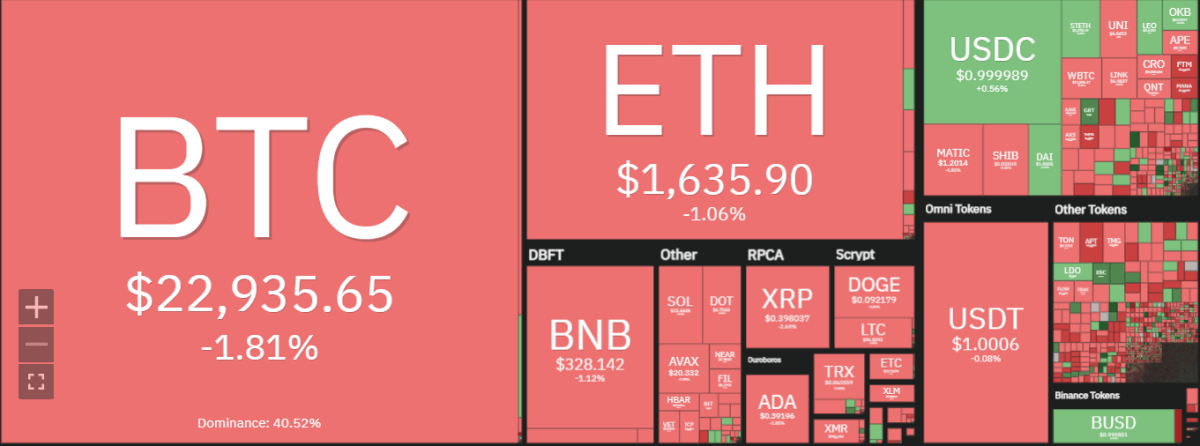

Our weekly crypto price analysis of the cryptocurrencies XRP, BNB, ADA, and DOGE shows that all coins are currently in a neutral range. Bitcoin has been trading at a high of $23,416 and a low of $22,734 for the past week. Ethereum price analysis shows that it is trading above the $1,600 mark and is expected to remain in this range for the coming week as well. XRP is trading at a high of $0.4108 and a low of $0.39 for the past week. BNB, ADA, and DOGE were trading in a range of $335- 320, $0.40-0.38, and $0.0960-0.090 respectively for the past week. Overall, all the coins are trading in a neutral range with no major price movements seen over the week’s analysis period. It is advised that traders look out for any major price breakout before making a trade decision.

The altcoins were also seen trading in a tight range with no major price movements seen over the week’s analysis period. Most altcoins have been trading below their all-time highs which were recorded earlier this year in January. A few of them, however, have managed to surmount their all-time highs and are currently being traded at high levels. It is recommended that traders cautiously observe the trends of their desired coins before deciding to enter or exit a position.

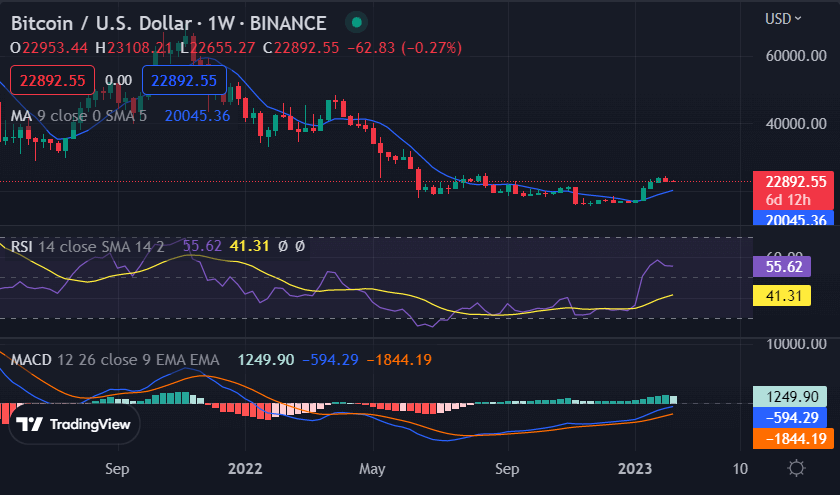

BTC/USD

Bitcoin price analysis shows that the coin is trading in a range of $22,734 to $23,416 in the past week.BTC/USD is currently trading at $22,861 with a decrease of 2.47% for the past 24 hours. Although the past week the coin gained significantly in terms of price, it failed to break out of the range.

Bitcoin price analysis shows that it has been consolidating around the lower support levels which could indicate further downside pressure in the near term. The coin currently holds a market capitalization of over $440 billion and a daily volume of more than $22 billion.

The moving average convergence divergence (MACD) shows a bearish crossover indicating a further correction in the near term. The relative strength index (RSI) is currently at 41.31 levels implying that Bitcoin is currently trading in a neutral zone. The moving average is currently at a downward slope and indicates a bearish sentiment for the coin in the near future.

