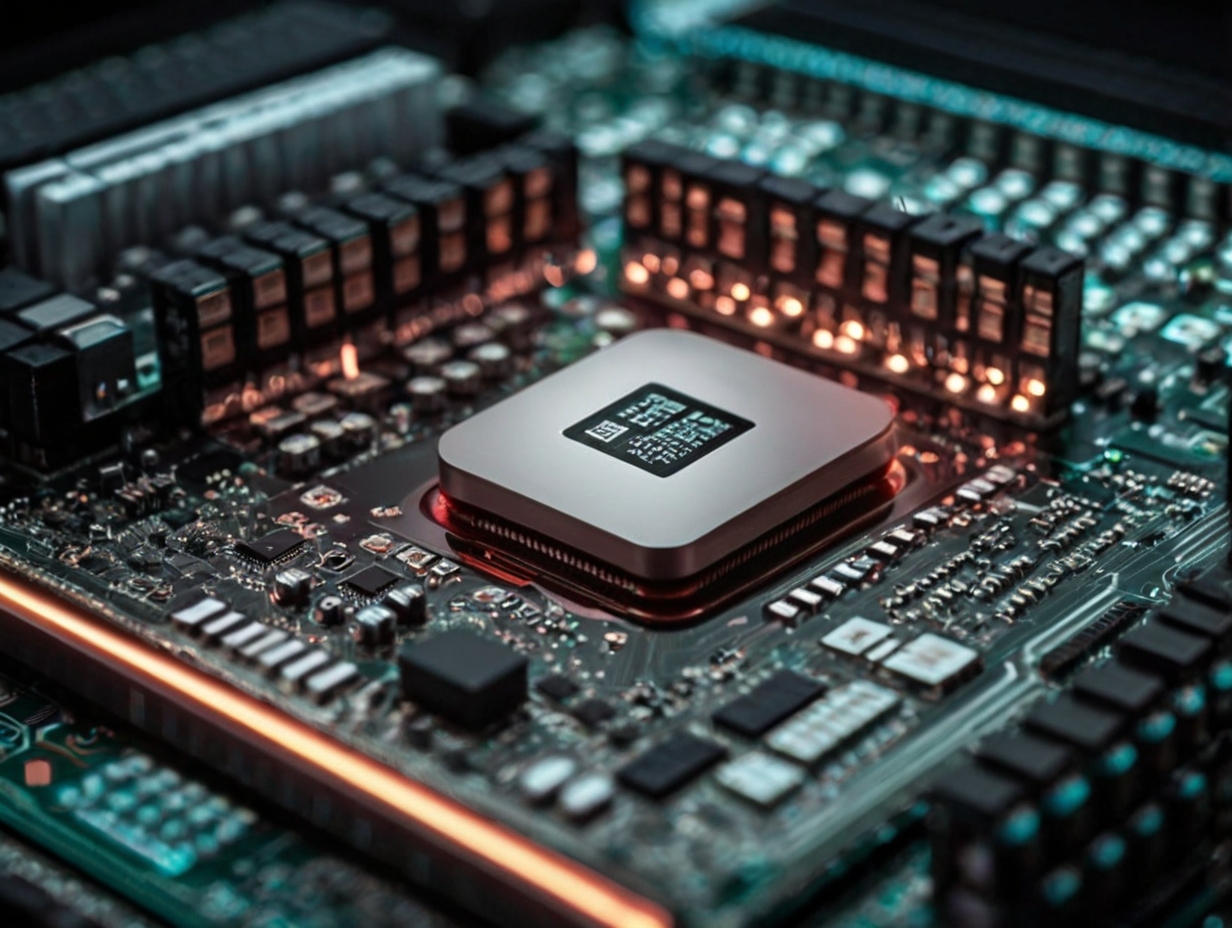

AMD, a prominent chipmaker, finds itself under pressure as the U.S. government tightens regulations on tech exports to China. The recent announcement from U.S. officials indicates that AMD will require an export license to sell certain chips tailored for Chinese customers, particularly an AI chip.

This development is part of Washington’s broader crackdown on advanced chip sales and chipmaking tools to China due to national security concerns.

Export Restrictions Impact AMD’s Operations

The refusal to allow AMD to sell its AI chip without an export license underscores the company’s entanglement in the escalating tensions between the U.S. and China. While AMD has not officially commented on its intentions regarding seeking the required license, investor concerns regarding the potential impact on the company’s China business were evident as AMD’s stock dipped by 2.2%. However, the shares managed to rebound by the end of the trading session.

The U.S. began unveiling export restrictions in 2022 to limit China’s access to advanced chips and chipmaking tools, citing national security worries. These controls were further tightened in October 2022, extending to cover more technological sectors.

In response to these regulations, companies like AMD and Nvidia have adjusted their offerings for the Chinese market to comply with the heightened restrictions. Nvidia, for instance, has downgraded the performance of its AI chips for Chinese buyers.

Major Chinese tech firms, including Tencent and Baidu, have resorted to stockpiling Nvidia’s pre-ban AI chips to sustain their development efforts for the next 1-2 years. Additionally, Huawei, faced with potential gaps resulting from the U.S. ban, has initiated the development of its own AI chips.

Challenges for AMD and industry implications

The Biden administration’s intensifying efforts to regulate tech exports pose significant challenges for AMD and other chipmakers. Navigating the complex export rules risks impacting their operations in a major market like China. This situation forces companies like AMD and Nvidia to reassess their strategies and adapt to the evolving regulatory landscape.

Despite the regulatory challenges, AMD’s stock price has shown resilience, experiencing significant gains in recent weeks. The stock, which has risen by nearly 50% year-to-date, witnessed a notable uptick last week,

adding around 15% gains since the previous Thursday. While the recent rally has been swift, it’s important to note that it occurred alongside the formation of three price gaps, one of which was filled on Tuesday.

While the current advance may appear fragile, supported mainly by investors eager to capitalize on the momentum, the mid-January to late February trading range provides solid support. Additionally, the October-to-March uptrend line reinforces the medium-term bullish trend.

A breakthrough above record high of $211.01 could potentially pave the way for further gains, with the $250 mark looming as a minor psychological resistance.