Our weekly crypto price analysis indicates that the cryptocurrencies have been trading in a narrow range. The Bitcoin price didn’t show any major changes and was trading between $22,000 and $23,000. Reaching a high of around $23,056 during the week and a low of around $22,043, with buyers and sellers mostly in equilibrium.

Ethereum price has been range-bound between $1,600 and $1,658 for the whole of last week. The Ethereum price didn’t show any major changes during the week and was trading within a narrow band of around 6.05%. The Binance Coin (BNB) had its best day of the week with a high of $304, the highest since the previous week. The Dogecoin (DOGE) price on the other hand had its best daily performance however some bearish sentiments were seen as the price fell to a low of $0.08536.

Ripple (XRP) opened at around $0.3853 and closed near its weekly high of $0.431 during the week, up by more than 10.12%. Cardano (ADA) showed little change in its price as it remained range-bound between $0.36 and $0.38 for the whole of last week, closing the week at $0.3745.

Looking at the altcoins, we can see that the majority of them are trading in neutral zones with not much volatility. It looks like a consolidation period for most cryptocurrencies and investors should be cautious if they plan on investing in any cryptocurrencies at this stage.

BTC/USD

Bitcoin is trading at $22,740, within a narrow range as the bulls and bears are in a tug-of-war. We expect that the BTC price could either break above $23,000 or fall below $22,000 soon. Bitcoin surpassed the moving averages but was unable to break through the barrier at $23,000 and started to move downward. The trading volume for Bitcoin decreased slightly last week, suggesting that the market is in a consolidation period. Currently, the trading volume of Bitcoin is around $24 billion and the market cap is at $440 billion.

The MACD shows a decreasing bullish momentum as the cryptocurrency is trading in a range-bound market. The RSI shows that the asset is in neither overbought nor oversold conditions, which indicates that there might be more sideways movements ahead.

ETH/USD

Ethereum is currently trading at $1,633 and has been range-bound for the past week between $1,600 and $1,658. It is likely that Ethereum will remain in this range for some time as investors wait to see how Bitcoin performs.

The 50-day moving average (MA) is below the 200-day (MA) which indicates that there could be more bearish sentiments ahead. The MACD shows a decreasing bullish momentum as the asset is trading in a range and the RSI is neutral, indicating that Ethereum could remain range-bound for some time.

XRP/USD

XRP is trading at $0.4233, up by 10.12% for the week. It looks like the bulls are in control of XRP with some strong buying pressure at lower levels and steady support from buyers on the higher side. We expect that XRP could breach the resistance level of $0.431 if the buying pressure continues.

The moving average is currently at $0.372, indicating that the asset is still in an uptrend and could continue to move higher. The MACD shows increasing bullish momentum and the RSI indicates that XRP is currently in overbought conditions.

BNB/USD

Binance Coin is trading at $304, Currently, the bulls are in control of BNB with steady support from buyers on the higher side. We expect that BNB could breach the resistance level of $310 if the buying pressure continues. However, if the bears start to dominate, BNB could fall back down to $299. The current price is above the moving average, indicating that the bulls are in control.

The Stochastic RSI is currently in the neutral zone, providing no clear indications of future price action. The MACD line had a bearish crossover with the signal line but remains in the positive zone – indicating that there may be some buying pressure still present in this pair. The RSI (Relative Strength Index) is close to 50 levels and trading in a sideways manner.

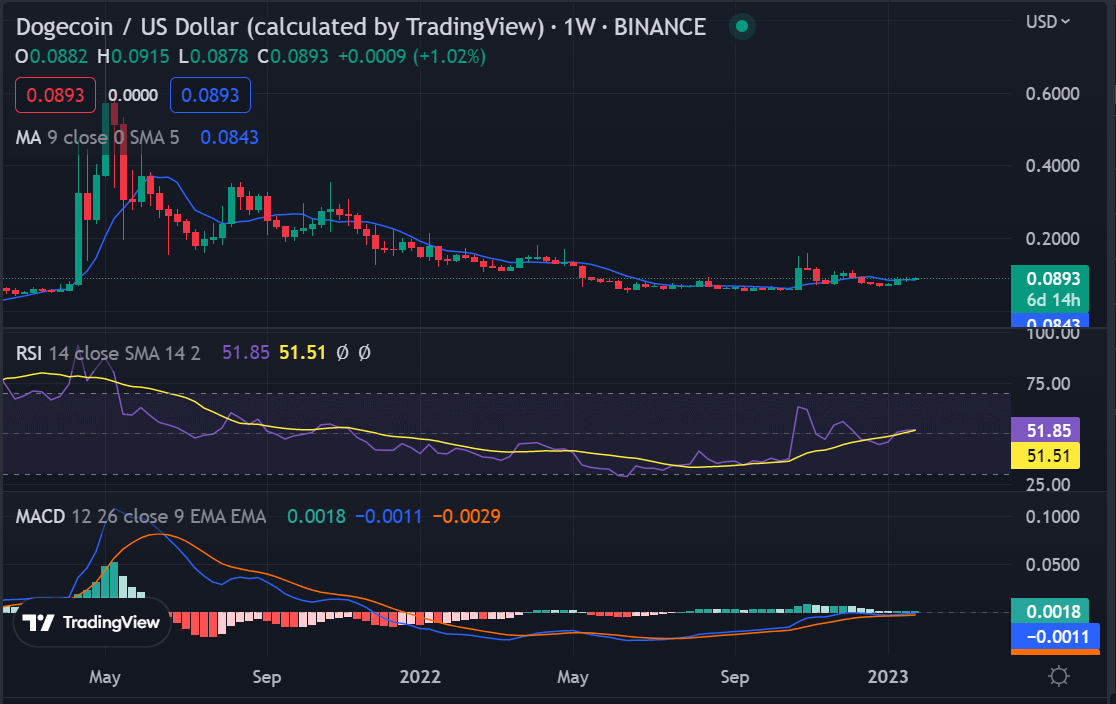

DOGE/USD

According to our weekly crypto price analysis, Dogecoin has been on a declining trendline but has started to show signs of recovery in the last few hours. Dogecoin’s price is starting to gain momentum and is currently trading at $0.08912. If the buyers manage to push past the $0.09289 resistance, it is likely that DOGE/USD pair could reach its next target of $0.09300– with a potential further rise towards the all-time high of $0.100.

The 50-day and 200-day MA are trending downwards, indicating a bearish sentiment in the market. The MACD line had a bearish crossover with the signal line but remains in the positive zone – which suggests that there might be some buying pressure still present in this pair. The RSI (Relative Strength Index) is in the neutral zone and is currently at 51.51 levels.

ADA/USD

Cardano is currently trading at $0.3774 and down by 1.04% for the last 24 hours. However, the ADA has gained 7.56% in the last week. The selling pressure is continuing to mount and the ADA bulls are struggling to push past the resistance at $0.3855. If the buying pressure increases, we could see a potential breakout of this level in the near future.

The Moving Average has been trending downwards for the last few days, indicating that there might be bearish sentiments ahead. The MACD line had a bearish crossover with the signal line and has moved below the zero line, indicating that there is more selling pressure in this pair. The RSI (Relative Strength Index) is currently at 35.48 levels and trading in a sideways manner.

Weekly crypto price analysis conclusion

Our Weekly crypto price analysis concludes that the weeks had been quite volatile for the crypto world. The narrow range bound action for Bitcoin and Ethereum combined with the strong bullish breakout for XRP, BNB and DOGE are likely to lead to even more volatility in the near future. The markets are also showing signs of recovery as the buying pressure increases, while other coins facing selling pressure, such as ADA, could see a potential breakout from their current trading range.