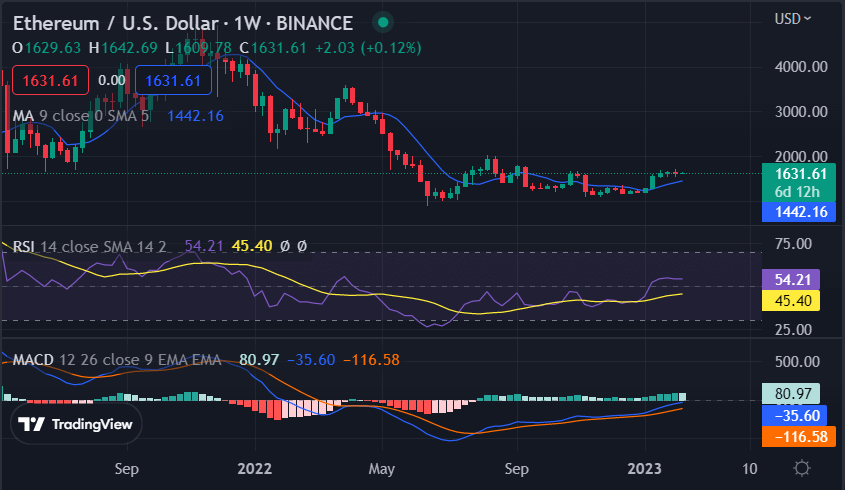

ETH/USD

Recent Ethereum price analysis shows that the coin is trading above the $1,600 mark for the past week. ETH/USD pair is currently trading at $1,632 with a decrease of 2.58% for the past 24 hours which shows that the coin is currently in a consolidation phase. The support for ETH/USD has been established at $1,616 and the resistance is established at $1,669, and if the price manages to break out of this range, further upward movement can be expected.

The 50-day moving average and 200-day moving average are indicating a bearish crossover with the 50-day moving average below the 200-day moving average. The RSI shows that the asset is currently trading in a bearish pattern with the RSI standing at 45.40 levels. The MACD for ETH/USD shows that the coin is currently in a bearish divergence with the signal line and the MACD line both showing downward pressure.

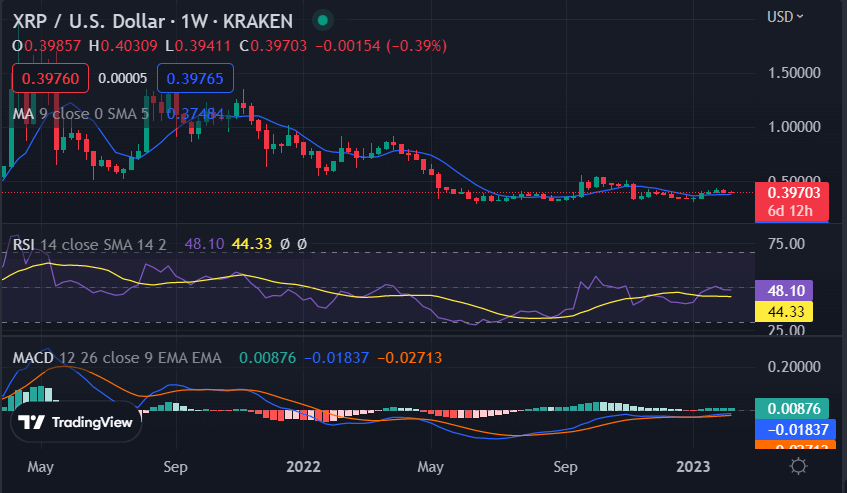

XRP/USD

XRP price analysis is currently at $0.3966 with a decrease of 3.41% for the past 24 hours. The coin has been trading in a tight range over the past week and is expected to remain within this range in the near term as well. Support for XRP/USD has been established at $0.3962 and the resistance is established at $0.4103, which is expected to be tested in the near future.

The 24-hour trading volume for XRP/USD is currently at $996 million, while the market capitalization stands at $20 billion. The MACD for XRP/USD shows that the coin is in a bearish divergence with both the signal line and the MACD line showing downward pressure. The relative strength index (RSI) stands at 44.33 levels which implies that the asset is trading in a downtrend.

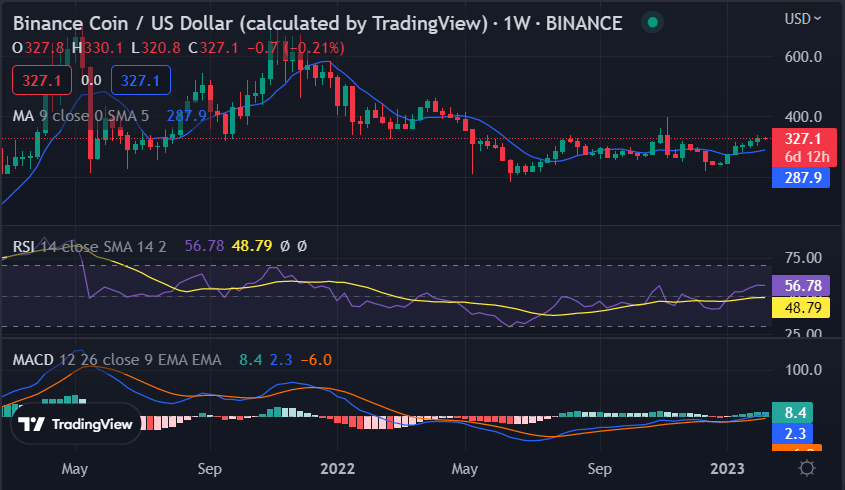

BNB/USD

Binance price analysis is at $325, Currently, BNB is in a red zone and down 1.8% over the last 24 hours. The bullish need to get back above the $330 resistance level in order for BNB to take a bullish trend again. The previous week the bullish pressure was in control with more buying activity and pushing the price up. However, currently, the bearish pressure has taken control and pushing BNB/USD down.

The Stochastic RSI is currently in the overbought zone which means that the bullish pressure is decreasing. The MACD indicator shows a bearish divergence, which is further hinting at the bearish pressure in the market. The 50-day moving average and 200-day moving average are also heading lower showing a bearish trend for BNB/USD. The overall market sentiment for cryptocurrencies is currently neutral to bearish as most coins are trading sideways or seeing losses in their prices.

DOGE/USD

Dogecoin price analysis shows that the coin is currently trading at $0.09199 with a decrease of 3.31% for the past 24 hours. The previous week bulls and bears were both fightings for control of the market, but bulls eventually took control and pushed Dogecoin’s price above the $0.10 level. Currently, the bearish pressure is in control as more selling activity is taking place.

The Stochastic RSI for DOGE/USD is currently in the oversold zone which implies that the bearish pressure might be slowing down and a price rebound can be expected soon. The MACD indicator shows a bearish divergence with histogram bars heading lower and the MACD line below the signal line. The moving average is currently at $0.0829 just below the current price.

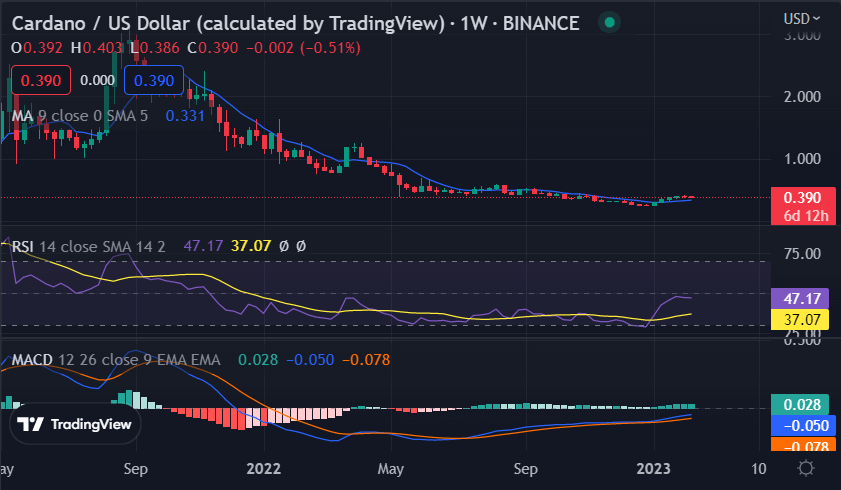

ADA/USD

The recent Cardano price analysis shows that the coin is currently trading at $0.3918 with a decrease of 1.90% for the past 24 hours. The 24-hour trading volume has decelerated and is currently at $394 million while the market capitalization stands at $13 billion, which shows that the sellers are currently dominating the market.

The relative strength index (RSI) is on a downward slope though still in the upper half of the neutral zone at an index of 37.07. The MACD indicator is at $-0.028 with the MACD line below the signal line and histogram bars are narrow indicating a bearish divergence. The 50-day moving average is heading lower and is currently at $0.331, while the 200-day moving average is at $0.334.

Conclusion

Overall, the market sentiment for cryptocurrencies is currently bearish with most coins trading in the red zone and seeing losses in their prices. The past week saw some coins taking a bullish turn, but the bearish pressure is back in control and pushing the prices lower. This week the market will be focusing on the upcoming Bitcoin halving event which is expected to have a major impact on the prices of cryptocurrencies in the near future. Furthermore, traders and investors should keep an eye on the support and resistance levels in order to spot any potential trading opportunities.